Limited Companies

Description

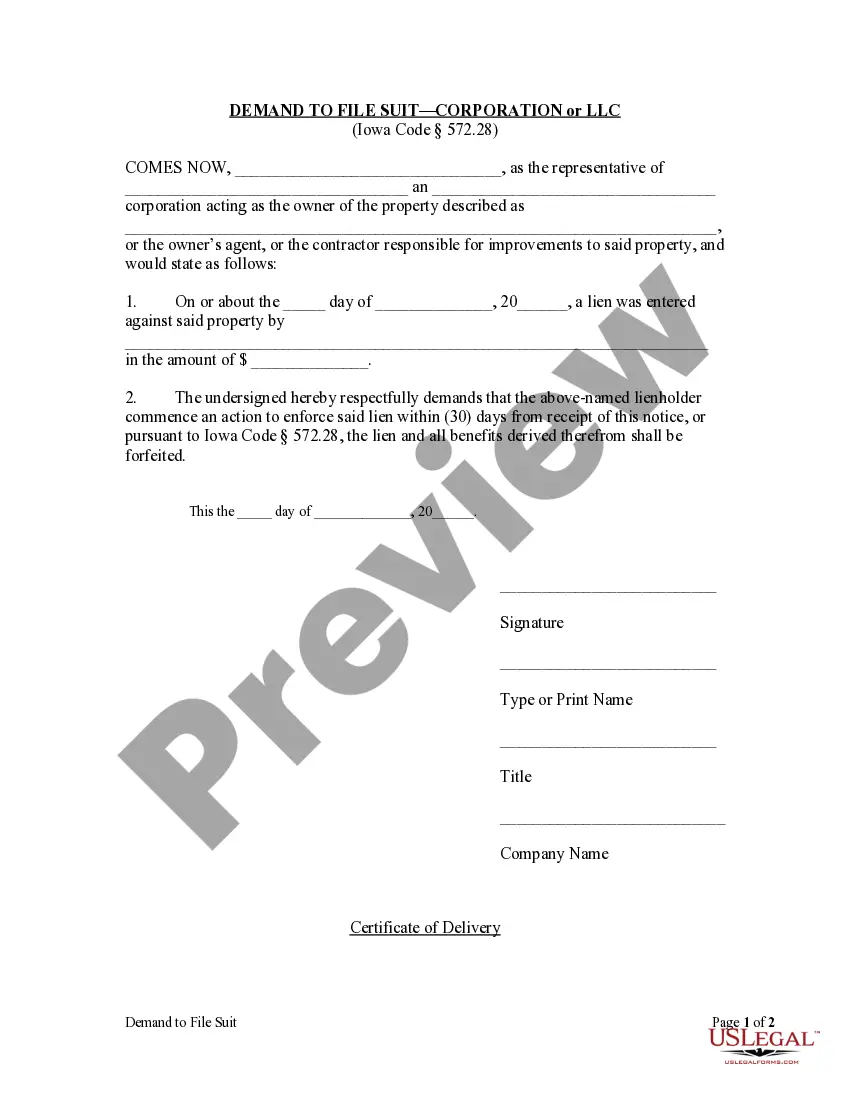

How to fill out Iowa Demand To File Suit By Corporation Or LLC?

- Log in to your US Legal Forms account if you’ve used the service before. Ensure your subscription is active; if not, renew it as per your payment plan.

- If you’re a new user, start by previewing the form and its description. Check to ensure it aligns with your requirements and complies with local jurisdiction.

- If the selected form doesn't meet your needs, utilize the Search tab to find a more suitable option. Once you identify a fitting template, proceed.

- Purchase the required document by clicking the Buy Now button, then choose the subscription plan that best fits your needs. You'll need to create an account for access.

- Complete your purchase by entering your payment details or using your PayPal account to finalize the subscription.

- Download your chosen form to your device. You can also access it anytime later through the My Forms menu in your account.

US Legal Forms not only empowers users by providing a robust collection of legal documents but also offers access to premium experts who can assist with form completion, helping ensure accuracy and legal compliance.

Take the first step towards forming your limited company today by visiting US Legal Forms and exploring their vast library!

Form popularity

FAQ

The main difference between Ltd and LLC lies in their structure and jurisdiction. Ltd, or limited company, is more commonly used in the UK and indicates a company where the liability of shareholders is limited. On the other hand, an LLC, or limited liability company, is a structure primarily used in the United States, providing a blend of the benefits of partnerships and corporations. Both structures protect personal assets, but the specific regulations and implications can vary significantly.

Public limited companies, while providing opportunities for raising capital, also come with significant disadvantages. First, they must comply with extensive regulatory requirements, which can be costly and time-consuming. Second, public companies face scrutiny from shareholders and the public, potentially leading to pressure to perform. Lastly, the loss of control can occur, as decisions may be influenced by many external stakeholders.

Limited companies face several disadvantages, such as regulatory requirements and administrative burdens. Establishing a limited company involves higher setup costs and ongoing obligations, including annual filings and record-keeping. Moreover, managing the corporate structure can be more complicated than operating a sole proprietorship. Seeking assistance from a service like US Legal Forms can alleviate some of these challenges.

A limited company is defined as a business structure where the owners' liability is limited to their investment in the company. This means that personal assets are generally protected from the company's debts. Additionally, limited companies must be registered with the appropriate government authorities and must adhere to rules regarding financial disclosure. Ensuring compliance from the beginning is essential for long-term success.

One notable disadvantage of a limited company is the complexity involved in its formation and maintenance. Unlike sole proprietorships, limited companies require adherence to strict regulatory obligations, such as filing annual accounts and conducting regular meetings. These requirements can consume time and resources. Utilizing platforms like US Legal Forms can simplify this process and provide essential guidance.

Forming a limited company can be a strategic decision for many business owners. It offers benefits like limited liability, which protects your personal assets from business debts. Additionally, limited companies often enjoy greater credibility with clients and investors. This structure can also provide tax advantages and improve access to funding.

A limited company, such as an LLC, typically needs to file annual tax returns with the IRS. Depending on the state, you may also have to submit annual reports or other state-specific filings. Utilizing uslegalforms ensures that you stay compliant with all necessary filings and deadlines specific to your limited company.

Identifying your LLC type typically involves reviewing your state’s formation documents and any election forms submitted to the IRS. Most businesses recognize their status as a standard LLC unless they’ve opted for S corp classification. If you're uncertain, resources from uslegalforms can help clarify your LLC’s type.

To classify your LLC as an S corp, you must file Form 2553 with the IRS, ensuring that your LLC meets specific eligibility requirements. This includes being a domestic entity with only allowable shareholders, such as individuals or certain trusts. Platforms like uslegalforms offer guidance on completing these forms accurately.

To determine if your LLC is classified as a C corp or S corp, examine the IRS forms associated with your business. An LLC that hasn’t elected S corp status is likely a C corp by default. You can also consult with a tax professional or use resources like uslegalforms to verify your classification.