Llc Limited Liability With Us

Description

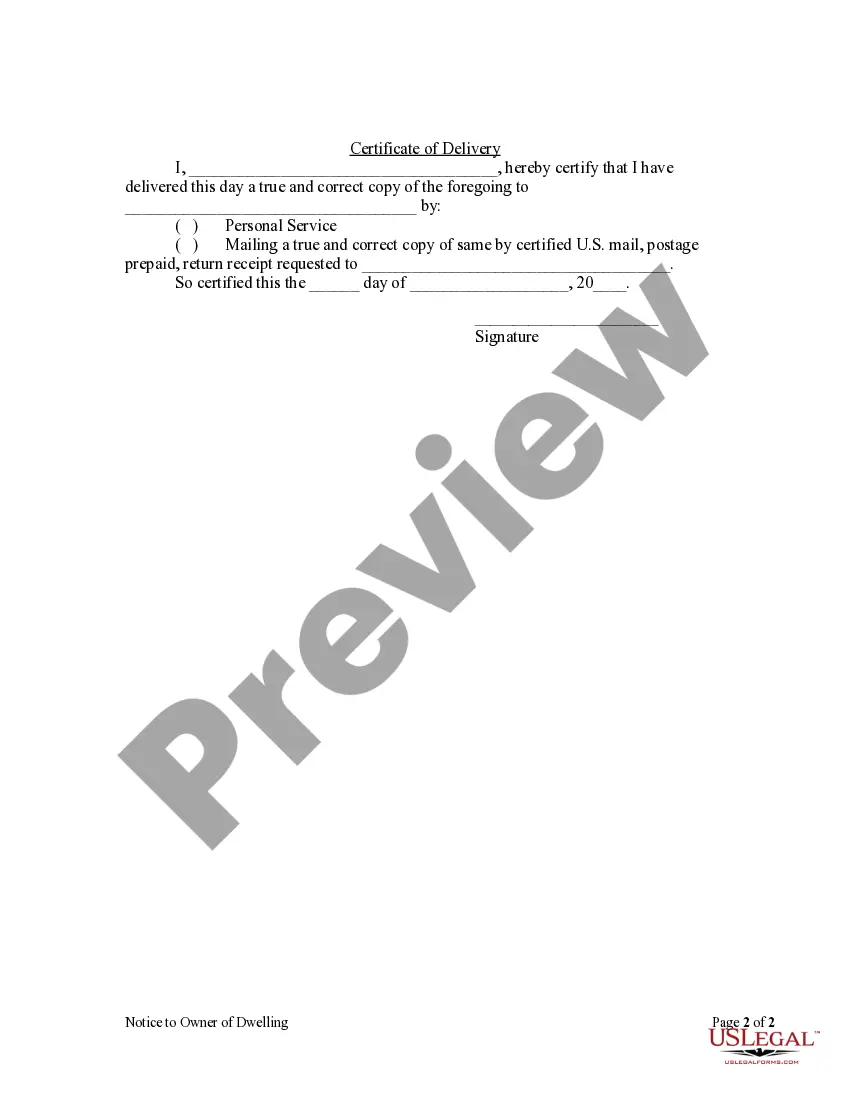

How to fill out Iowa Notice To Owner Of Dwelling By Corporation Or LLC?

- Log in to your account if you are a returning user, ensuring your subscription is active. If not, renew it according to your plan.

- For first-time users, begin by searching for the appropriate LLC form. Review the preview and details to confirm it meets your jurisdiction requirements.

- If the form does not match your needs, utilize the Search function to find the perfect template for your situation.

- Once you have selected a suitable document, click the 'Buy Now' button and choose your desired subscription plan. Create an account for access to our extensive library.

- Enter your payment information via credit card or PayPal to finalize your purchase.

- Download your completed form and save it on your device. You can also access your documents anytime through the 'My Forms' section in your profile.

In conclusion, US Legal Forms makes it simple for anyone to obtain essential legal documents like LLC limited liability forms. By following these straightforward steps, you can ensure that your legal needs are met efficiently.

Don't hesitate—visit US Legal Forms today and empower yourself with the right legal resources!

Form popularity

FAQ

An LLC, or limited liability company, is a business structure that protects its owners from personal liability for the company’s debts. This means that if the business faces legal issues, your personal assets typically remain safe. Understanding the intricacies of forming an LLC can be helpful, and we can guide you through the process of Llc limited liability with us.

Filling out an LLC involves several key steps, starting with selecting a unique business name and confirming that it is available in your state. After that, prepare and submit Articles of Organization to your state's business registration office. Taking these steps properly lays the foundation for your LLC limited liability with us, providing you with essential legal protections.

To fill out a W-9 for a single-member LLC, provide your legal business name and select the status as an LLC. Depending on your tax information, enter either your EIN or your SSN. This practice helps establish your business identity and enhance your LLC limited liability with us, making future transactions smoother.

member LLC should fill out a W9 by entering its official name and marking the 'Limited Liability Company' box. Include your EIN or your SSN, depending on your preference for receiving income. This structured approach simplifies tax processes and solidifies your status under LLC limited liability with us.

To write a limited liability company (LLC), begin with your chosen business name, followed by 'LLC' to indicate its legal structure. For instance, 'Your Business Name LLC' clearly denotes the limited liability designation. Registering your LLC with the appropriate state authority ensures you enjoy the protections offered by LLC limited liability with us.

A single person filling out a W9 should provide their name and address accurately, indicating whether they are an individual, LLC, or other entity type. If you operate as a single-member LLC, mark the appropriate box under 'Business name' and include your EIN or SSN. This clarity ensures compliance and facilitates your business transactions under the framework of LLC limited liability with us.

member LLC is neither an S Corporation nor a C Corporation by default. Instead, it is treated as a disregarded entity for tax purposes, which means it passes profits and losses directly to your personal tax return. You can elect to have your LLC classified as an S Corp or C Corp by filing specific forms with the IRS, ensuring you maximize the benefits of your LLC limited liability with us.

When filling out a W9 for a single-member LLC, it's important to determine whether to use your Social Security Number (SSN) or an Employer Identification Number (EIN). If you are filing as an individual and have not elected to have your LLC treated as a corporation, you may use your SSN. However, obtaining an EIN can separate your personal and business finances, offering more benefits for your LLC limited liability with us.

A US person for tax purposes includes citizens, residents, and certain entities created or organized in the United States. This classification impacts tax filing requirements and benefits. Understanding who qualifies as a US person can help you make informed decisions regarding your LLC and your tax obligations. Collaborating with uslegalforms ensures you receive tailored guidance for your specific circumstances.

No, you generally file LLC and personal taxes separately. An LLC can be treated as a pass-through entity for tax purposes, meaning profits and losses pass through to your individual tax return. However, if the LLC opts for corporate tax status, tax filings will differ. It's beneficial to grasp the nuances of LLC limited liability with us to ensure compliance with tax regulations.