Limited Business

Description

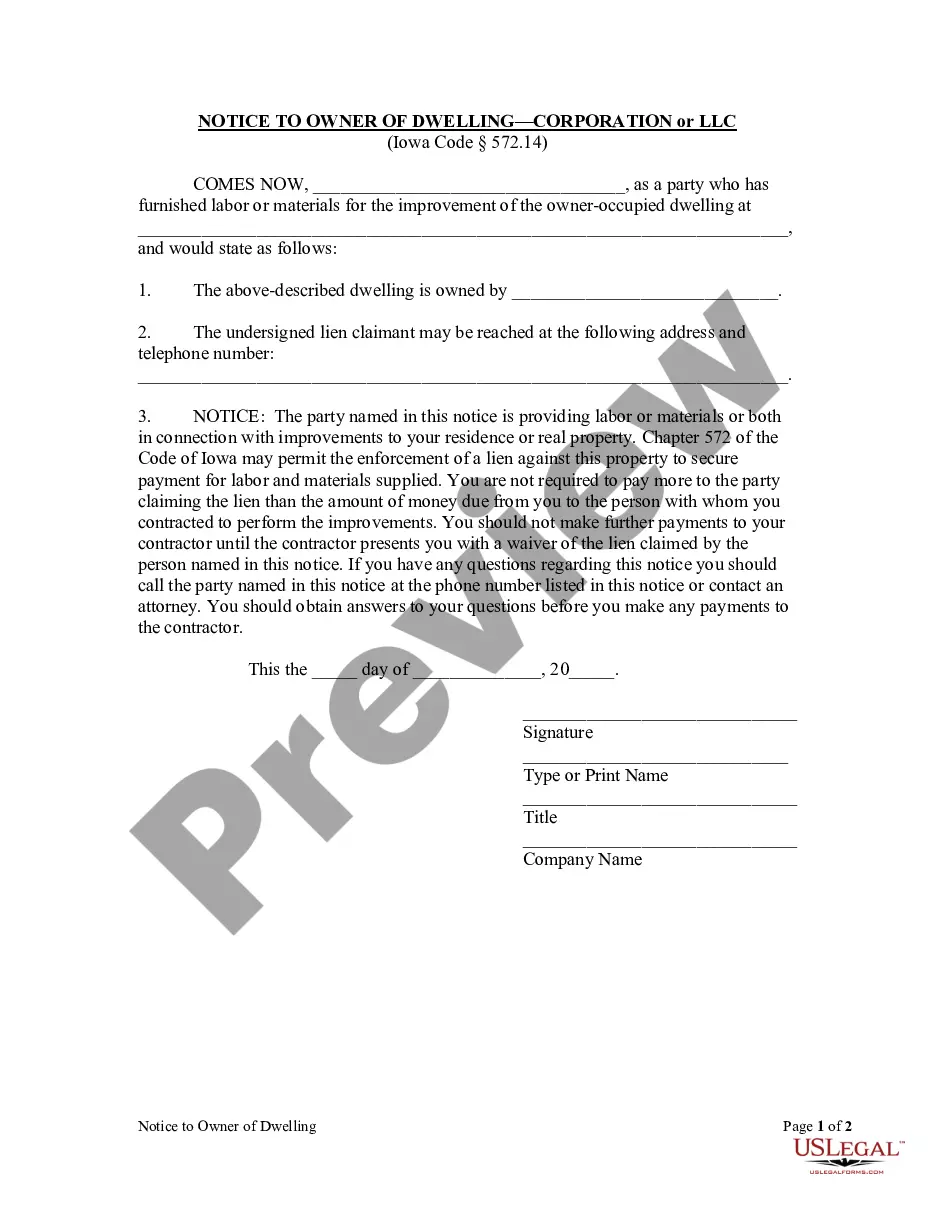

How to fill out Iowa Notice To Owner Of Dwelling By Corporation Or LLC?

- Log into your existing US Legal Forms account or create a new one if you are a first-time user.

- Preview the form descriptions to ensure the document meets your limited business needs and aligns with local regulations.

- Use the Search function to find alternative templates if necessary for your specific requirements.

- Select the appropriate subscription plan by clicking the 'Buy Now' button to gain access to the extensive library.

- Complete your purchase using your credit card or PayPal to finalize your subscription.

- Download the chosen form template to your device and access it anytime from the 'My Forms' section.

With these steps, you can efficiently navigate the US Legal Forms platform to acquire the necessary legal documentation for your limited business. Enjoy the peace of mind that comes with using a robust collection of legal resources.

Start today and see how US Legal Forms can simplify your business documentation process!

Form popularity

FAQ

Being a limited company means that the business operates as a separate entity from its owners, providing legal protection and limiting personal financial liability. This structure allows for easier access to funding, joint ventures, and business expansion opportunities. Furthermore, limited companies often enjoy credibility and trust through their operational transparency. For those looking to establish a secure and professional business framework, forming a limited business is a strategic choice.

In the context of business, 'limited' refers to the limitation of liability that protects owners against losing more than their initial investment in the company. This limitation means that personal assets are not at risk if the business fails or faces lawsuits. Thus, a limited business structure is attractive for many entrepreneurs, as it allows them to pursue their ventures with a financial safety net. It's crucial to understand these benefits when selecting the right business structure.

When a business is structured as a limited company, it signifies that it is a separate legal entity from its owners. This structure allows the company to own property, enter into contracts, and incur debts independently. As a limited business, it can also provide certain tax advantages and protect the owners from liability beyond their initial investment. Being a limited company can be a smart move for serious entrepreneurs who want to grow their brands with reduced risk.

A limited business often refers to a company structure where the owners’ liability is limited to their investment in the business. For instance, a small tech startup or a locally owned restaurant can operate as a limited business, protecting the owners from personal financial risk. This means that if the business encounters financial trouble, the owners' personal assets remain safe. Understanding this example is essential for anyone considering how to manage risks effectively.

You become a limited company by formally registering your business with the appropriate state authorities. This includes filing the necessary documents and adhering to state regulations. The structure protects personal assets from business liabilities, providing peace of mind as you grow. For the best approach to establishing your limited business, consider using services from US Legal Forms for streamlined registration.

You can determine if you are a limited company by checking your official business registration documents. If your business structure limits personal liability and includes 'Limited' in its name, you likely qualify. Additionally, reviewing your incorporation paperwork helps confirm your status. If you're unsure, US Legal Forms can assist you in identifying and validating your limited business structure.

A limited company qualifies based on its legal formation under state law, typically involving registering with the state. This type of business limits owners' liabilities regarding debts and obligations. Various forms include LLCs and limited partnerships. To establish your limited business accurately, consider resources like US Legal Forms for guidance in registration.

A limited company can encompass various types of business structures, including LLPs and LLCs. An LLC, or Limited Liability Company, specifically offers limited liability to its owners while benefiting from pass-through taxation. It's crucial to choose the right structure that fits your business needs to protect your personal assets. US Legal Forms helps you navigate these options when establishing your limited business.

You can often use 'limited' interchangeably with LLC, but there are important distinctions. 'Limited' typically refers to a limited company structure, while LLC is a specific legal entity type. Each state has its own regulations regarding business naming, so it’s best to check local rules. Consider using US Legal Forms to ensure compliance and clarity in your limited business structure.

You don’t have to form an LLC unless you choose to or unless your business reaches a certain scale. However, if you are generating profits and want to protect your personal assets, it's wise to consider forming one sooner rather than later. Consulting with a legal expert can help clarify when it’s appropriate to establish an LLC for your limited business.