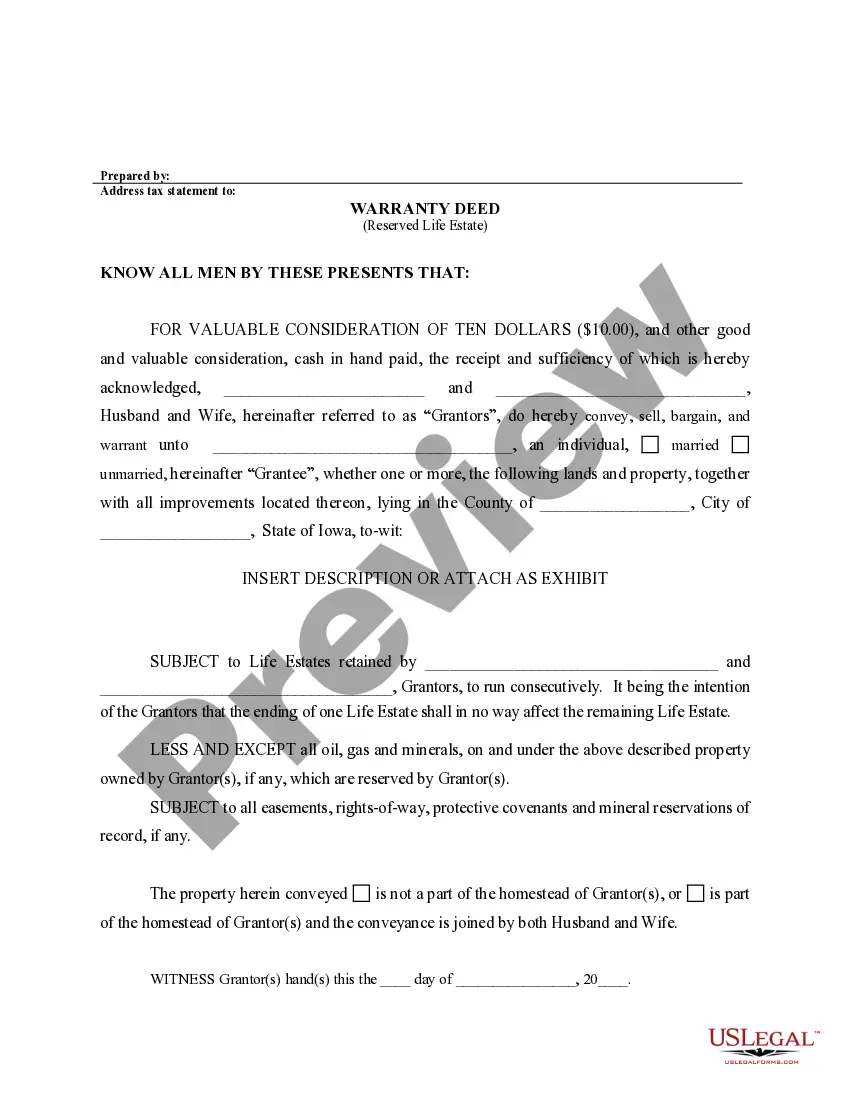

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

Life estate in Iowa with condition subsequent is a legal concept that grants individuals the right to possess and use a property for the duration of their lifetime, with the condition that certain specified events or circumstances occur upon their death. This type of life estate is subject to the condition subsequent, meaning that it can be terminated if the specified condition is met. In Iowa, there are two primary types of life estate with condition subsequent: 1. Life Estate with Condition Subsequent by Will: This type of life estate is created through a person's last will and testament. The property owner, also known as the granter, grants another person, known as the life tenant, the right to live in and use the property during their lifetime. However, the life estate is subject to a condition subsequent, which is a specific event or circumstance that must occur upon the life tenant's death, for example, the property reverting to the original owner or passing to another specified individual. 2. Life Estate with Condition Subsequent by Deed: This type of life estate is created through a deed during the granter's lifetime. The property owner transfers the property to another person, the grantee, while reserving a life estate for themselves. Similar to the life estate created by will, this type is also subject to a condition subsequent. The condition could be the property reverting to the granter's ownership, passing to a specific individual, or any other condition agreed upon. It's important to note that life estates in Iowa with condition subsequent can be highly customized and tailored to meet the individual needs and preferences of the granter. The condition subsequent can vary based on individual circumstances, and it is crucial to seek legal advice to ensure that the life estate is properly established and the condition subsequent is clearly defined and enforceable. If you are considering establishing a life estate in Iowa with condition subsequent, it is vital to consult with an experienced attorney who specializes in real estate and estate planning to ensure that your interests, needs, and intentions are fully protected and legally sound.