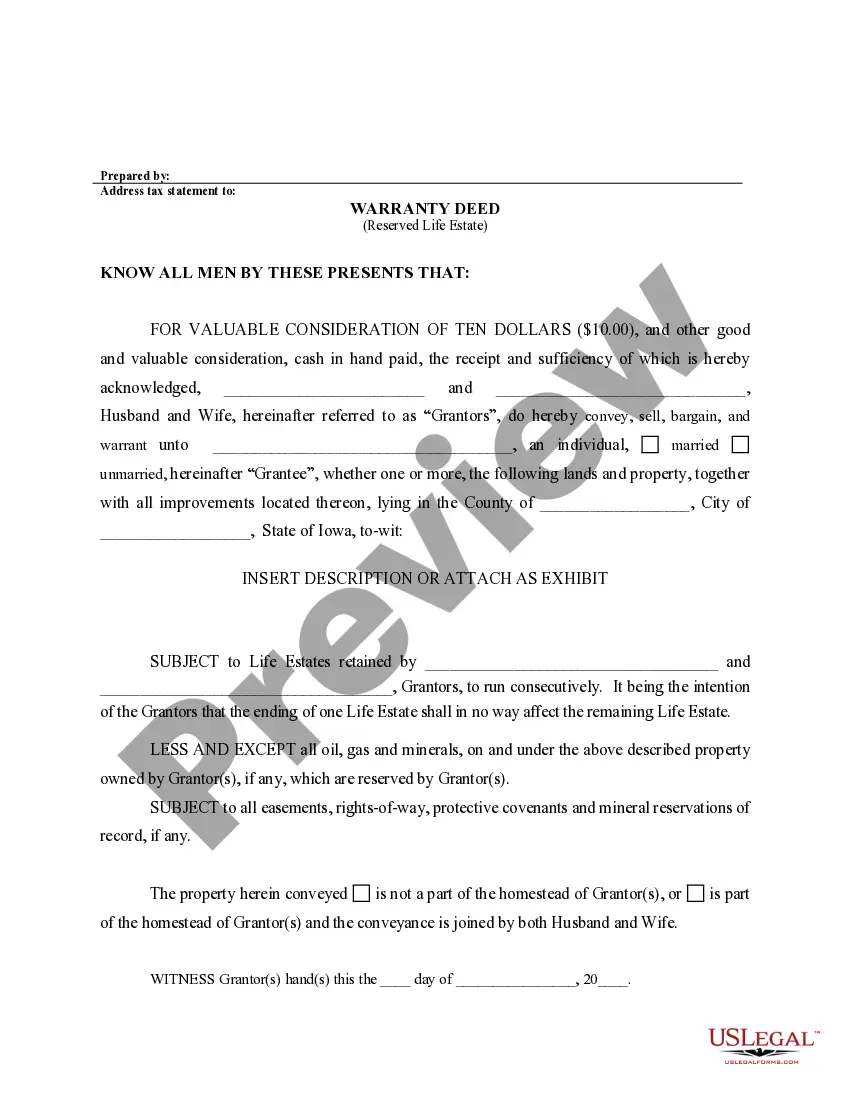

This form is a warranty deed from parent(s) to child with a reservation of a life estate in the parent(s). The form allows the grantor(s) to convey property to the grantee, while maintaining an interest in the property during the lifetime of the grantor(s).

Iowa Life Estate Form

Description

How to fill out Iowa Warranty Deed To Child Reserving A Life Estate In The Parents?

There’s no longer a need to squander time searching for legal paperwork to adhere to your local jurisdiction's regulations.

US Legal Forms has gathered all of them in one location and eased their availability.

Our website provides over 85k templates for any commercial and personal legal matters organized by state and area of application.

Once you find the suitable template, click Buy Now adjacent to the template title. Select the desired pricing plan and either create an account or Log In. Proceed to pay for your subscription using a credit card or via PayPal. Choose the file format for your Iowa Life Estate Form and download it to your device. You can print your form for manual completion or upload the document if you prefer filling it out in an online editor. Preparing legal documentation in accordance with federal and state regulations is rapid and effortless with our platform. Experience US Legal Forms today to keep your records organized!

- All forms are expertly drafted and verified for authenticity, ensuring you receive a current Iowa Life Estate Form.

- If you are acquainted with our platform and possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever necessary by opening the My documents section in your profile.

- If you haven’t utilized our platform previously, the process will require a few additional steps to finalize.

- Here’s how new users can find the Iowa Life Estate Form in our catalog.

- Examine the page content closely to confirm it includes the sample you require.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

To release a life estate, you must complete and file an Iowa life estate form. This legal document formally transfers your interest in the property back to the remainderman or other parties. It's a straightforward process, but making sure you follow all local laws is essential. Consider using the US Legal Forms platform to access the necessary forms and ensure accurate completion.

One downside of a life estate is that it can limit the owner's control over the property during their lifetime. Once you establish an Iowa life estate form, you cannot easily sell or transfer the property without the consent of the remainderman. Additionally, life estates may complicate estate planning and could lead to unexpected tax consequences. Evaluating these factors is crucial before proceeding.

Yes, an individual with a life estate may need to file a tax return. Generally, the life tenant is responsible for reporting income generated from the property, such as rent or dividends. While the life estate itself does not directly file taxes, understanding the implications of your Iowa life estate form can help you navigate tax responsibilities effectively. Consider consulting a tax professional to ensure compliance.

Yes, a life estate typically takes precedence over a will when it comes to the ownership of the property in question. Since the property is designated to transfer automatically to the remainderman at the end of the life estate, the provisions of a will cannot alter this arrangement. Utilizing an Iowa life estate form ensures that your intentions regarding the property are clearly documented and legally binding.

In Iowa, the threshold for probate is generally $50,000 in total assets. If the estate's value surpasses this amount, it must go through the probate process, which can sometimes be lengthy and costly. By planning ahead with an Iowa life estate form, you can help your heirs avoid probate, simplifying the transfer of your assets.

In Iowa, a life estate grants a person the right to use and occupy a property for their lifetime, after which the property automatically transfers to a designated individual or individuals. This arrangement can provide significant tax benefits and reduce potential disputes among heirs. Using an Iowa life estate form can help you effectively establish this arrangement, ensuring compliance with local laws.

Writing a life estate involves creating a legal document that outlines the property rights of both the life tenant and the remainderman. You can use an Iowa life estate form to facilitate this process, which provides clear instructions on how to complete the document correctly. It is essential to detail the terms regarding life tenancy and appointees to avoid any misunderstandings later on.

A life estate allows an individual to retain the right to live in a property during their lifetime while transferring the eventual ownership to another person. This arrangement can simplify estate planning and avoid probate issues. By using an Iowa life estate form, you can ensure a smooth transition of property ownership, helping to reduce stress for your loved ones in the future.

In Iowa, a life estate functions by granting the life tenant rights to use the property for their lifetime, with ownership passing to the remainderman upon death. This arrangement is outlined clearly in an Iowa life estate form, which ensures all terms are documented legally. Understanding these details can help you navigate estate planning effectively.

One downside of a life estate is that it limits the life tenant’s ability to sell or mortgage the property without the remainderman’s consent. Additionally, the life estate does not shield the property from creditors, potentially complicating asset management. Knowing these factors can help you make informed decisions, especially when using an Iowa life estate form.