Iowa Life Estate Form With Two Points

Description

How to fill out Iowa Warranty Deed To Child Reserving A Life Estate In The Parents?

- Log into your US Legal Forms account if you're a returning user and download the required form template by clicking the Download button. Confirm your subscription is active; if not, please renew it based on your payment plan.

- If you're a first-time user, start by checking the Preview mode and form description to ensure you have selected the appropriate form compatible with your local jurisdiction.

- If you find discrepancies, utilize the Search tab at the top of the page to locate alternative templates that meet your needs.

- Proceed to purchase your document by clicking the Buy Now button and selecting your preferred subscription plan. You must register for an account to access the document library.

- Complete your purchase by entering your credit card information or using your PayPal account.

- Download your form to your device so you can complete it. Access it later from the My Documents menu in your profile.

US Legal Forms empowers individuals and attorneys alike, providing access to an extensive library of over 85,000 fillable and editable legal forms. With a comprehensive collection and assistance from premium experts, users can ensure their documents are legally sound.

Don't hesitate to get started! Access US Legal Forms today and streamline your legal document process.

Form popularity

FAQ

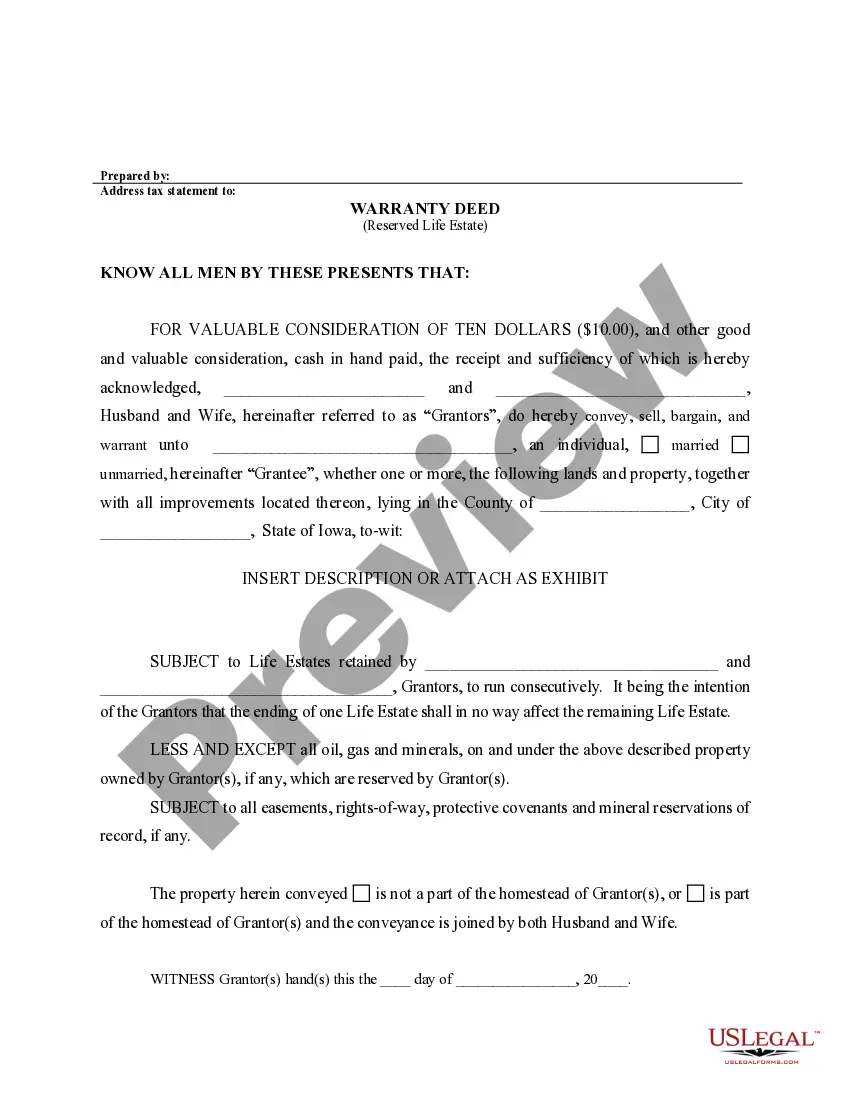

As mentioned earlier, a will cannot override a life estate. The life estate deed's terms govern the property during the life tenant's lifetime, effectively superseding any will provisions. Therefore, estate planning should clearly define intentions to avoid conflicts between a will and a life estate. Employing the Iowa life estate form can help delineate these concerns in your estate plan.

Creditors can indeed pursue a life estate under certain conditions, especially if the life tenant owes debts at the time of their passing. Creditors may have claims against the life estate’s value, especially if the deceased life tenant had outstanding financial obligations. However, it’s essential to understand that the remainderman's interest is usually protected until the life tenant’s death. To navigate these concerns, you can use the Iowa life estate form, ensuring you make informed choices.

A will cannot override a life estate deed because the life estate holds priority over the instructions laid out in a will. When a life estate is established, it legally defines who has rights to the property during the life tenant's lifetime. Therefore, it's crucial to understand that a will cannot alter these rights once the life estate is in place. For those looking to create effective estate planning documents, the Iowa life estate form can provide clarity.

While life estates can provide significant benefits, they come with drawbacks. For instance, once a life estate is established, the life tenant cannot sell the property without obtaining consent from the remainderman. Furthermore, life tenants may face difficulties in accessing home equity and they may lose control over the property after their passing. Understanding these drawbacks is essential, and using the Iowa life estate form can help clarify your intentions.

Revoking a life estate usually occurs under specific circumstances, such as when the life tenant and remainderman both agree to terminate it. Alternatively, a life estate can be revoked if the life tenant engages in willful misconduct or fails to maintain the property. Additionally, certain legal actions may afford a remainderman the ability to challenge the life estate. If you're unsure about the revocation process, you can utilize the Iowa life estate form to guide you through the steps.

Life estate arrangements come in various forms, including traditional life estates, pour-over wills, and enhanced life estates. A traditional life estate allows a person to use the property during their lifetime, whereas a pour-over will typically directs assets into a trust upon death. Enhanced life estates, often called lady bird deeds, enable the homeowner to retain control and sell or mortgage the property without restriction. You can easily create these arrangements using the Iowa life estate form available through US Legal Forms.

Calculating the value of an estate involves assessing all assets, including real estate, personal property, and financial accounts. You should start by determining each asset's fair market value, which can sometimes require appraisals. Using an Iowa life estate form can help document these values and clarify ownership claims. This process can get complex, so consulting professionals or using reliable resources is advisable.

While life estates can provide benefits, they have downsides as well. For instance, the person holding the life estate cannot sell or mortgage the property without the consent of the remainderman, limiting financial flexibility. Moreover, the life tenant is responsible for the property's upkeep and taxes, which can be a burden. It is crucial to weigh these disadvantages when considering an Iowa life estate form.

A common example of a life estate involves an elderly parent who grants their home to their child while retaining the right to live there until they pass away. This arrangement can be documented through an Iowa life estate form, solidifying the agreement. After the parent's passing, the child automatically inherits the property without undergoing probate. This arrangement not only secures living rights but also simplifies the transition of ownership.

Life estate calculation typically involves determining the fair market value of the property and factoring in the life expectancy of the property owner. An established formula is used to quantify this value and is useful when filling out an Iowa life estate form. It is advisable to work with real estate professionals to get an accurate assessment. Making clarity on such matters is vital for successful estate planning.