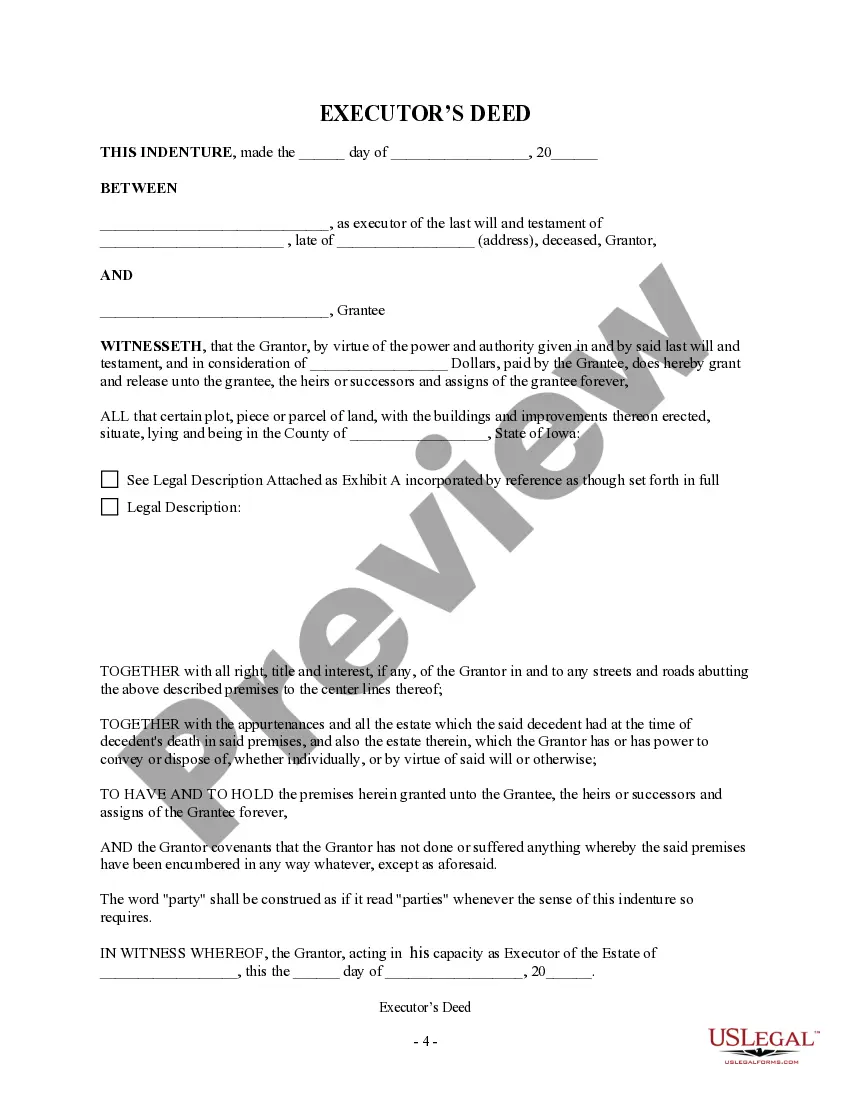

This form is an Executor's Deed where the grantor is the executor of an estate and the Grantee is an individual. Grantor conveys the described property to the grantee. \This deed complies with all state statutory laws.

Iowa Executor Fees

Description

How to fill out Iowa Executor's Deed - Executor To Individual?

Getting a go-to place to take the most recent and relevant legal samples is half the struggle of dealing with bureaucracy. Choosing the right legal documents requirements precision and attention to detail, which is the reason it is very important to take samples of Iowa Executor Fees only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and see all the details about the document’s use and relevance for your situation and in your state or county.

Take the following steps to complete your Iowa Executor Fees:

- Use the library navigation or search field to locate your sample.

- Open the form’s information to ascertain if it suits the requirements of your state and county.

- Open the form preview, if there is one, to make sure the template is the one you are interested in.

- Return to the search and find the correct template if the Iowa Executor Fees does not suit your requirements.

- When you are positive regarding the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Choose the pricing plan that suits your requirements.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (bank card or PayPal).

- Choose the file format for downloading Iowa Executor Fees.

- When you have the form on your device, you can modify it with the editor or print it and finish it manually.

Get rid of the headache that comes with your legal documentation. Explore the extensive US Legal Forms catalog where you can find legal samples, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

There are a lot of decisions to be made, and the executor has quite a bit of discretion over what are reasonable expenses for the estate to cover. Once probate has begun, the executor can pay all of these reasonable expenses from the estate's assets, as well as repaying costs the family may have covered up front.

Iowa statute holds that executors may collect "reasonable" compensation for their services, but not in excess of the following rates as applied to the gross value of the estate (as calculated before considering any debts or obligations): 6% for the first $1,000. 4% for the next $4,000. 2% for everything more.

Basics of Iowa Executor Fees This means $220 plus 2% of the probated estate. Iowa code enables personal representatives, also known as executors, to be compensated for their work since probate can be a difficult and complicated process.

If you aren't in the trade or business of being an executor (for instance, you are the executor of a friend's or relative's estate), report these fees on your Schedule 1 (Form 1040), line 8.

If you are in the trade or business of being an executor, report fees received from the estate as self-employment income on Schedule C (Form 1040), Profit or Loss From Business.