Iowa Property Values

Description

How to fill out Iowa Postnuptial Property Agreement?

Creating legal documents from the ground up can occasionally feel a bit daunting. Certain situations may require extensive research and a significant financial commitment.

If you're looking for a simpler and more cost-effective method of generating Iowa Property Values or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms covers nearly every dimension of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously prepared by our legal experts.

Utilize our website whenever you require trustworthy and dependable services through which you can easily find and download the Iowa Property Values. If you are already familiar with our services and have set up an account with us before, just Log In to your account, choose the template, and download it or re-download it at any moment in the My documents section.

Ensure that the form you select complies with the laws and regulations of your state and county. Choose the most appropriate subscription plan to obtain the Iowa Property Values. Download the document, then fill it out, sign it, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us now and make form completion simple and efficient!

- Not registered yet? No problem.

- It takes only a few minutes to sign up and browse the catalog.

- But before you dive into downloading Iowa Property Values, consider these tips.

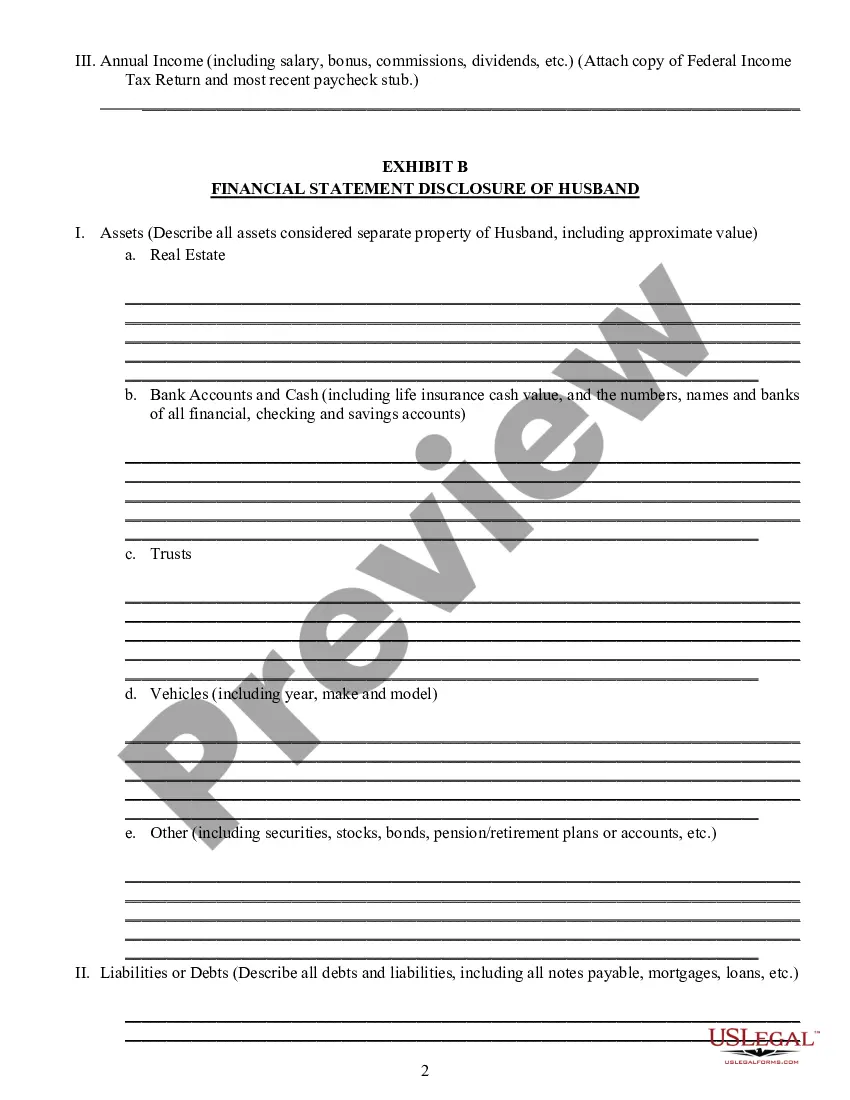

- Examine the form preview and descriptions to confirm that you have the correct form.

Form popularity

FAQ

Iowa Property Tax Rates Tax rates are denominated in dollars per thousand. So if your total tax rate is 20, that would mean you owe $20 in taxes for every $1,000 in assessed value. On a home with an assessed value of $200,000, the total tax bill would be $4,000.

Iowa Property Tax Credit for Senior and Disabled Citizens Eligibility: Must be 65 or older or totally disabled, and meet annual household low income requirements. Filing Requirements: A property owner must file a claim with the county treasurer by June 1 preceding the fiscal year in which the property taxes are due.

Taxable value is the portion of the assessed value on which a tax is applied, after equalization, rollbacks, and tax rates are determined, and credits and the results of any appeals are applied.

This is called the "assessed value." The assessed value is to be at actual or market value for most property taxes. The assessor totals the assessed value in each classification and reports it to the county auditor. Each assessor sends the reports, called "abstracts," to the Iowa Department of Revenue.

Iowa Special Assessment Credit Eligibility: Must be 65 or older or totally disabled, and meet annual household low income requirements. Filing Requirements: The claimant must file a claim with the county treasurer by September 30 of each year.