Iowa Property For Sale

Description

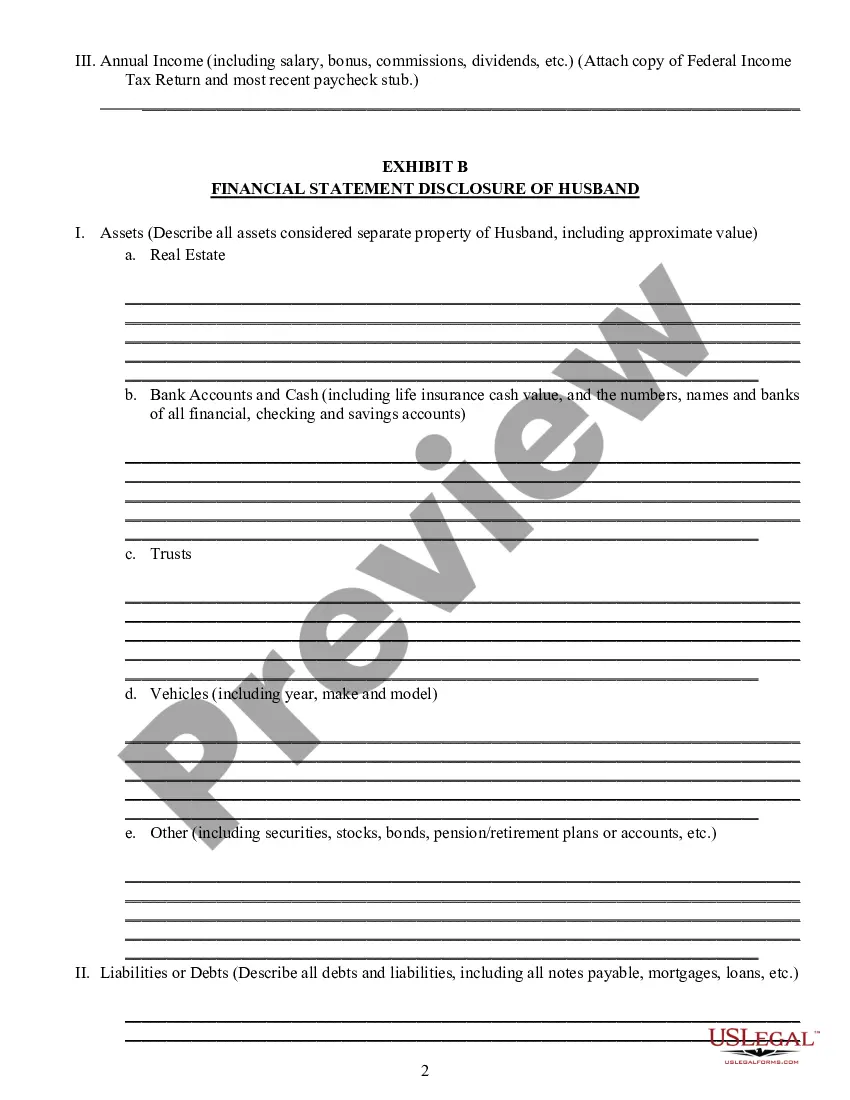

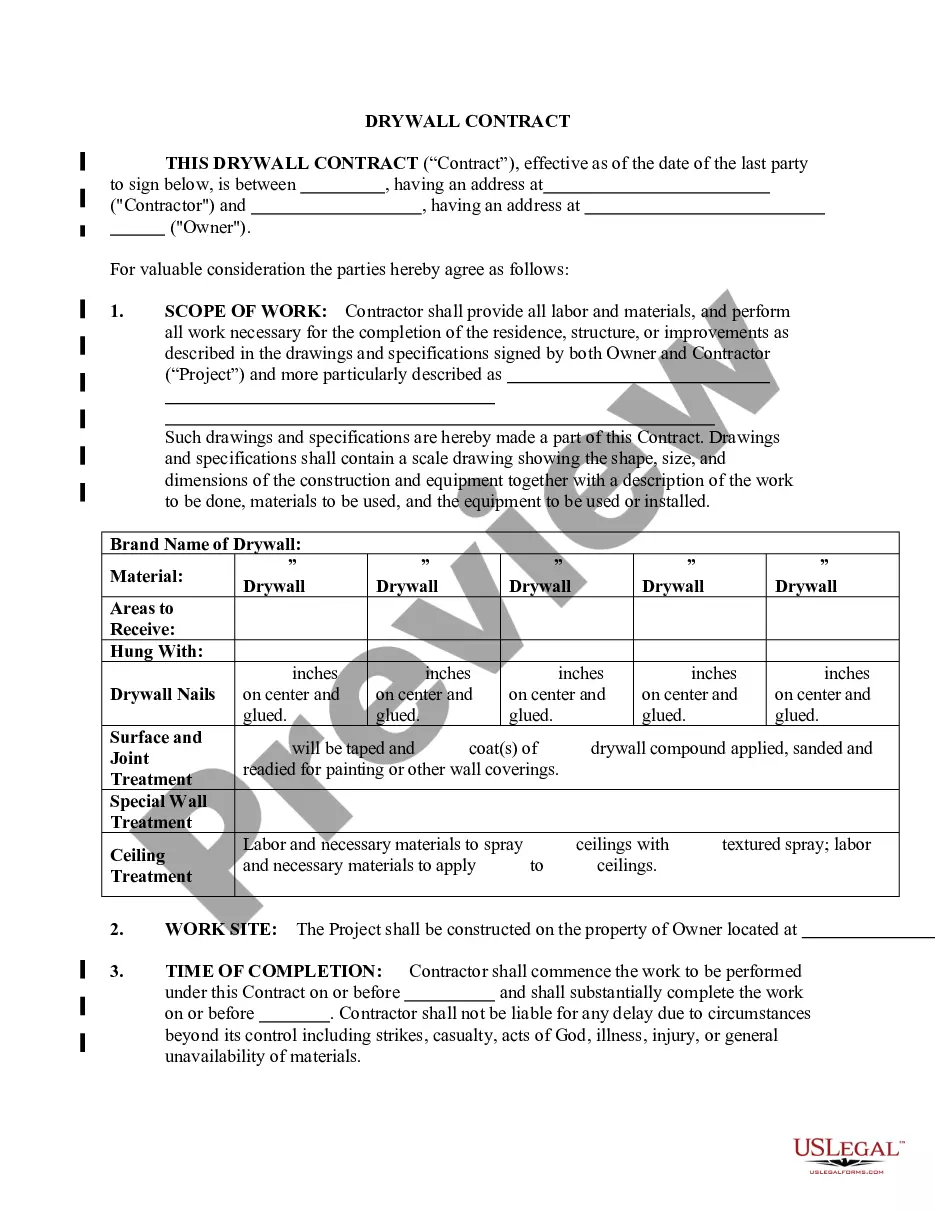

How to fill out Iowa Postnuptial Property Agreement?

Handling legal papers and operations could be a time-consuming addition to your day. Iowa Property For Sale and forms like it often require that you look for them and navigate how you can complete them correctly. As a result, regardless if you are taking care of financial, legal, or personal matters, having a comprehensive and convenient online catalogue of forms when you need it will go a long way.

US Legal Forms is the best online platform of legal templates, featuring more than 85,000 state-specific forms and a variety of resources that will help you complete your papers quickly. Discover the catalogue of pertinent papers available with just one click.

US Legal Forms gives you state- and county-specific forms offered by any moment for downloading. Safeguard your document managing procedures using a high quality service that allows you to make any form within minutes with no extra or hidden cost. Simply log in to your profile, find Iowa Property For Sale and acquire it immediately within the My Forms tab. You may also access previously saved forms.

Could it be your first time using US Legal Forms? Register and set up a free account in a few minutes and you’ll have access to the form catalogue and Iowa Property For Sale. Then, adhere to the steps below to complete your form:

- Be sure you have discovered the correct form by using the Review feature and reading the form description.

- Choose Buy Now when all set, and select the subscription plan that fits your needs.

- Select Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of experience supporting users deal with their legal papers. Discover the form you require right now and enhance any process without having to break a sweat.

Form popularity

FAQ

Under Iowa law you may redeem the tax sale certificate by making payment to the County Treasurer for the amount sold, interest of 2% per month and the tax sale certificate & redemption fees of $20.00 each.

In a typical real estate transaction, taxes are prorated and the buyer is either given credit for the seller's portion or the seller pays the taxes directly to the County Treasurer as part of the property sale.

Iowans age 65 or older are eligible for a property tax exemption worth $3,250 for the assessment year beginning Jan. 1, 2023. In subsequent years, the exemption doubles to $6,500. Exemptions are a reduction in the taxable value of the property, not a direct reduction of how much property taxes a homeowner pays.

When you sell property, you will likely incur capital gains taxes based on the difference between your sale price and your basis (your original purchase price plus improvements and less depreciation).

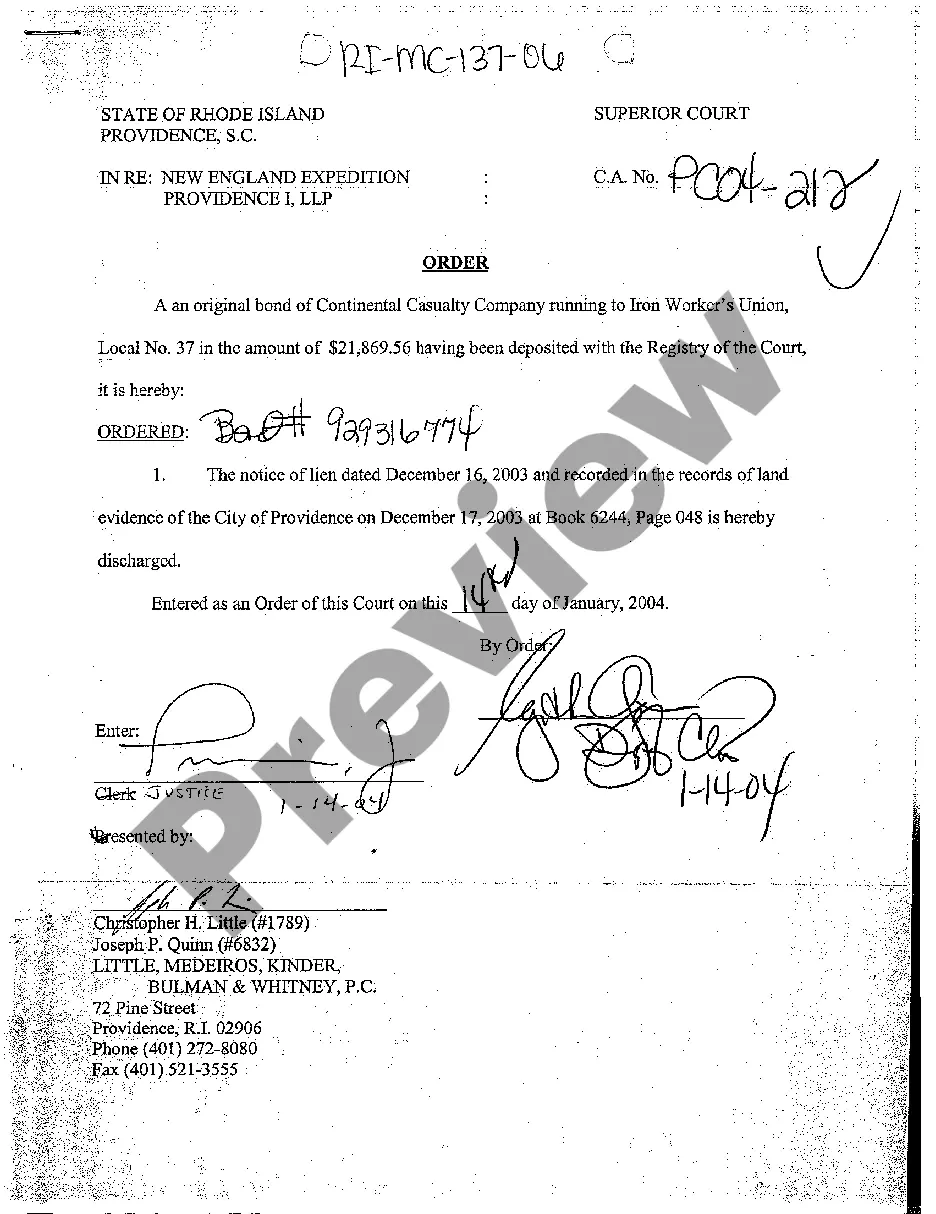

The Annual Tax Sale is an auctioned sale of delinquent property taxes. Bidders have to pay a registration fee in order to buy properties at tax sale. They purchase the taxes for what is owing and then the hold a lien against the property. It could be for one dollar or thousands of dollars.