Hawaii Limited

Description

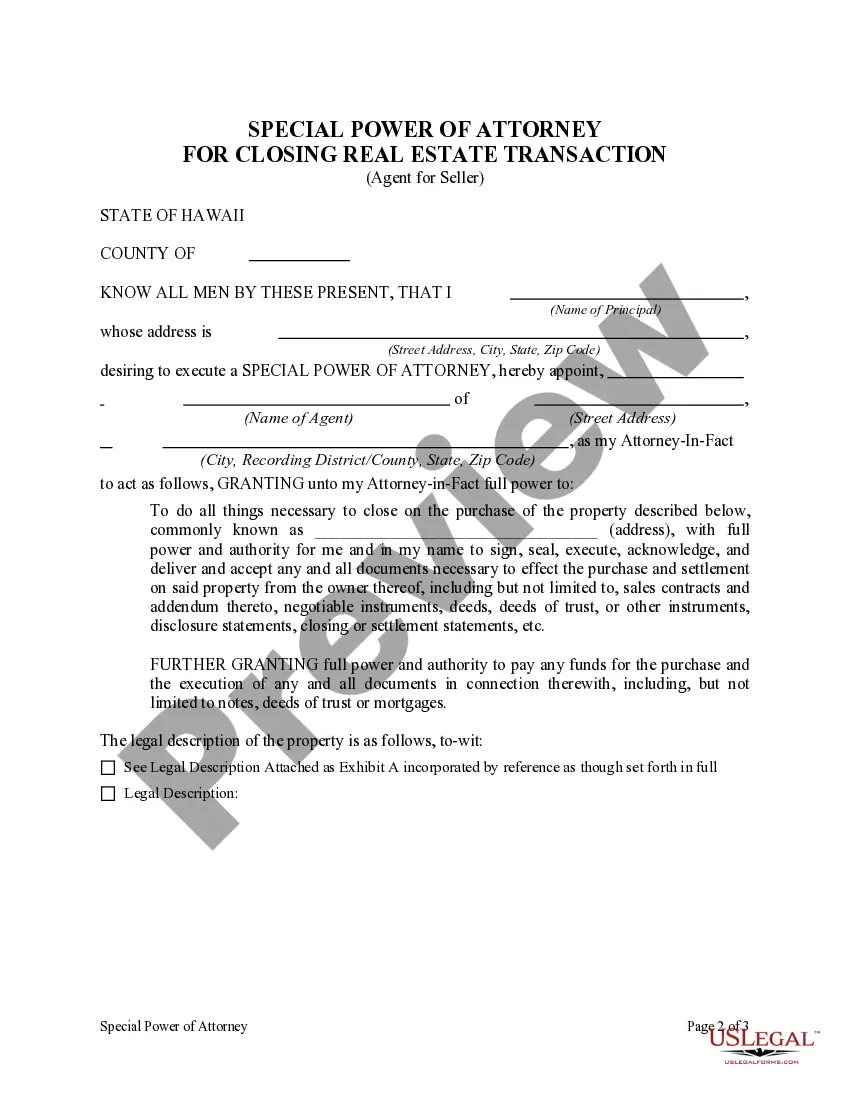

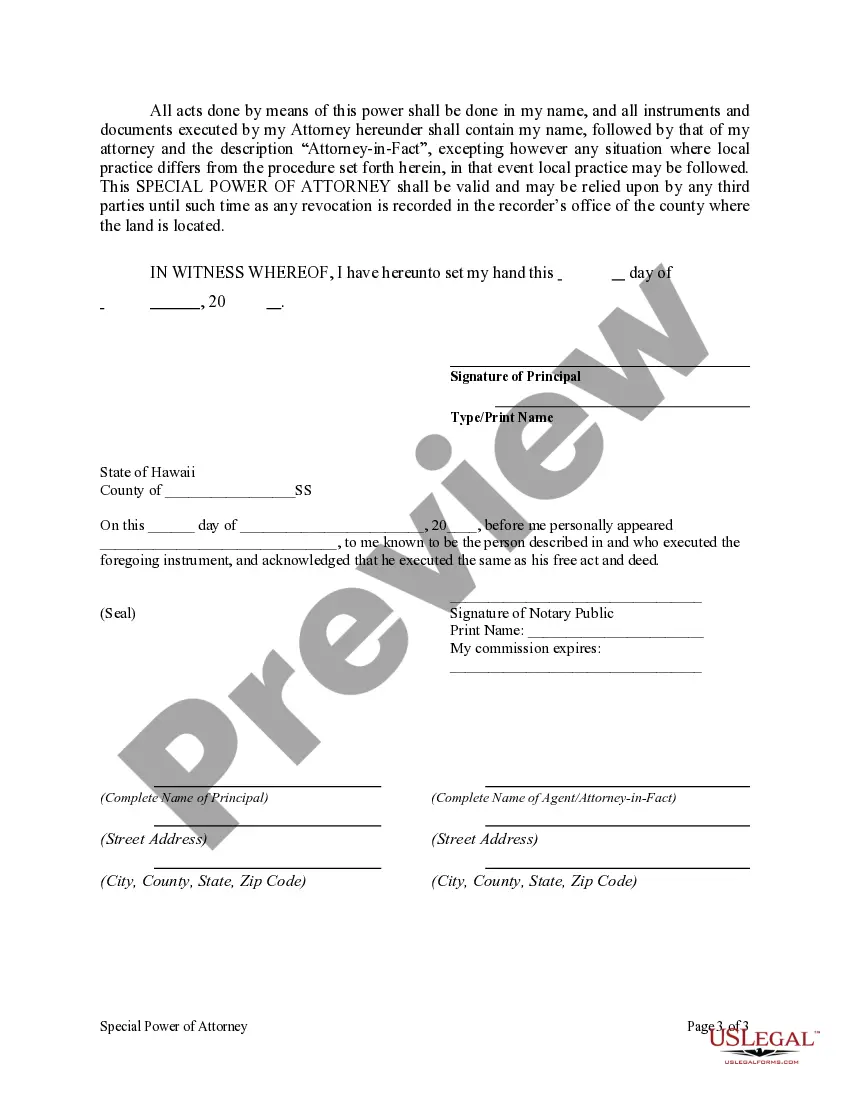

How to fill out Hawaii Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- If you're an existing user, log in to your account and select the desired Hawaii limited document by clicking the Download button. Don’t forget to verify your subscription's validity.

- For first-time users, begin by reviewing the Preview mode and the form description to ensure it fits your specific needs, particularly regarding Hawaii regulations.

- Use the Search tab for any additional templates you might require. If you find discrepancies, continue searching until you've located the correct form.

- Proceed to purchase the form you need by clicking the Buy Now button and selecting a subscription plan that suits you. Note that account registration is necessary for library access.

- Complete your purchase by entering your payment details through a credit card or your PayPal account.

- Finally, download your chosen form and store it on your device, where it will be readily available in the My Forms section of your profile.

Utilizing US Legal Forms not only grants you quick access to legal documents but also provides peace of mind with precise and legally sound resources. Their extensive library and expert support are game-changers for both individuals and attorneys.

Start today by visiting US Legal Forms to streamline your legal document needs. Empower yourself with the right tools for Hawaii limited legal matters!

Form popularity

FAQ

A livable income in Hawaii varies depending on several factors, including location, family size, and lifestyle choices. As of recent studies, many experts suggest that a monthly income exceeding $4,000 is more viable for covering basic expenses and living comfortably in the state. Exploring the costs of living and budgeting is crucial for anyone considering a move, and platforms like uslegalforms can offer valuable resources.

A budget of $3,000 a month may provide a more manageable living situation in Hawaii, but it still requires careful planning. Rent, groceries, and transportation can take up a significant portion of that income. It’s important to choose a location and lifestyle that fits within your financial means. Tools from uslegalforms can assist in budgeting and understanding local economic conditions.

Living on $2,000 a month in Hawaii could be difficult due to the high living expenses. Rent prices, food costs, and utilities can quickly exceed this budget. If you plan to move to Hawaii, consider having additional savings or advisors to assist with budgeting. Consulting platforms like uslegalforms can help you navigate financial obligations while living in the state.

The term 'Hawaii limited purpose' often refers to specific legal provisions allowing certain types of organizations or activities to operate within legal boundaries. This could include limited liability companies or organizations that fulfill specific community needs. Understanding these designations can be vital if you plan to start a business or engage in other commercial activities in Hawaii. Resources like uslegalforms can offer clarity on regulations and compliance.

The largest private landowner in Hawaii is the 'Kamehameha Schools' organization, which manages a significant portion of agricultural and residential land. This entity focuses on sustaining Hawaiian culture and providing educational opportunities. Knowing who owns large land parcels can provide insights for anyone interested in real estate or land use in Hawaii. It reflects the unique blend of heritage and modern needs in the islands.

To become a resident of Hawaii, you generally need to live in the state for at least 12 months. During this time, it’s important to establish ties to the community, such as obtaining a local driver's license and registering to vote. After this period, you can claim residency for various purposes, including taxes and legal benefits. Understanding the residency requirements is essential for anyone considering a long-term move.

Setting up an LLC in Hawaii involves several key steps, starting with selecting a suitable name for your business. You then need to prepare and file your Articles of Organization with the state's Department of Commerce and Consumer Affairs. Additionally, it's important to create an operating agreement and obtain any necessary licenses. Utilizing platforms like US Legal Forms can simplify the setup process, ensuring you have all required documents in place.

The process to complete the formation of an LLC in Hawaii usually takes about 5 to 10 business days once your application is submitted. However, if you choose expedited services, this timeframe can be shortened significantly. To avoid delays, ensure that your documentation is thorough and correct. For additional assistance, consider using US Legal Forms to help guide you through each step efficiently.

In Hawaii, businesses must file General Excise Tax (GE tax) returns periodically, usually on a monthly or quarterly basis. This depends on your total revenue; businesses with larger revenues typically file monthly, while others may qualify for quarterly filings. Staying on top of your GE tax obligations is crucial, and utilizing resources like US Legal Forms can help you manage these deadlines with ease.

Filling out a form for Hawaii is essential for protecting the state's unique environment and agricultural industry. These forms help ensure that potentially harmful pests and diseases do not enter, safeguarding Hawaii's limited resources. By understanding the importance of these forms, you play a role in protecting this beautiful state for future generations.