Hawaii Contractors Bundle For Sale

Description

How to fill out Hawaii Contractors Forms Package?

- Start by logging into your existing US Legal Forms account if you have one; otherwise, create a new account.

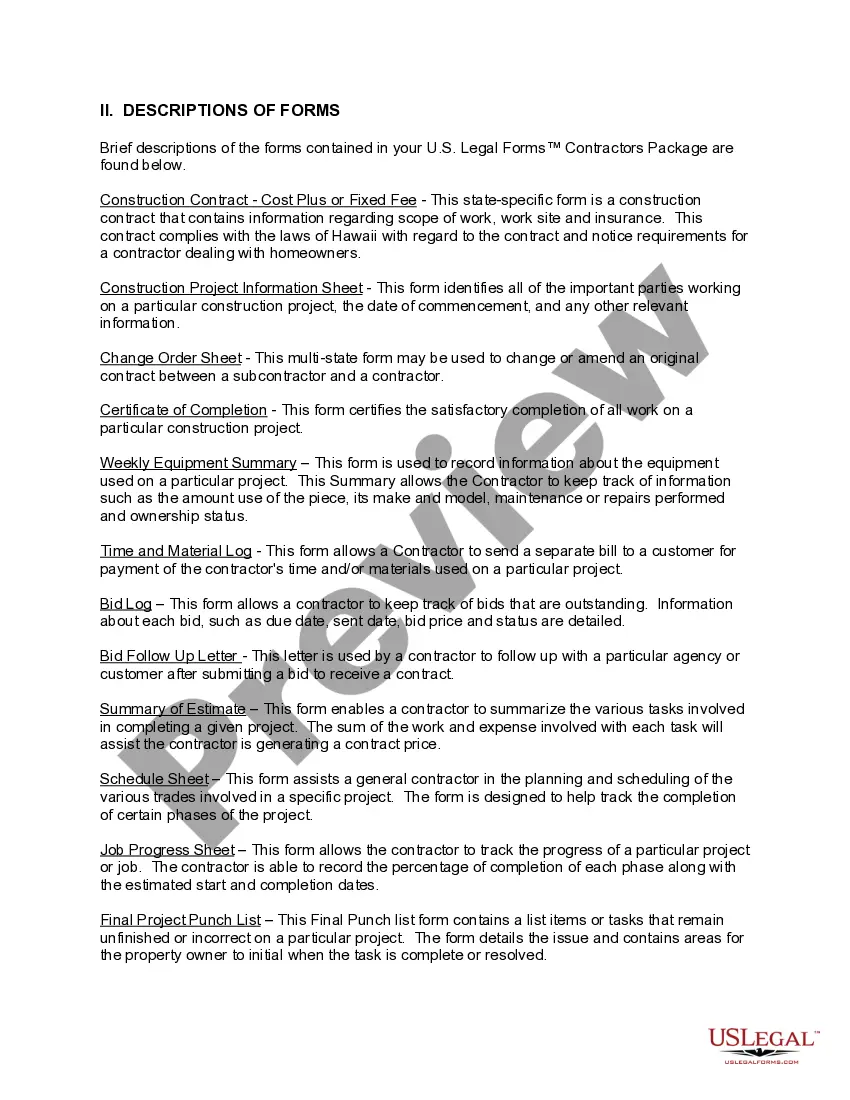

- Explore the detailed form descriptions available in the Hawaii contractors bundle to identify the documents you need.

- If the forms do not meet your specific requirements, use the search function to find more suitable options.

- Select your preferred subscription plan by clicking the Buy Now button and registering your account.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Once purchased, download the forms directly to your device and find them under the My Forms section of your profile.

By utilizing the US Legal Forms service, you not only get access to a robust collection of legal forms but also benefit from expert assistance in completing those documents accurately.

With over 85,000 customizable templates and support from legal professionals, getting the documents you need has never been easier. Start your journey towards easy legal compliance today!

Form popularity

FAQ

The N356 form in Hawaii is used for reporting and paying specific taxes related to Hawaii’s business operations. This form is vital for ensuring compliance with state tax regulations. Businesses can benefit from the Hawaii contractors bundle for sale, which includes guidance on tax forms, helping you stay organized and compliant.

To obtain a seller's permit in Hawaii, you must register with the Hawaii Department of Taxation. This process typically involves filling out specific forms and providing necessary business details. Using the Hawaii contractors bundle for sale can simplify this process by supplying forms and instructions to help you get started.

A vendor's license and a seller's permit are closely related but not the same. A vendor's license allows you to operate a business, while a seller's permit specifically permits you to collect sales tax. To navigate these requirements effectively, consider the Hawaii contractors bundle for sale, which assists in obtaining the necessary licenses.

G 45 and G 49 serve different purposes in Hawaii’s tax system. G 45 is used for filing periodic general excise tax returns, while G 49 is a year-end reconciliation form. Understanding these forms is essential for any business owner, especially those utilizing the Hawaii contractors bundle for sale, which may provide guidance on these filings.

Yes, if you sell products or services online in Hawaii, you generally need a business license. This requirement helps ensure you operate legally and compliantly. Implementing the Hawaii contractors bundle for sale can streamline your setup and provide necessary legal documentation.

To file the Hawaii N 20 form, you must submit it to the Department of Taxation in Hawaii. You can do this by mailing the completed form to the appropriate address listed on their website. Additionally, consider using the Hawaii contractors bundle for sale, which may contain helpful resources for compliance and filing.

Yes, hiring an unlicensed contractor in Hawaii is illegal and can result in fines and complications for both parties involved. It is important to ensure that any contractor you hire holds the necessary licenses to protect yourself and your investments. A Hawaii contractors bundle for sale can assist you in finding reliable, licensed contractors and understanding your rights as a client.

Independent contractors do not necessarily have to own a formal business; however, they often operate as sole proprietors or under a registered business entity. This allows them to manage their affairs independently and handle taxes appropriately. If you are considering the Hawaii contractors bundle for sale, keep in mind it may provide resources for setting up your business effectively.

Yes, most contractors must be licensed in Hawaii to perform work legally. Licensing ensures that contractors meet the necessary standards for professionalism and safety. If you're exploring options, a Hawaii contractors bundle for sale can simplify the process to get licensed and start your projects with confidence.

Yes, Hawaii allows for reciprocity with certain states for contractors, meaning if you hold a license in one of those states, you may obtain a Hawaii license more easily. This can make it easier for out-of-state contractors to work in Hawaii. Therefore, when considering a Hawaii contractors bundle for sale, it's beneficial to check if it includes information about reciprocity and how it may apply to you.