Trust A Live

Description

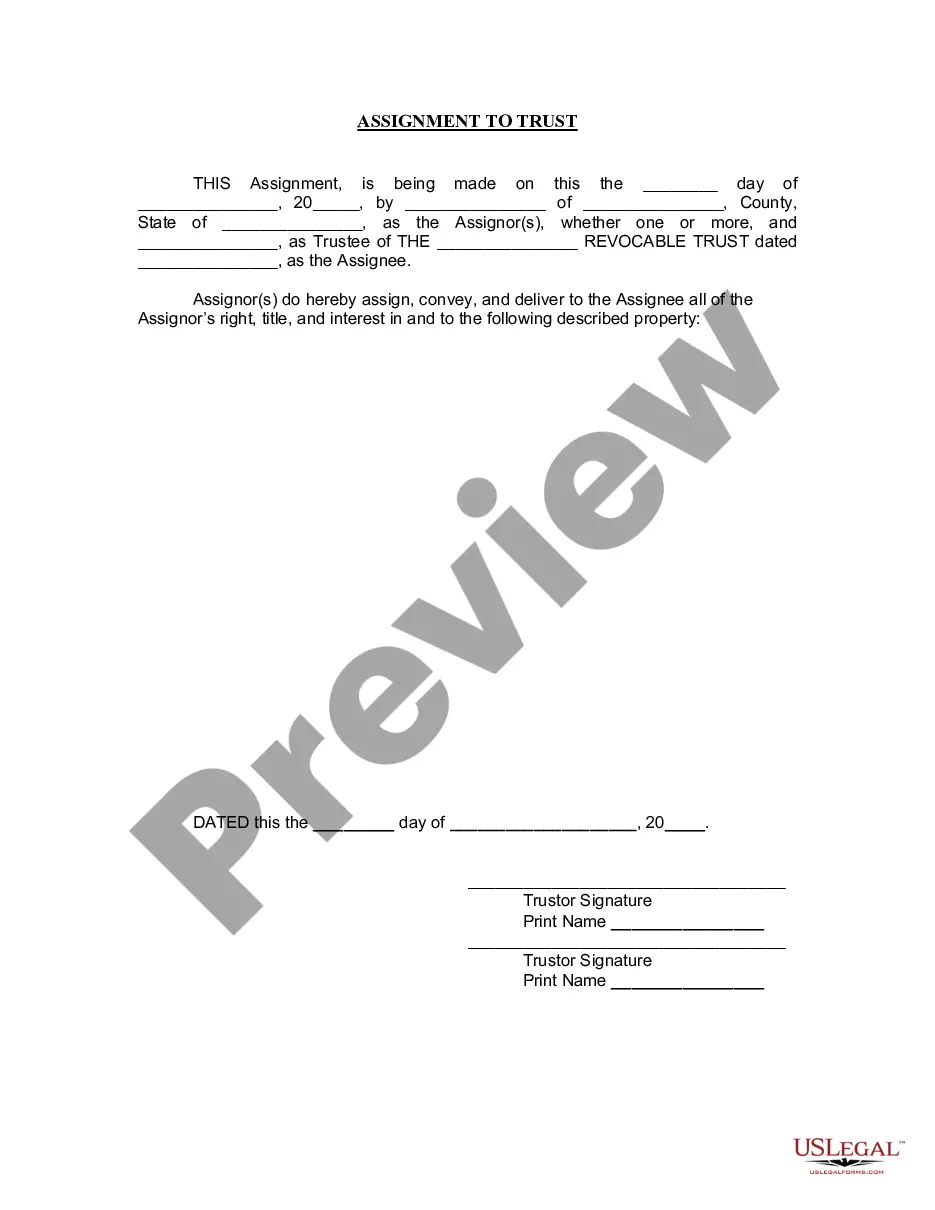

How to fill out Hawaii Assignment To Living Trust?

- If you have previously used US Legal Forms, log in to your account and verify your subscription status. Ensure it is current; renew if necessary.

- For first-time users, start by previewing available forms to confirm you select one that aligns with your requirements and local jurisdiction.

- If adjustments are needed, utilize the Search tab to refine your options until you find the right form.

- Click 'Buy Now' on your chosen document and select your preferred subscription plan to get started.

- Complete your purchase by entering your credit card information or connecting via your PayPal account.

- Download your selected form to your device for completion. You can later access it in the My Forms section of your profile.

With US Legal Forms, you gain access to a comprehensive library, expert assistance, and a seamless process that simplifies legal documentation.

Start your journey towards precise and reliable legal forms today—trust a live guide at US Legal Forms to assist you in the process!

Form popularity

FAQ

The best way to leave property to your children after your death is by utilizing a trust arrangement. By doing this, you can designate specific instructions for the distribution of your property, ensuring that your wishes are honored. A trust also helps your heirs avoid the complications of probate, which can delay the transfer of assets. Consulting platforms like US Legal Forms can provide valuable resources to create the right trust for your needs.

To effectively leave a house to your children, consider establishing a trust, especially if you want to ensure your wishes are followed after you pass away. With a trust, you can specify how and when your children receive the property, which adds a layer of protection. Moreover, using a trust avoids the lengthy probate process, making things easier for your loved ones. With tools from US Legal Forms, setting up such a trust is straightforward.

Deciding whether to gift a house or put it in a trust can be complex. If you trust a live implementation, putting the house in a trust often provides more protection and control over the asset. Trusts can help avoid probate and may offer tax advantages. Conversely, gifting a house might have immediate tax implications and could expose the property to your child's personal liabilities.

When you trust a live arrangement and put your home in your child's name, you may face several drawbacks. Firstly, you lose control over the property, which can become an issue if your child encounters financial problems or legal disputes. Additionally, if your child faces a divorce or lawsuit, the home could be at risk. Therefore, careful consideration is essential before making such a decision.

Filing an estate tax return electronically is possible, but it comes with specific conditions. For estates that exceed the federal threshold amount, you must file Form 706, which is often necessary to be submitted by mail. It’s best to ensure you understand the requirements thoroughly. For assistance, think about utilizing USLegalForms to simplify your process when you choose to trust a live service.

Yes, you can file IRS Form 1041 electronically in many cases. It’s essential to verify that you meet all necessary requirements and use compatible software that supports e-filing. Using trusted software can significantly reduce your stress during the filing process. If you’d like greater assurance, consider reaching out to services that help you trust a live professional for guidance.

In Illinois, you may not be able to file Form IL-1041 electronically under specific circumstances, especially depending on the type of income. However, checking with the Illinois Department of Revenue is essential, as regulations frequently change. To streamline your estate or trust filing, explore user-friendly platforms such as USLegalForms, which can assist with these filings.

Filling out a living trust involves several steps. Start by gathering necessary documents, such as assets and beneficiary information, and then take the time to draft the trust document itself. Consulting with a qualified attorney is often wise, as they can help you navigate potential issues. For an efficient experience, consider using USLegalForms, where you can fill out and manage your living trust online.

You can use TurboTax to file Form 1041, the income tax return for estates and trusts. However, make sure that your situation actually fits TurboTax's requirements, as some more complex matters may not be well-suited for this software. If you're unsure, consulting with professionals can provide clarity. Remember, when in doubt, it's good to trust a live expert to assist with these filings.

While a living trust has many benefits, it also has some downsides. One concern is upfront costs, as establishing a living trust can require legal fees and additional management. Another downside is the necessity for active involvement; you must fund the trust properly to ensure it serves its purpose. Always consider these factors when deciding to trust a live option.