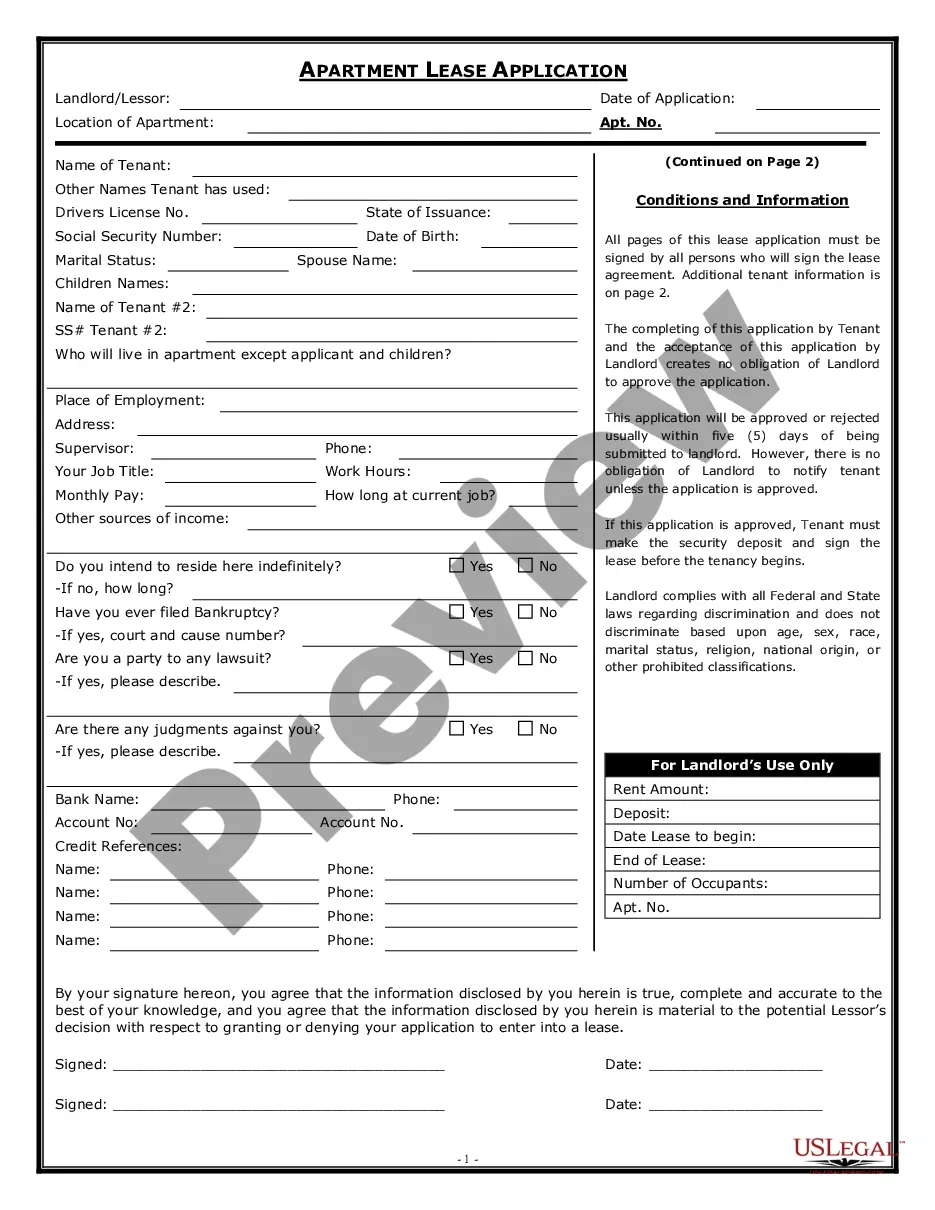

This form is an Apartment Lease Application for the Landlord to have the proposed Tenant complete and submit to the Landlord for the Landlord to evaluate. It contains required disclosures and an authorization for release of information.

Rental Application Hawaii Withholding Tax

Description

How to fill out Rental Application Hawaii Withholding Tax?

Navigating through the red tape of official documents and forms can be challenging, particularly if one does not engage in that professionally.

Even selecting the appropriate template for a Rental Application Hawaii Withholding Tax will consume considerable time, as it must be accurate and precise to the last detail.

Nonetheless, you will have to invest significantly less time in locating a suitable template from a trustworthy resource.

Obtain the correct form in a few easy steps: Enter the name of the document in the search bar. Locate the relevant Rental Application Hawaii Withholding Tax among the results. Review the outline of the sample or open its preview. When the template meets your requirements, click Buy Now. Continue to select your subscription plan. Utilize your email and create a security password to register an account at US Legal Forms. Select a credit card or PayPal payment method. Download the template file on your device in the format of your choosing. US Legal Forms can save you considerable time investigating whether the form you discovered online is appropriate for your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of searching for the right forms online.

- US Legal Forms is a single destination you require to find the most recent samples of documents, confirm their usage, and download these samples to complete them.

- This is a repository with over 85,000 forms that are applicable in various professional fields.

- When looking for a Rental Application Hawaii Withholding Tax, you will not need to doubt its relevance as all the forms are validated.

- Having an account at US Legal Forms will ensure you have all the essential samples within your reach.

- Store them in your history or add them to the My documents catalog.

- You can access your saved forms from any device by merely clicking Log In at the library site.

- If you still lack an account, you can always initiate a new search for the template you require.

Form popularity

FAQ

Rental income in Hawaii is taxed as ordinary income and is subject to both state and federal taxes. Depending on your total taxable income, you may fall into various tax brackets, which can influence your strategies around rental applications and tax payments. Consulting with our services can provide you with clarity on how to appropriately report and manage your rental income tax obligations in Hawaii.

Short-term rentals in Hawaii are taxed at a rate of 10.25%, which includes both the general excise tax and the transient accommodations tax. This tax applies to rentals lasting less than 180 days. If you're applying for a rental in this category, our platform can assist you in managing and understanding these tax implications effectively.

term rental in Hawaii refers to properties rented for six months or longer. This duration distinguishes longterm rentals from shortterm rentals, which typically last less than six months. Understanding this classification is essential when filling out your rental application in Hawaii and planning your tax obligations.

Yes, Hawaii is a mandatory withholding state for rental income. When non-residents earn rental income, property owners are required to withhold 7.25% for general excise tax purposes. This is a crucial factor to consider when navigating your rental application in Hawaii, as it impacts your overall rental income.

In Hawaii, rental income is subject to state income tax, which can range from 1.4% to 11% depending on your income level. It's important to understand how this applies to your specific situation, especially if you are considering submitting a rental application in Hawaii. Utilizing our services can help ensure you are compliant with Hawaii's tax regulations and avoid any potential pitfalls.

The TAT, or Transient Accommodations Tax, is an excise tax levied on short-term rentals in Hawaii. It supports the tourism industry and helps fund essential services across the state. If you're completing a rental application, familiarize yourself with the TAT to ensure you understand the full costs associated with your rental.

Yes, Hawaii does have a withholding tax, especially applicable to real estate transactions. This includes taxes applied to certain types of payments made to non-residents, which may also relate to rental application processes. Understanding the rental application Hawaii withholding tax can help you clarify your potential obligations as a buyer or seller.

To set up tax withholding, first ensure you understand your local tax requirements. You will generally need to use IRS Form W-4 to gather employee tax information. For rental properties, it's especially useful to track these withholdings to handle your rental application Hawaii withholding tax properly. Consider consulting resources like uslegalforms to assist you in navigating through setup and compliance.

Setting up payroll in Hawaii begins with registering your business with the Department of Taxation for withholding tax purposes. You also need to determine the state and federal taxes that apply to your employees. By using a payroll service or software, you can streamline this process and manage not only payroll but also your rental application Hawaii withholding tax obligations effectively.

Yes, when you collect rent, you may need to issue a tax form. Form 1099-MISC is often used to report rents received throughout the year. It's essential to keep detailed records, as the income will be part of your rental application Hawaii withholding tax filings. Ensure you are familiar with the necessary forms to stay compliant.