Hawaii Child Support Calculator For Two Different Mothers

Description

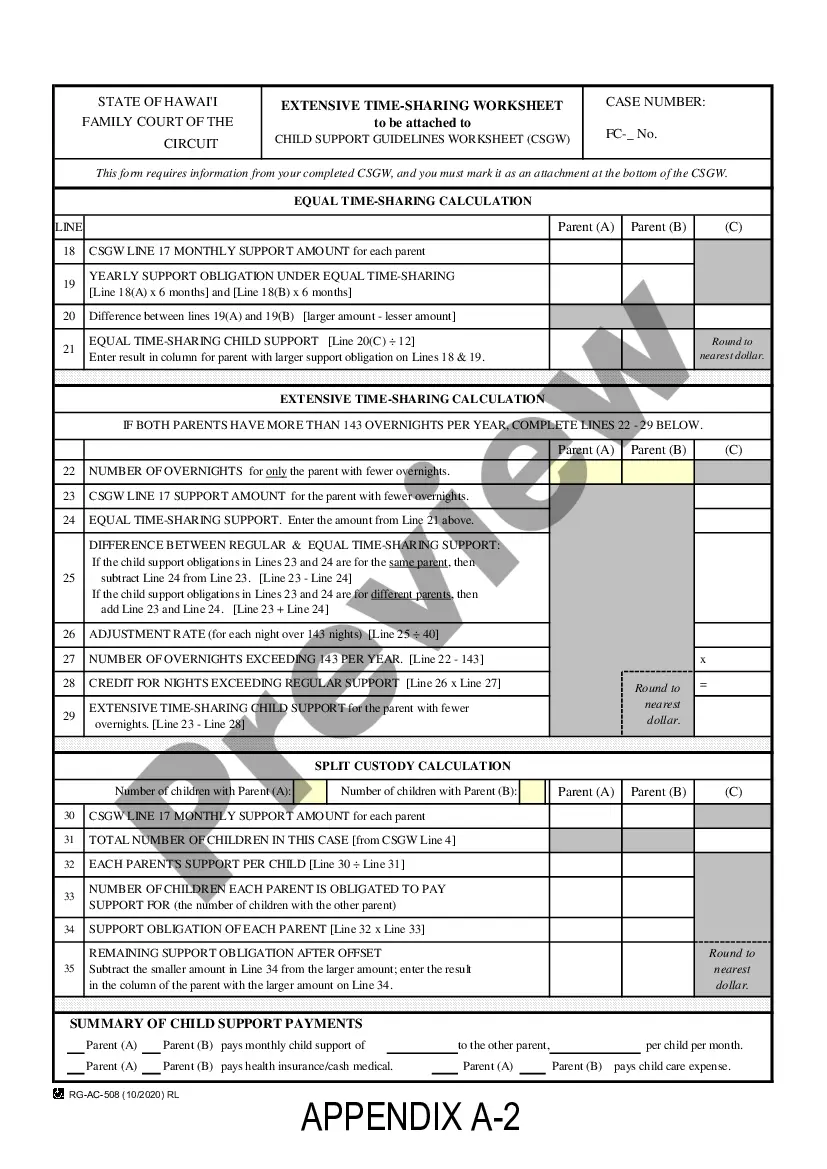

How to fill out Hawaii Child Support Guidelines Worksheet For Joint Custody / Extensive Visitation?

It’s well-known that you cannot become a legal expert instantly, nor can you learn how to swiftly create Hawaii Child Support Calculator For Two Different Mothers without possessing a specialized skill set.

Assembling legal documentation is a lengthy process that necessitates specific education and expertise. So why not entrust the development of the Hawaii Child Support Calculator For Two Different Mothers to the professionals.

With US Legal Forms, one of the most comprehensive legal document collections, you can access everything from court filings to templates for internal communications. We recognize how important compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all forms are location-specific and current.

Select Buy now. Once the payment is processed, you can acquire the Hawaii Child Support Calculator For Two Different Mothers, fill it out, print it, and send or mail it to the required individuals or organizations.

You can re-access your forms from the My documents tab at any point. If you’re an existing customer, you can simply Log In, and find and download the template from the same tab. Regardless of the purpose of your documents—whether financial and legal or personal—our website has you covered. Try US Legal Forms now!

- Start with our website and obtain the form you need in just minutes.

- Find the document you require using the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if Hawaii Child Support Calculator For Two Different Mothers is what you’re looking for.

- If you need a different template, begin your search again.

- Create a free account and choose a subscription plan to purchase the template.

Form popularity

FAQ

Under Illinois law (750 ILCS 5/505), child support is now calculated based on an ?income shares? model. In the income shares model, the court determines what the parents' combined net income is, and then it determines what portion of that net income should go toward the child support obligation.

Hawaii child support is based on the number of overnight visits. Hawaii uses overnights or where the children sleep as the basis for figuring shared custody timeshare percentages in its child support formula. Besides income, overnight totals are a key part of the Hawaii child support formula.

The father having another child will affect the child support calculation. The child support will only change if a party relevant to the case files for a modification. This is because the Illinois child support calculation looks at each parents' obligations to other families.

If one child before the court, then 20% of net resources. If two children before the court, then 25% of net resources. If three children before the court, then 30% of net resources. Assume you have two children by two different mothers.

The short answer is ? generally no. As discussed above, the formula looks at the gross monthly incomes of both parties, then factors in medical insurance premiums and child care expenses. In situations where one party is also paying alimony to the other party, that amount will be factored in as well.