Hawaii Child Support Calculator For Texas

Description

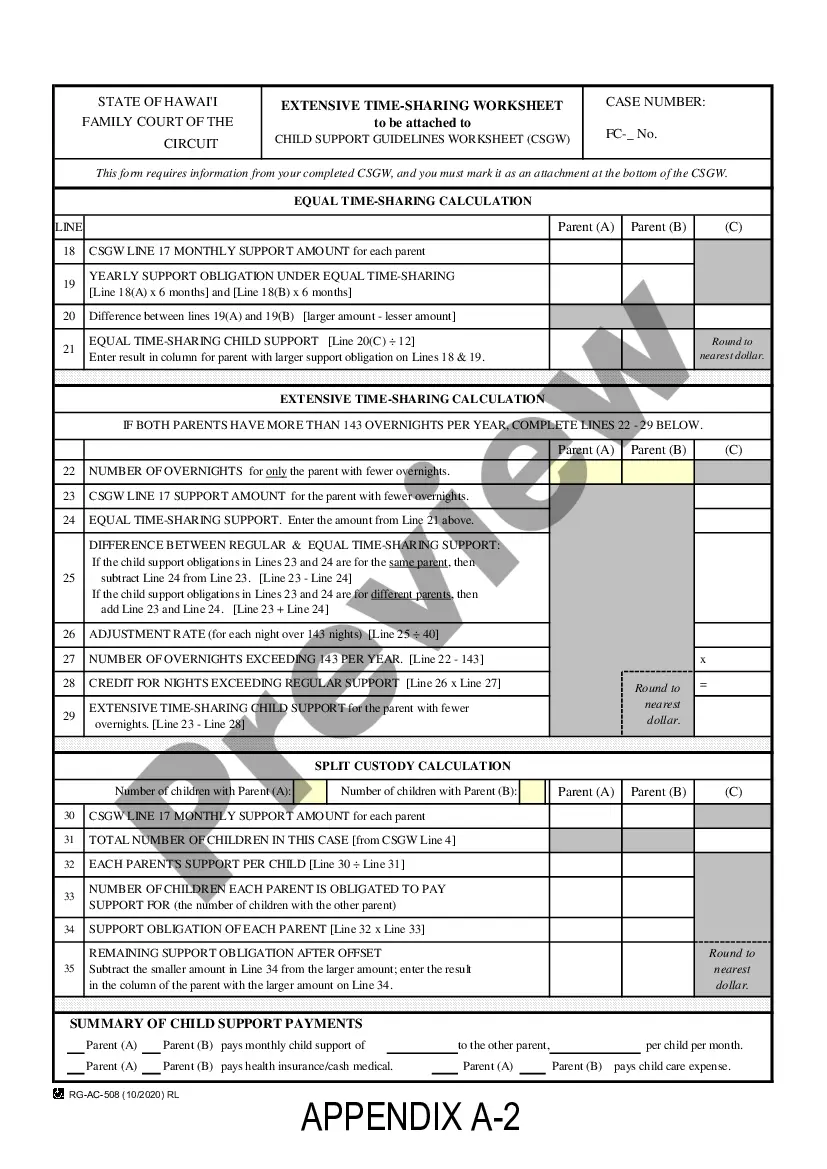

How to fill out Hawaii Child Support Guidelines Worksheet For Joint Custody / Extensive Visitation?

The Hawaii Child Support Calculator For Texas you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and local laws. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, easiest and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Hawaii Child Support Calculator For Texas will take you just a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or check the form description to verify it fits your needs. If it does not, make use of the search option to find the correct one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Choose the format you want for your Hawaii Child Support Calculator For Texas (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Make use of the same document again anytime needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Texas child support laws provide the following Guideline calculations: one child= 20% of Net Monthly Income (discussed further below); two children = 25% of Net Monthly Income; three children = 30% of Net Monthly Income; four children = 35% of Net Monthly Income; five children = 40% of Net Monthly Income; and six ...

Ing to Texas law, if you are paying child support for one child, you'll need to pay 20% of your net monthly income. If you have two children, you are paying 25% of your net monthly income, three children are 30%, four children are 35%, and so on.

Is There a Maximum Amount of Child Support? Yes. Texas divorce laws state the maximum child support amount for one child is $1,840. This is because state law dictates a maximum amount of net monthly income that can be used to calculate child support, which is $9,200.

Hawaii child support is based on the number of overnight visits. Hawaii uses overnights or where the children sleep as the basis for figuring shared custody timeshare percentages in its child support formula. Besides income, overnight totals are a key part of the Hawaii child support formula.

Texas child support laws provide the following Guideline calculations: one child= 20% of Net Monthly Income (discussed further below); two children = 25% of Net Monthly Income; three children = 30% of Net Monthly Income; four children = 35% of Net Monthly Income; five children = 40% of Net Monthly Income; and six ...