The New Hampshire Request for Refund of Filing Fee is a form that allows individuals or entities to request a refund of fees paid to the New Hampshire Department of Revenue Administration (NH DRA) for filing a document with the state. This form is typically used to request a refund for filing fees paid for documents such as business entities, LCS, corporations, partnerships, and other types of documents. There are two types of New Hampshire Request for Refund of Filing Fee: one is for documents filed prior to July 1, 2011, and the other is for documents filed on or after July 1, 2011. The form should be completed and submitted to the NH DRA, along with the original receipt and documentation to support the request. The NH DRA will review the application and make a determination on the request.

New Hampshire Request for Refund of Filing Fee

Description

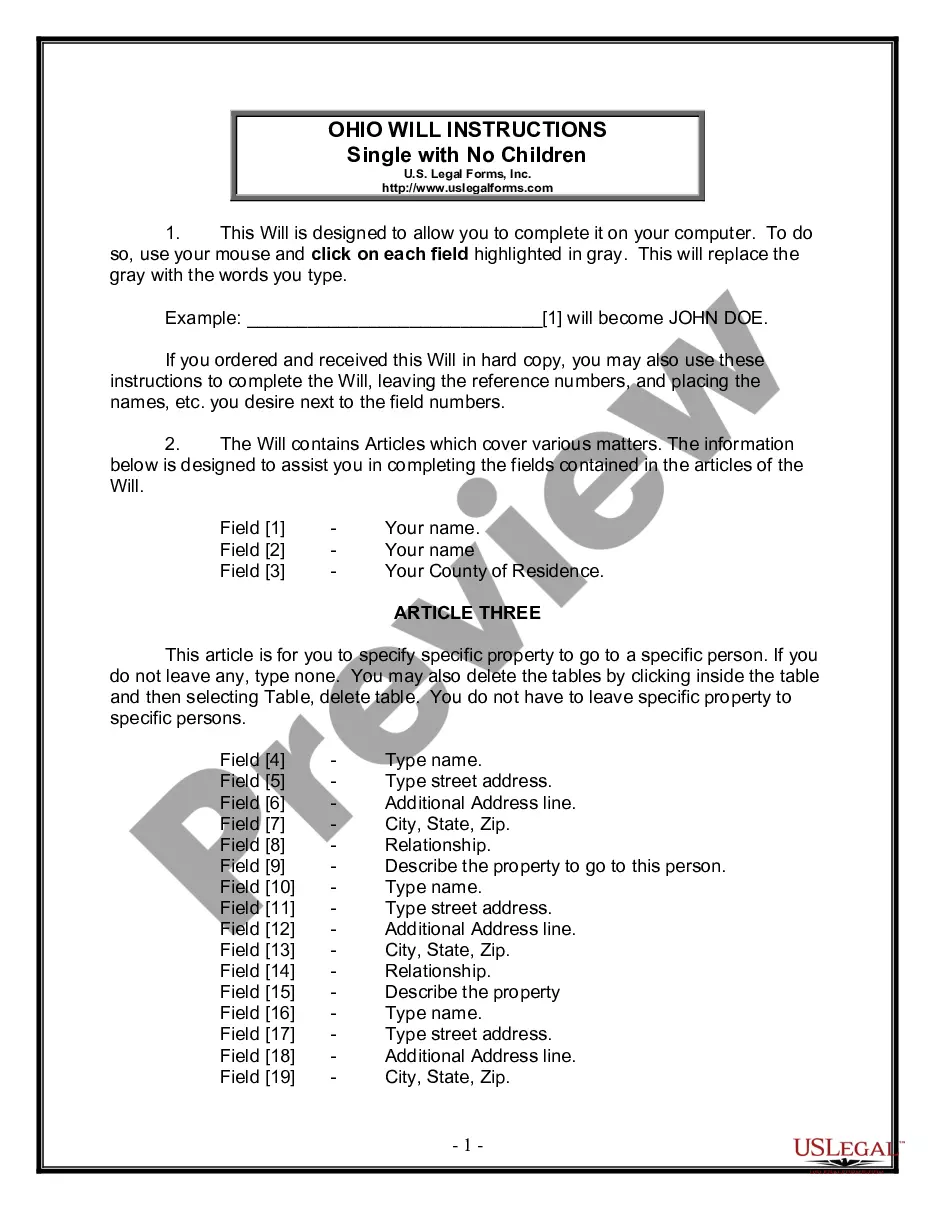

How to fill out New Hampshire Request For Refund Of Filing Fee?

Handling legal documentation requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your New Hampshire Request for Refund of Filing Fee template from our service, you can be certain it meets federal and state regulations.

Working with our service is straightforward and fast. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your New Hampshire Request for Refund of Filing Fee within minutes:

- Remember to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the New Hampshire Request for Refund of Filing Fee in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the New Hampshire Request for Refund of Filing Fee you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

How much is a New Hampshire Business License? New Hampshire doesn't have a general business license at the state level, so there are no fees there. However, your business may need a state-level occupational license or municipal-level license or permit to operate.

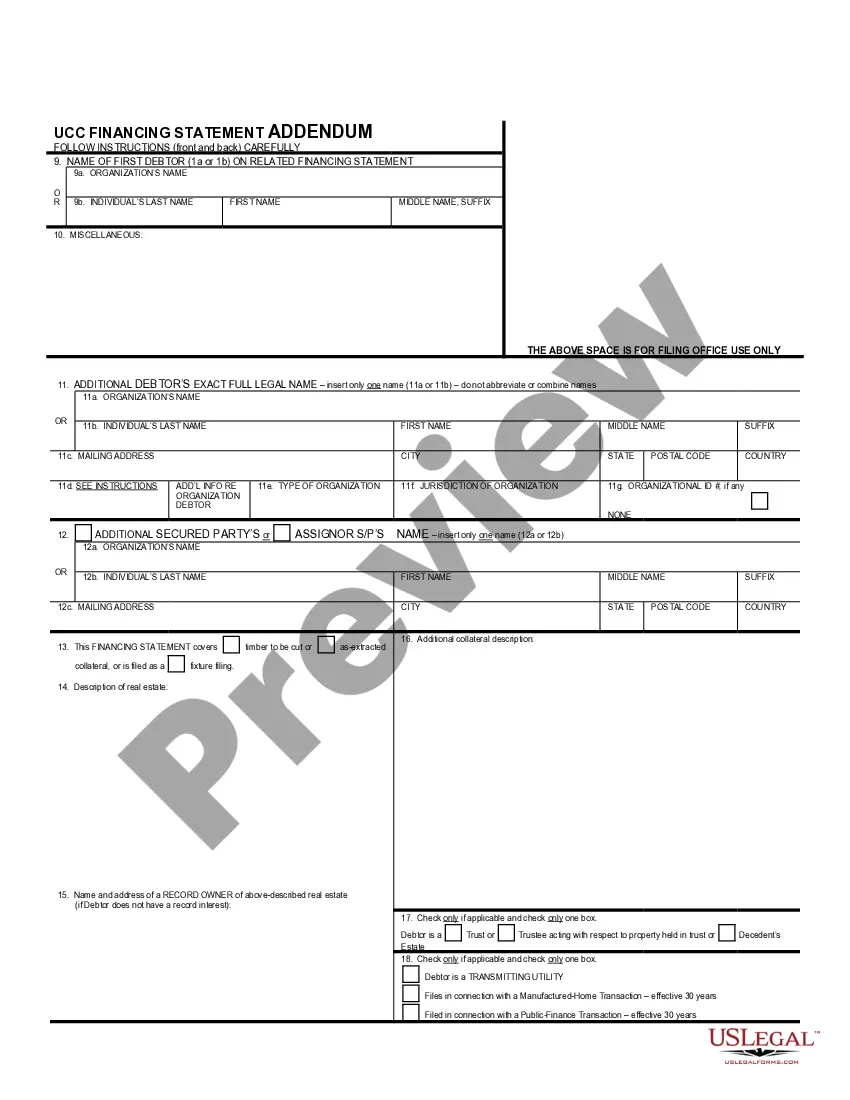

Forms and Search Requests Available OnlinePaper FormsFeesFile OnlineUCC 5: National Information Statement$48.00EFS 1 EFS 3$15.00File OnlineUCC 11-U Search: State Information Request Form.Routine $10.00 24 Hour $25.00 Same Day $35.00Form 9Contact UCC for filing fee6 more rows

New Hampshire Professional Corporation Annual Report Requirements: Agency:New Hampshire Secretary of State - Corporations DivisionFiling Method:Mail or online.Agency Fee:$100. +$2 to file online.Due:Annually by April 1. Reports may be filed as early as January 1.Penalties:$50 late fee.2 more rows

As of 2022, the filing fees for divorce petitions in New Hampshire were $250 (or $252 with minor children). Court fees are always subject to change, so you may want to check with the family court clerk's office to verify the current amount, as well as the accepted methods of payment.

It costs $100 to file for a New Hampshire LLC. If you file the form online, there is an additional $2 service fee charged with the $100.

All New Hampshire LLCs need to pay $100 per year for Annual Reports. These state fees are paid to the Secretary of State. And this is the only state-required annual fee. You have to pay this to keep your LLC in good standing.

$90.00 filing fee for claims of $5,000 or less.

LLC filing fees range from $35 to $500. As of 2023, the average cost to form an LLC in the US is $132.