Hawaii Child Support Calculator For Florida

Description

How to fill out Hawaii Child Support Guidelines Worksheet For Joint Custody / Extensive Visitation?

Drafting legal documents from scratch can sometimes be intimidating. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more cost-effective way of creating Hawaii Child Support Calculator For Florida or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual collection of over 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-specific forms carefully prepared for you by our legal experts.

Use our platform whenever you need a trusted and reliable services through which you can easily find and download the Hawaii Child Support Calculator For Florida. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Hawaii Child Support Calculator For Florida, follow these recommendations:

- Review the form preview and descriptions to make sure you are on the the document you are looking for.

- Check if template you choose conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to purchase the Hawaii Child Support Calculator For Florida.

- Download the form. Then complete, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us now and turn document execution into something simple and streamlined!

Form popularity

FAQ

Both parents contribute child support payments, ing to their incomes. For instance, for income over $10,000, the guidelines stipulate the lowest amount based on the following percentages: One child ? 5%, two children ? 7.5%, 3 children -9.5%, four children ? 11%, five children -12% and 6 children up to 12.5%.

Gross income is the first factor used to calculate child support payments in Florida. Gross income includes all wages, salaries, or other compensation earned by either party and any money received from investments or other sources such as Social Security or disability benefits.

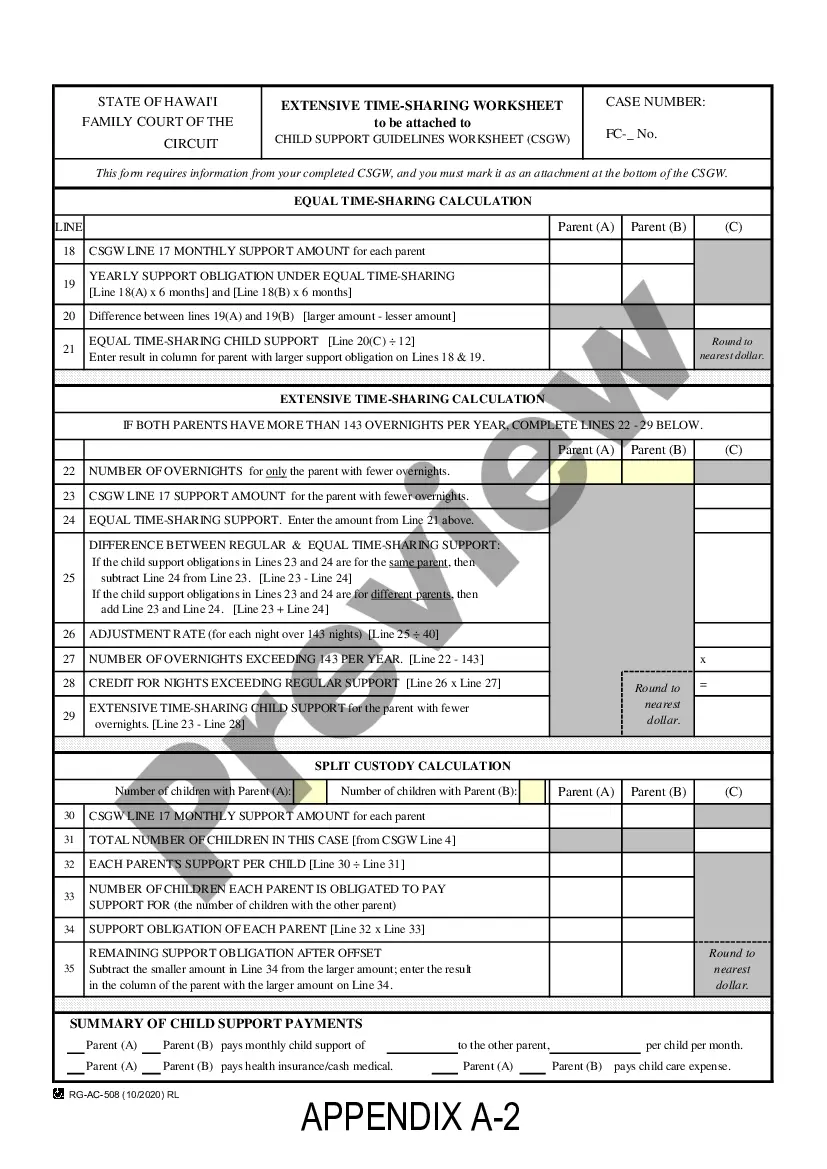

Hawaii child support is based on the number of overnight visits. Hawaii uses overnights or where the children sleep as the basis for figuring shared custody timeshare percentages in its child support formula. Besides income, overnight totals are a key part of the Hawaii child support formula.

After you have added up all of the various deductions which you are entitled to be credited with under Florida law, you subtract that total from your gross income. This is your monthly net income for calculating child support.

Divide either parent's net income by the combined available income. Multiply the result by 100 to get their percentage of financial responsibility. The remaining percentage is the other parent's responsibility. Example: Jamie divides her net income of $4,000 by $6,400 (the combined net income from Step 2).