Short Form Trust Agreement Hawaii Withholding

Description

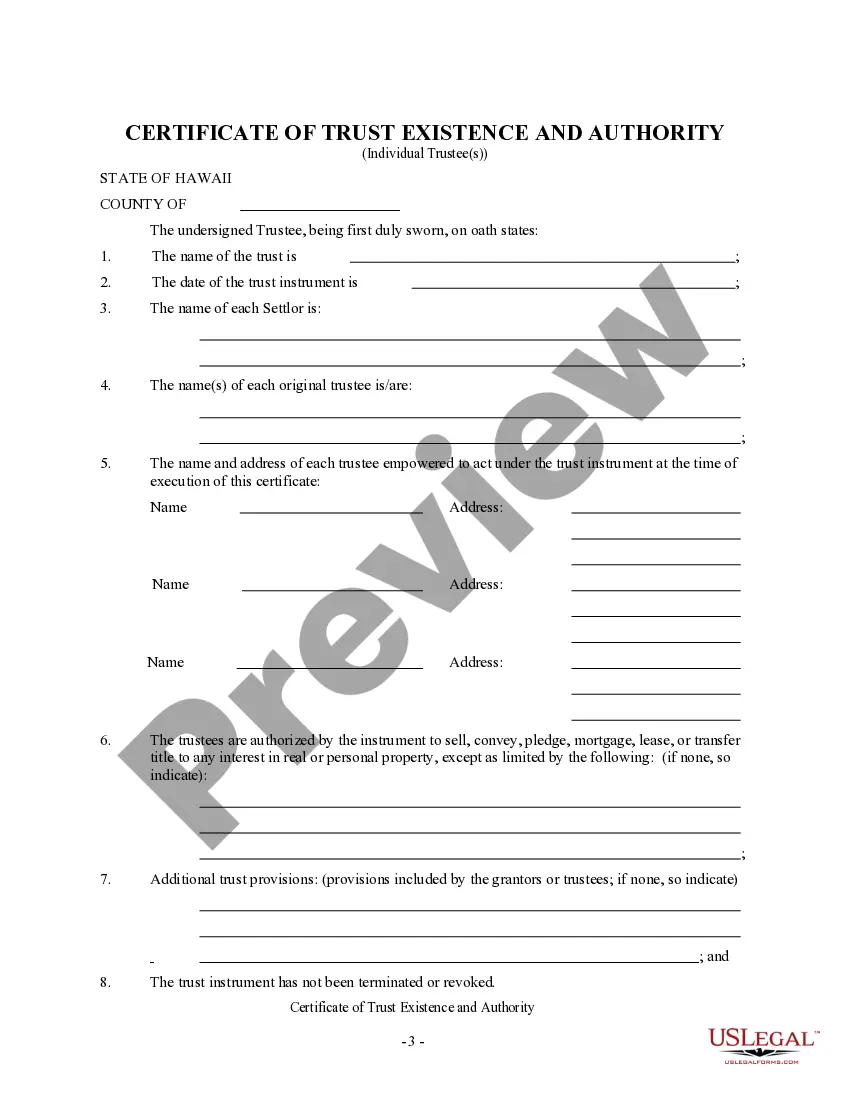

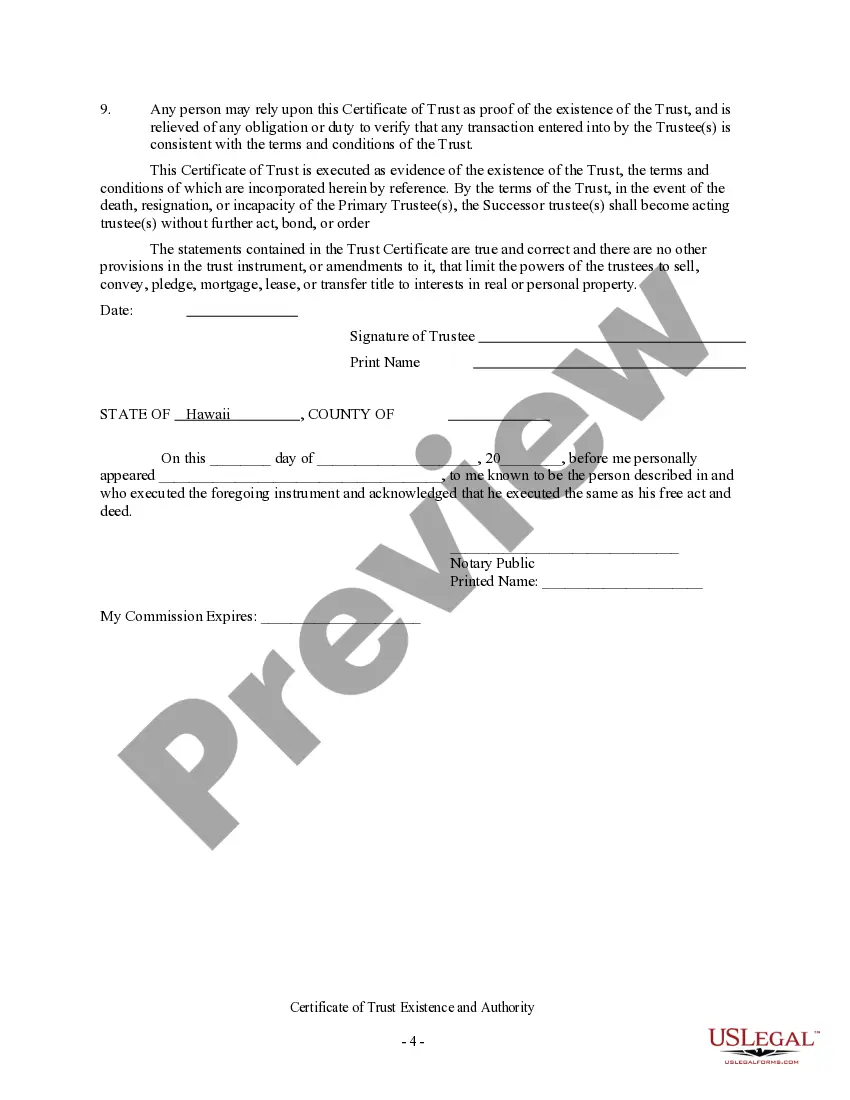

How to fill out Hawaii Certificate Of Trust Existence And Authority By Individual?

Drafting legal documents from scratch can sometimes be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re looking for a an easier and more affordable way of creating Short Form Trust Agreement Hawaii Withholding or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online library of more than 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-specific templates diligently put together for you by our legal specialists.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Short Form Trust Agreement Hawaii Withholding. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to set it up and navigate the library. But before jumping directly to downloading Short Form Trust Agreement Hawaii Withholding, follow these tips:

- Check the form preview and descriptions to ensure that you are on the the document you are looking for.

- Make sure the template you select conforms with the regulations and laws of your state and county.

- Choose the right subscription option to buy the Short Form Trust Agreement Hawaii Withholding.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us now and turn form execution into something simple and streamlined!

Form popularity

FAQ

A 7.25% withholding obligation is generally imposed on the transferee/buyer when a Hawaii real property interest is acquired from a nonresident person. This withholding serves to collect Hawaii income tax that may be owed by the nonresident person. Use this form to report and transmit the amount withheld.

Every employer that has one or more employees in Hawaii must withhold income tax from the wages of both resident and nonresident employees for services performed in Hawaii.

To satisfy both FIRPTA and HARPTA requirements, the combined cash requirement is fifteen percent (15%) of the sales price. withholding certificates from each of the taxing authorities, the entire amount should be withheld and remitted to the proper tax agencies.

The tax rates for estates and trusts range from 1.4% to 8.25%. The tax rates for corporations are 4.4% up to $25,000, 5.4% over $25,000 but not over $100,000, and 6.4% over $100,000 of taxable income.

Forms required to be filed for Hawaii payroll are: Income Withholdings: Form HI VP-1 Hawaii Withholding Payment Voucher is due semiweekly, monthly or quarterly based on the assigned schedule. Form HI HW-14 Hawaii Withholding Tax Return is due to be filed monthly or quarterly based on the assigned schedule.