Certificate Of Trust Example For Mortgage

Description

Form popularity

FAQ

A trust holds the title to the property, allowing the trustee to manage the mortgage and the asset more effectively. This arrangement ensures that the property is protected and can be passed to beneficiaries according to the trust's terms. The trust structure can offer tax benefits and help avoid probate. Utilizing a Certificate of trust example for mortgage can showcase the trust's authority and streamline the mortgage process.

Typically, the trustee manages the mortgage payments on a house held in a trust. The trustee uses funds from the trust or income generated by the trust assets to make these payments. Beneficiaries may also contribute if they benefit from the property. It's essential to refer to the Certificate of trust example for mortgage for specific payment responsibilities outlined in the trust documents.

Lenders often prefer a deed of trust because it offers a faster and simpler process in case of default. With a deed of trust, lenders can initiate a foreclosure without going through court, which can save time and legal costs. This efficiency makes deeds of trust appealing to lenders. Providing a Certificate of trust example for mortgage can reassure lenders about the trust's credibility and management.

A mortgage in a trust involves placing the property title under the trust's name, which allows for more controlled asset management. The trust then becomes the borrower, and the trustee manages the mortgage payments. This structure can help avoid probate and streamline the transfer of assets, making it beneficial for estate planning. A Certificate of trust example for mortgage can clarify the roles and responsibilities of the trustee and beneficiaries.

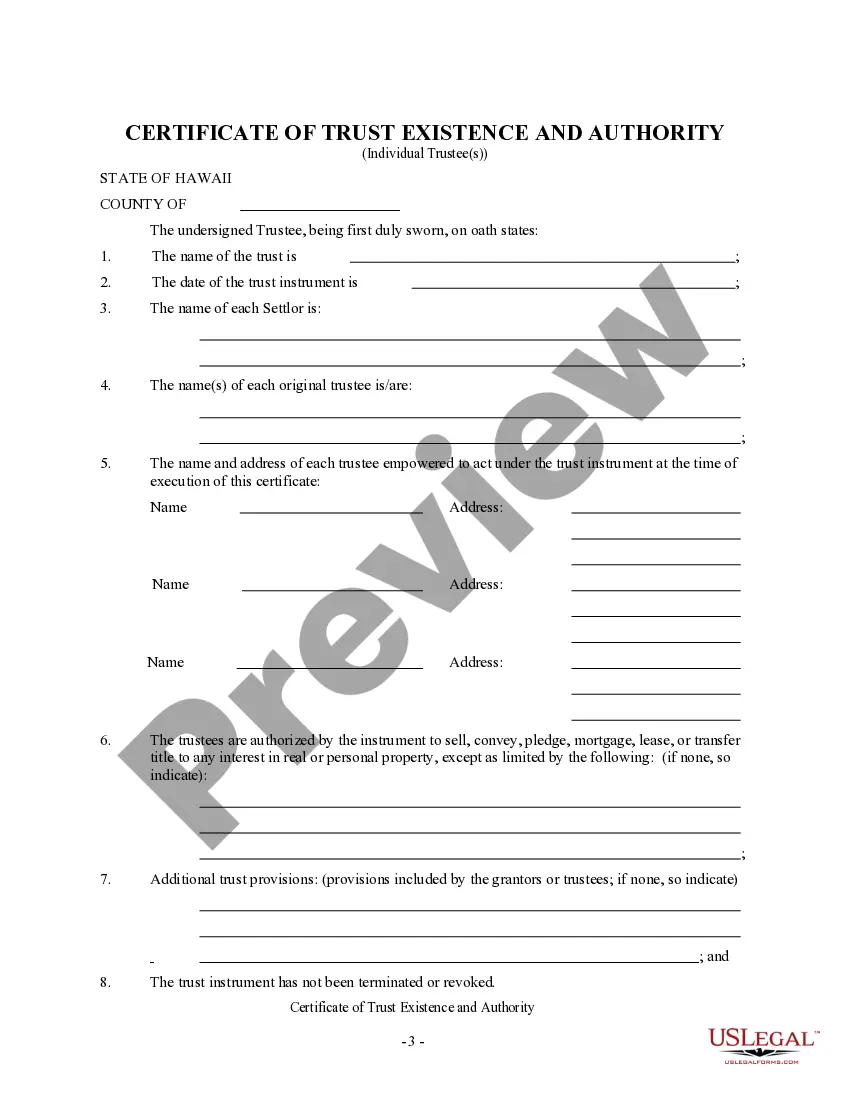

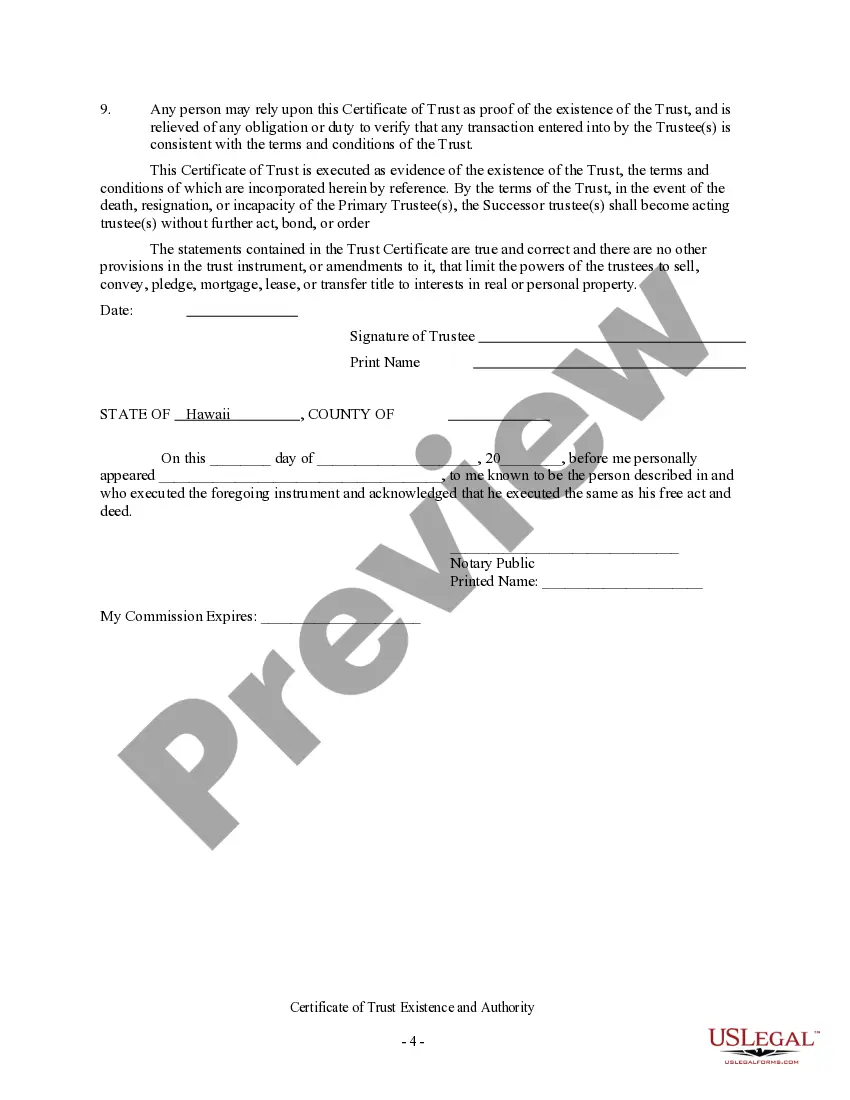

A certificate of trust serves as a legal document that confirms the existence of a trust without disclosing all its elements. It allows trustees to manage assets, such as a mortgage, while protecting the beneficiaries' privacy. When you have a Certificate of Trust example for mortgage, you create a formalized way to engage with lenders or other parties. This streamlines transactions and clarifies your intent regarding trust assets.

A certificate of trust works by providing a summary of the trust's existence without revealing the trust's full terms. It includes essential details, such as the trustee's identity and their powers, which can be useful during property transfers or legal transactions. Utilizing a Certificate of Trust example for mortgage can help clarify this process. By keeping sensitive information private, it simplifies dealings with financial institutions.

To draft a trust document, begin by clearly stating the trust’s name, purpose, and details about the assets included. Designate the trustees and beneficiaries, ensuring their roles and rights are explicitly outlined. For practical guidance, refer to a Certificate of Trust example for mortgage. Platforms like USLegalForms can provide helpful templates, making drafting straightforward and compliant with legal standards.

You can place your mortgage in a trust by first reviewing your mortgage agreement to ensure there are no restrictions. Next, consult with a legal expert to create a trust that specifies the mortgage as a trust asset. Additionally, obtain a Certificate of Trust example for mortgage, which will provide proof of the trust’s existence when dealing with your lender. Always keep lenders informed of any changes to ensure a smooth transfer.

To write a certification of trust, start by identifying the trust's name, date of creation, and the trustee's names. Include specific powers granted to the trustee regarding the property in question. It's helpful to reference a Certificate of Trust example for mortgage to ensure compliance with local laws and requirements. You can use resources like USLegalForms for templates and further guidance.

To place your house in a trust while it has a mortgage, you first need to review the mortgage agreement for any restrictions. Inform your lender about your decision to place the property in trust, as they may require documentation. You can then draft a deed transferring the property into the trust's name. Utilizing a certificate of trust example for mortgage situations can clarify this process and protect your interests.