Hawaii Provisions With Computer System

Description

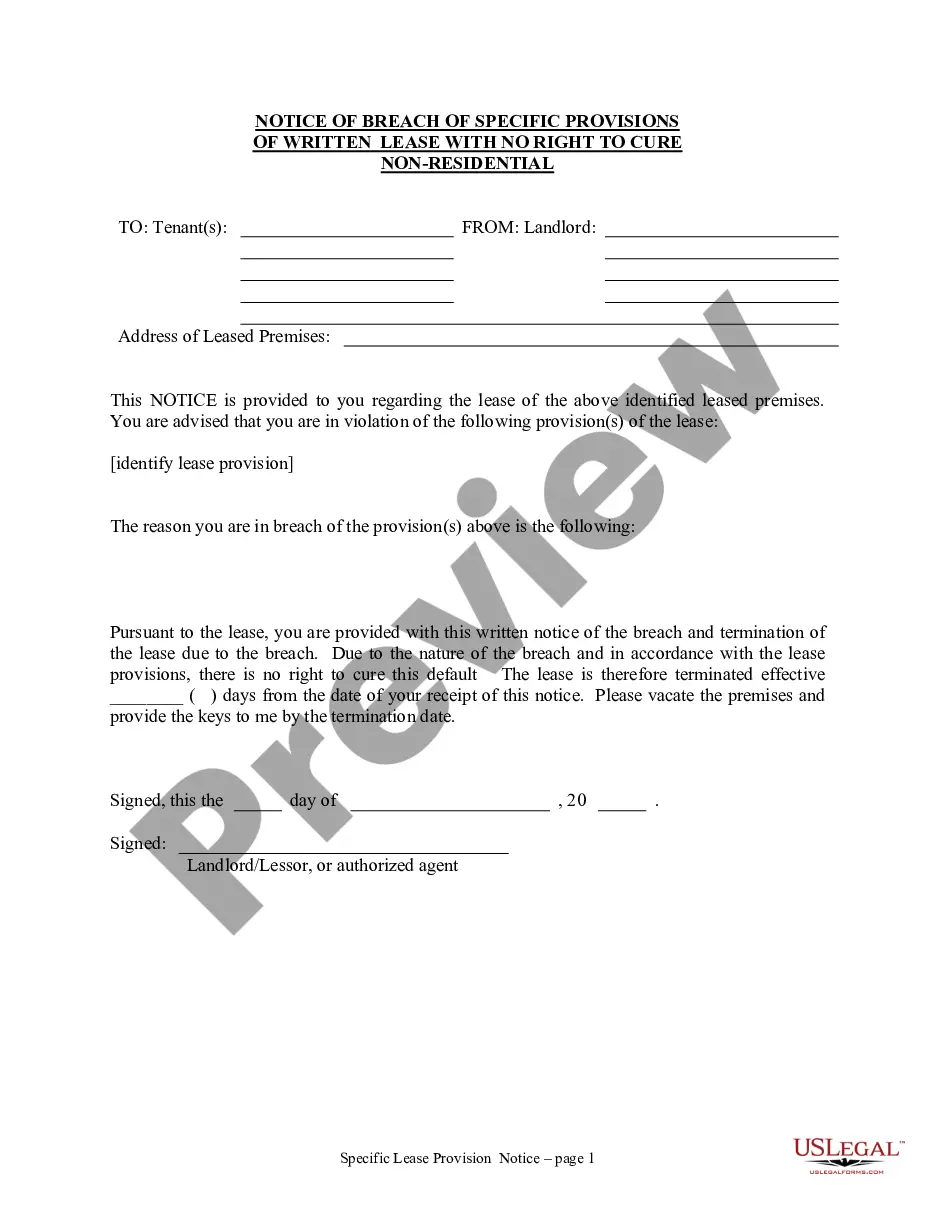

How to fill out Hawaii Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With No Right To Cure For Nonresidential Property From Landlord To Tenant?

- Log in to your US Legal Forms account if you're an existing user, or create a new account to get started.

- Check the form preview and description to confirm it's suitable for your needs and jurisdiction.

- Use the search feature if you need additional templates for your specific requirements.

- Select your desired document and click on the 'Buy Now' button, choosing a subscription plan that fits your usage.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Finally, download your form onto your device. You can also access it later from the 'My Forms' section in your profile.

By following these steps, you can easily create legally sound documents tailored to your needs. US Legal Forms is dedicated to offering a robust collection of forms and expert support to ensure your legal tasks are completed accurately.

Get started today and experience the benefits of hassle-free legal documentation!

Form popularity

FAQ

Yes, Hawaii features various privacy laws that govern the use of personal data. These laws include rights and protections that apply specifically to Hawaii provisions with computer systems. Staying informed about these regulations is critical for anyone engaging with technology or online services in Hawaii.

Hawaii does have privacy laws aimed at protecting citizens' personal information, especially in regards to digital interactions. These laws align with the broader concept of Hawaii provisions with computer systems, emphasizing the importance of responsible data use. Being aware of these laws can help both individuals and businesses exercise their rights effectively.

Yes, Hawaii has safe haven laws designed to protect certain individuals, particularly in cases involving children. These laws provide legal protection for specific circumstances, ensuring that Hawaii provisions with computer systems are not misused. Understanding these provisions can help individuals navigate complex legal challenges.

California is often recognized for having the strictest privacy laws in the United States. However, Hawaii provisions with computer systems also include specific privacy protections that businesses and residents must follow. It's essential to stay informed on these regulations to ensure compliance and protect personal information.

In Hawaii, felony cyber crimes generally involve crimes committed using a computer system, such as hacking or identity theft. The legal framework outlines specific actions that can result in felony charges, thereby emphasizing the need for compliant behavior when using Hawaii provisions with computer systems. These definitions are important for anyone engaged in digital activities in the state.

Yes, Hawaii operates under both state and federal laws, which can lead to unique legal situations. The state has laws that may differ from those of the mainland United States, particularly regarding Hawaii provisions with computer systems. Understanding these differences is crucial for residents and businesses operating in Hawaii.

Yes, you can file your Hawaii taxes online using various e-filing programs that comply with state regulations. This method simplifies the filing process and helps manage your tax documentation electronically. By taking advantage of a computer system, you can ensure that your submission adheres to the Hawaii provisions with computer system, expediting your filing and reducing errors.

Yes, Hawaii does tax remote workers if they are considered residents or if the work is performed for a business located in Hawaii. Understanding the Hawaii provisions with computer systems can help remote workers determine their tax obligations. It’s essential to account for any income earned while working remotely, so familiarize yourself with the state tax rules to avoid surprises.

Filing your Hawaii N 20 involves submitting the form to the Department of Taxation. You can choose to file online or by mail, depending on your preference. Utilizing a computer system to assist in this process can help make sure that you provide all required information and submit to the correct address. Always verify the latest filing instructions on the official website.

To file a Hawaii G-49, you must complete the required forms accurately and ensure that all necessary documentation is attached. You can either file by mail or electronically. Using a computer system can ease this process by guiding you through the steps and ensuring you meet all requirements for the Hawaii provisions with computer system. Check the Hawaii Department of Taxation's website for specific details.