Hawaii Promissory Note Without Interest

Description

How to fill out Hawaii Promissory Note - Horse Equine Forms?

There's no longer a necessity to devote hours searching for legal documents to comply with your local state requirements.

US Legal Forms has compiled all of them in one location and streamlined their accessibility.

Our platform provides over 85k templates for any business and individual legal situations categorized by state and purpose.

You can use the Search bar above to look for another template if the previous one didn't meet your requirements. Select Buy Now next to the template name once you locate the appropriate one. Choose the most suitable subscription plan and create an account or Log In. Proceed to pay for your subscription with a credit card or via PayPal. Choose the file format for your Hawaii Promissory Note Without Interest and download it to your device. Print your form to fill it out manually or upload the template if you prefer to utilize an online editor. Preparing official documents under federal and state regulations is quick and simple with our library. Try US Legal Forms today to keep your documentation organized!

- All forms are properly drafted and verified for validity, allowing you to feel confident in acquiring a current Hawaii Promissory Note Without Interest.

- If you are acquainted with our platform and already possess an account, make sure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documentation at any moment needed by accessing the My documents tab in your profile.

- If you've never used our platform before, the process will involve a few additional steps to complete.

- Here's how new users can access the Hawaii Promissory Note Without Interest in our catalog.

- Examine the page content meticulously to confirm it includes the sample you need.

- Utilize the form description and preview options if available.

Form popularity

FAQ

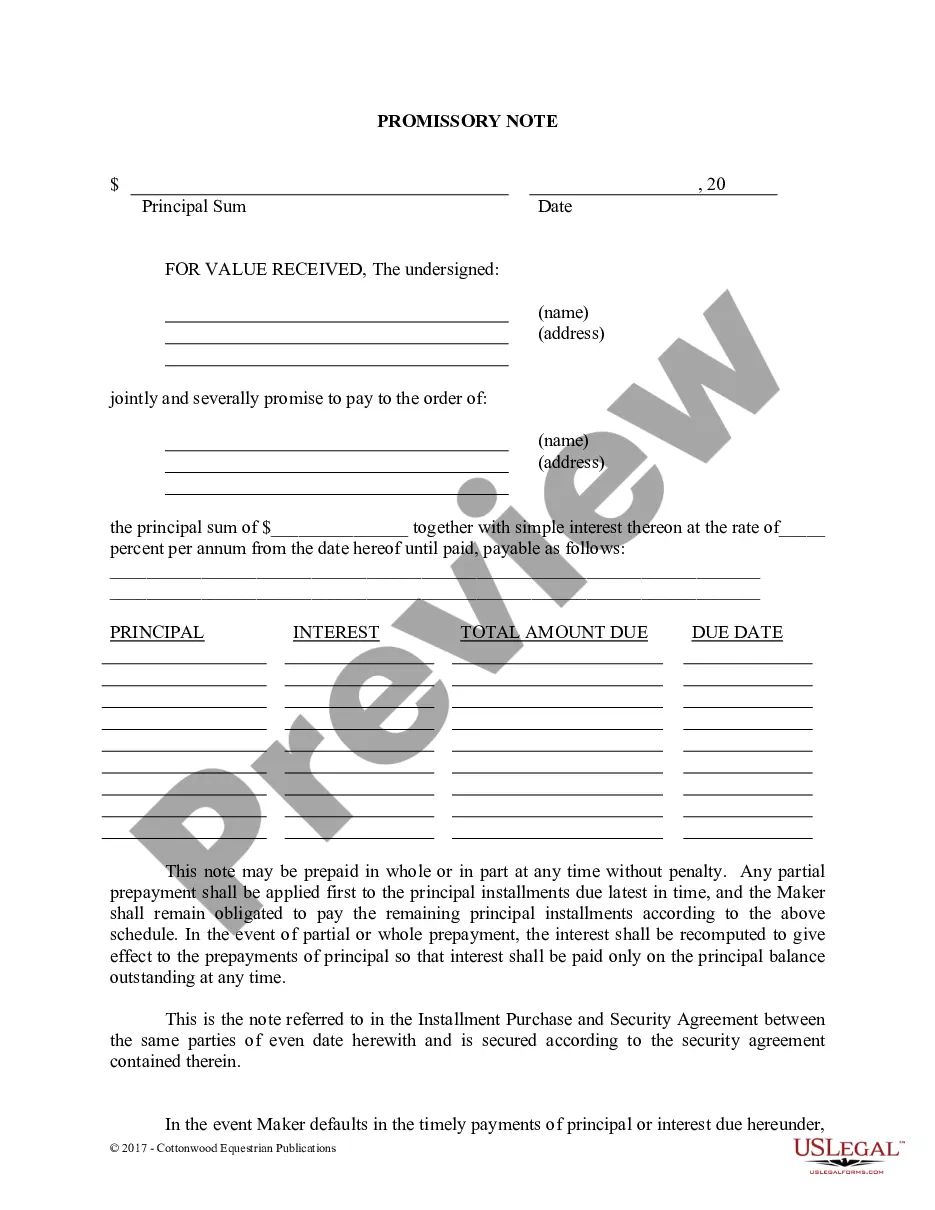

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

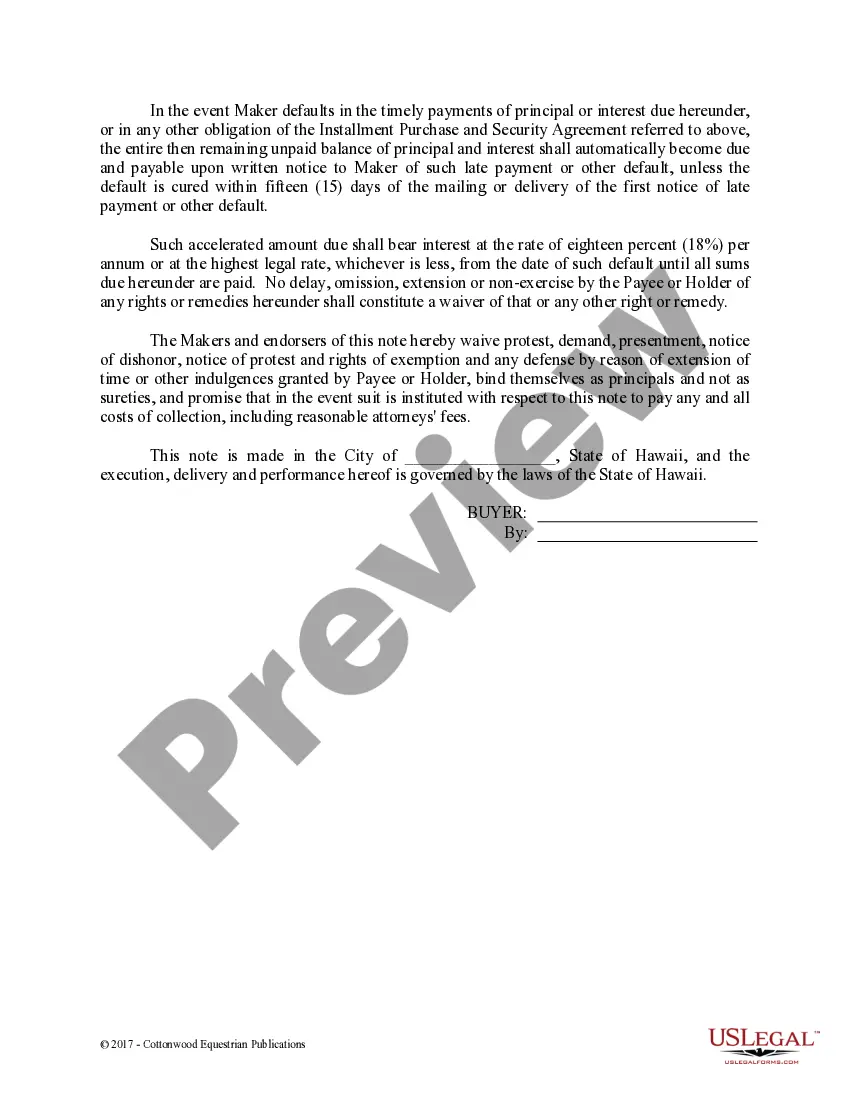

Principal and interest are payable in lawful money of the United States of America. Maker may prepay this Note in full or in part at any time without a prepayment charge. DEFAULT/ACCELERATION.

If you decide to give the loan without charging any interest, be prepared to justify it to the IRS, because it literally is a gift in the IRS's eyes. The IRS can "impute" interest on your loan, whether you actually charged any interest or not, and require you to report that imputed interest as income.

Promissory notes legally bind the borrower and lender in an agreement where the borrower is responsible for paying back a loan or debt. They lay out the conditions of the loan and detail the time frame for paying back the loan as well as any interest that might accrue over the life of the loan.