Hawaii Promissory Note With Collateral Sample

Description

How to fill out Hawaii Promissory Note - Horse Equine Forms?

No matter if you frequently handle documents or occasionally need to transmit a legal paper, it is essential to have a source where all samples are interconnected and current.

The first action you should take with a Hawaii Promissory Note With Collateral Sample is to verify that it is indeed the latest version, as this determines its eligibility for submission.

If you wish to streamline your quest for the most recent document examples, look for them on US Legal Forms.

Avoid the hassle of dealing with legal documents. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a collection of legal documents that encompasses nearly every sample you can search for.

- Look for the templates you require, assess their relevance immediately, and learn more about their applications.

- With US Legal Forms, you have access to over 85,000 form templates across a broad range of areas.

- Obtain the Hawaii Promissory Note With Collateral Sample examples in just a few clicks and save them at any time in your account.

- A US Legal Forms account will enable you to access all the samples you require with greater ease and minimal effort.

- Simply click Log In in the site header and navigate to the My documents section where all the forms you need are at your fingertips, eliminating the need to waste time searching for the correct template or verifying its applicability.

- To obtain a form without creating an account, follow these steps.

Form popularity

FAQ

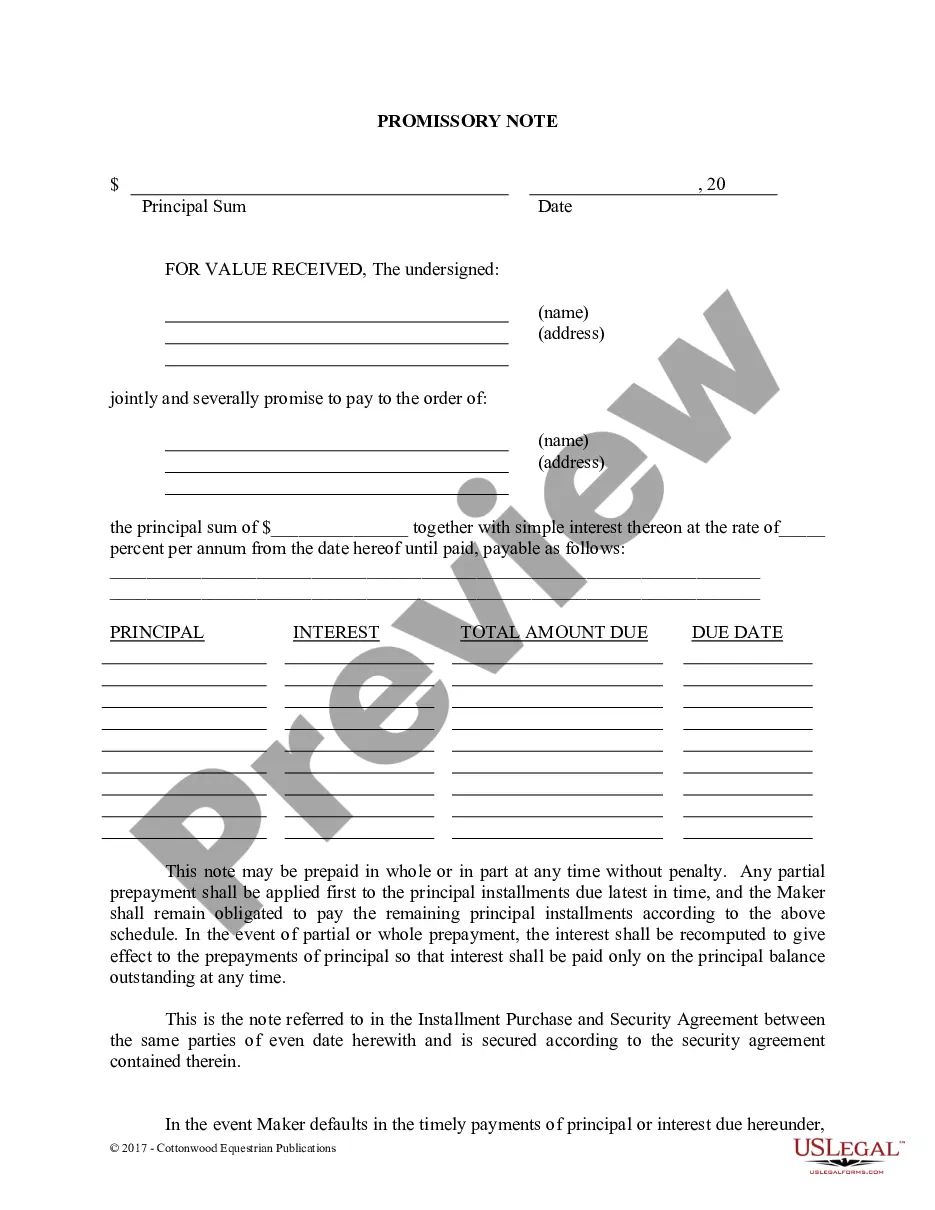

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.