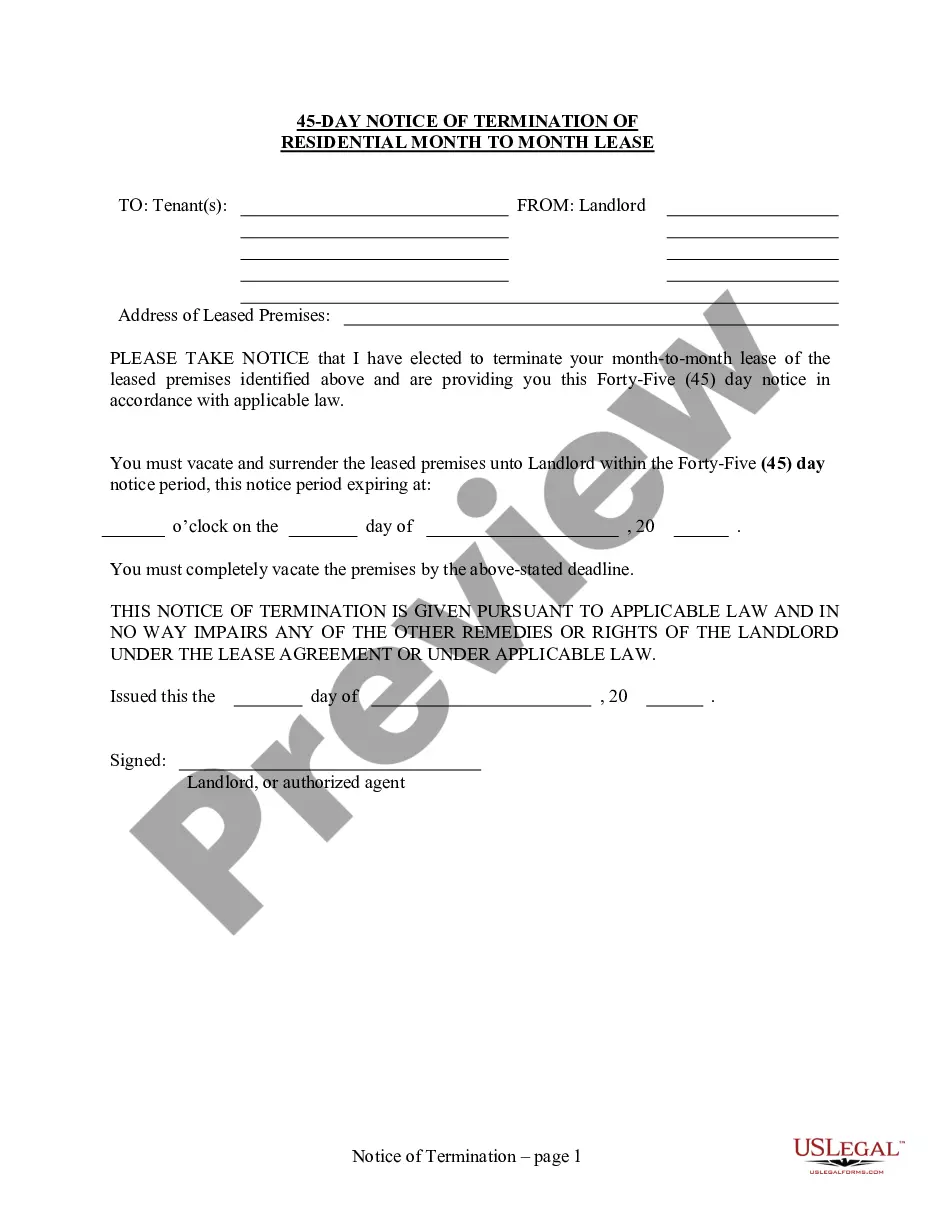

This is a sample letter from a Landlord to a Tenant. This particular letter serves as Notice that the Tenant has forty-five (45) to be out of the premises. The Landlord wishes to end their month-to-month rental agreement.

45 Day Notice Withdrawal Form

Description

How to fill out 45 Day Notice Withdrawal Form?

How to obtain expert legal documents conforming to your state regulations and prepare the 45 Day Notice Withdrawal Form without consulting an attorney.

Numerous services online offer templates to address various legal circumstances and formalities.

Nevertheless, it might require time to determine which of the accessible samples meet both your requirements and legal standards.

Download the 45 Day Notice Withdrawal Form using the corresponding button beside the file name. If you do not have an account with US Legal Forms, adhere to the following instructions.

- US Legal Forms is a reliable platform that assists you in locating formal documents created in accordance with the most recent state law revisions and economizing on legal support.

- US Legal Forms is not an ordinary online library.

- It comprises over 85,000 validated templates for different business and life situations.

- All documents are categorized by field and state to expedite your search process and enhance convenience.

- Additionally, it partners with powerful solutions for PDF modification and eSignatures, permitting users with a Premium subscription to swiftly finalize their paperwork online.

- It requires minimal time and effort to secure the necessary documentation.

- If you already possess an account, Log In and ensure your subscription is active.

Form popularity

FAQ

To get the IRS to release a lien, you will generally need to submit a Form 12277 and provide required information. This form helps to formally communicate your request for the lien’s release. Understanding the nuances of the 45 day notice withdrawal form can also guide you in the release process.

When a tax lien is withdrawn, it means that the IRS has decided to remove the lien from public records, often indicating that the conditions for withdrawal have been met. This process can restore your credit and financial standing. You may need to reference the 45 day notice withdrawal form as part of this endeavor.

An IRS lien can be removed but typically does not disappear on its own. You must satisfy the debt or follow a formal process using proper forms, possibly including Form 12277. Also, familiarize yourself with how the 45 day notice withdrawal form may support your efforts.

IRS Form 8915 is used for reporting qualified disaster distributions and recontributions. If you’ve been affected by a disaster, this form is essential for properly documenting your withdrawals. In some scenarios, the 45 day notice withdrawal form may be relevant as you make these claims.

Yes, IRS liens can be negotiated under specific circumstances. This usually involves submitting a Form 12277 or requesting a lien withdrawal. Understanding how the 45 day notice withdrawal form interacts with this process can be beneficial.

The form for claiming an early withdrawal penalty is IRS Form 5329. This form is essential for reporting penalties associated with distributions before age 59½. If you are managing your finances, consider the implications of the 45 day notice withdrawal form as well.

To claim your early withdrawal penalty, you will need to report it on your tax return using Form 5329. This form calculates the penalty associated with early withdrawals from retirement accounts. As you complete your tax filing, ensure you are aware of the role a 45 day notice withdrawal form could play in your reporting.

The amount the IRS settles for depends on various factors including your financial situation and the type of debt. Generally, settlements are negotiated, and working effectively through paperwork may require forms like the 45 day notice withdrawal form. Consulting a specialist may help you understand possible settlement amounts.

IRS Form 12277 is specifically designed to apply for the withdrawal of a federal tax lien. Submitting this form during the right circumstances can help you regain financial clarity. Additionally, if relevant, the 45 day notice withdrawal form might aid in your application process.

IRS Form 5329 is used to report additional taxes on distributions from qualified retirement plans, including early withdrawal penalties. This form is particularly important to file if you miss certain deadlines. If your situation involves penalties, a 45 day notice withdrawal form may help you clarify your case.