Hawaii State

Description

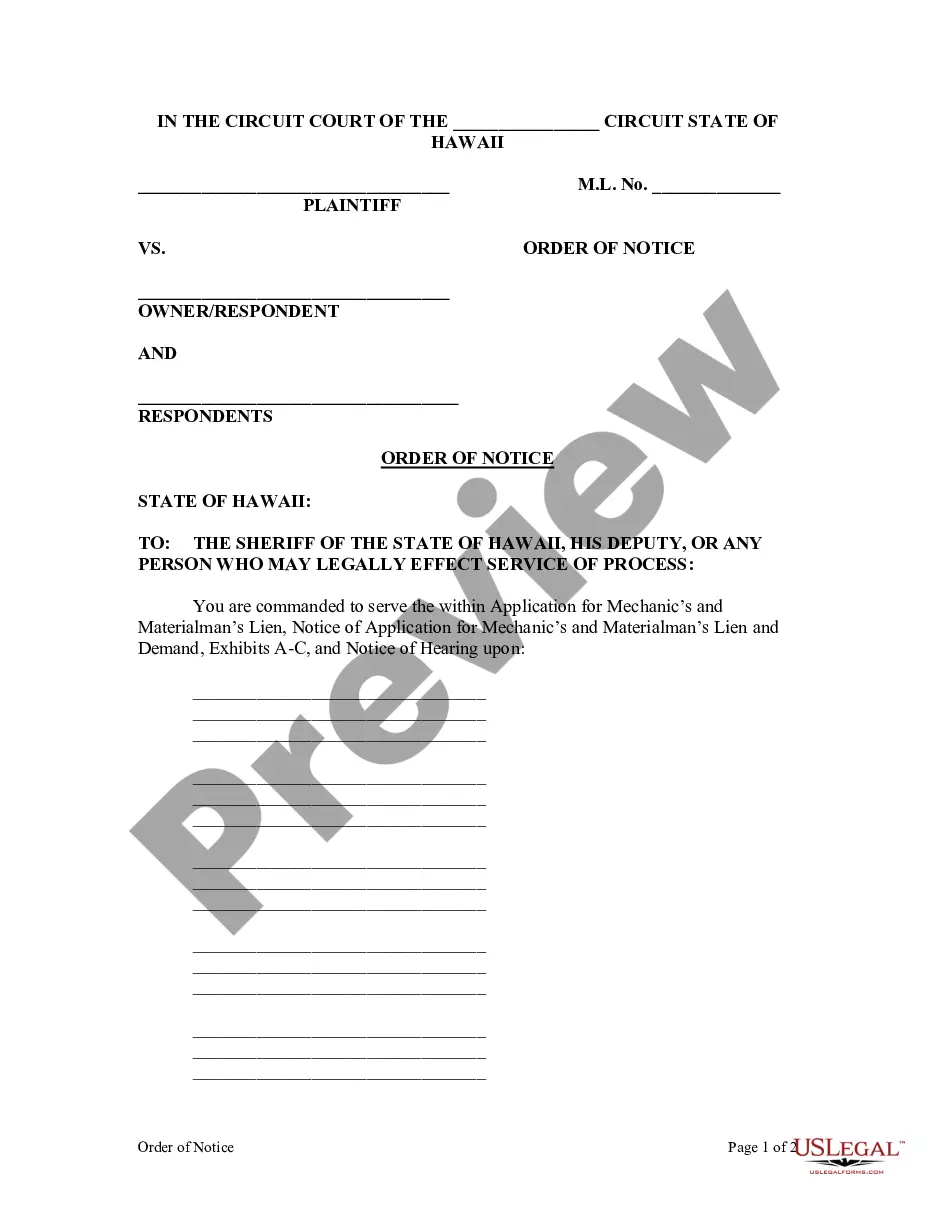

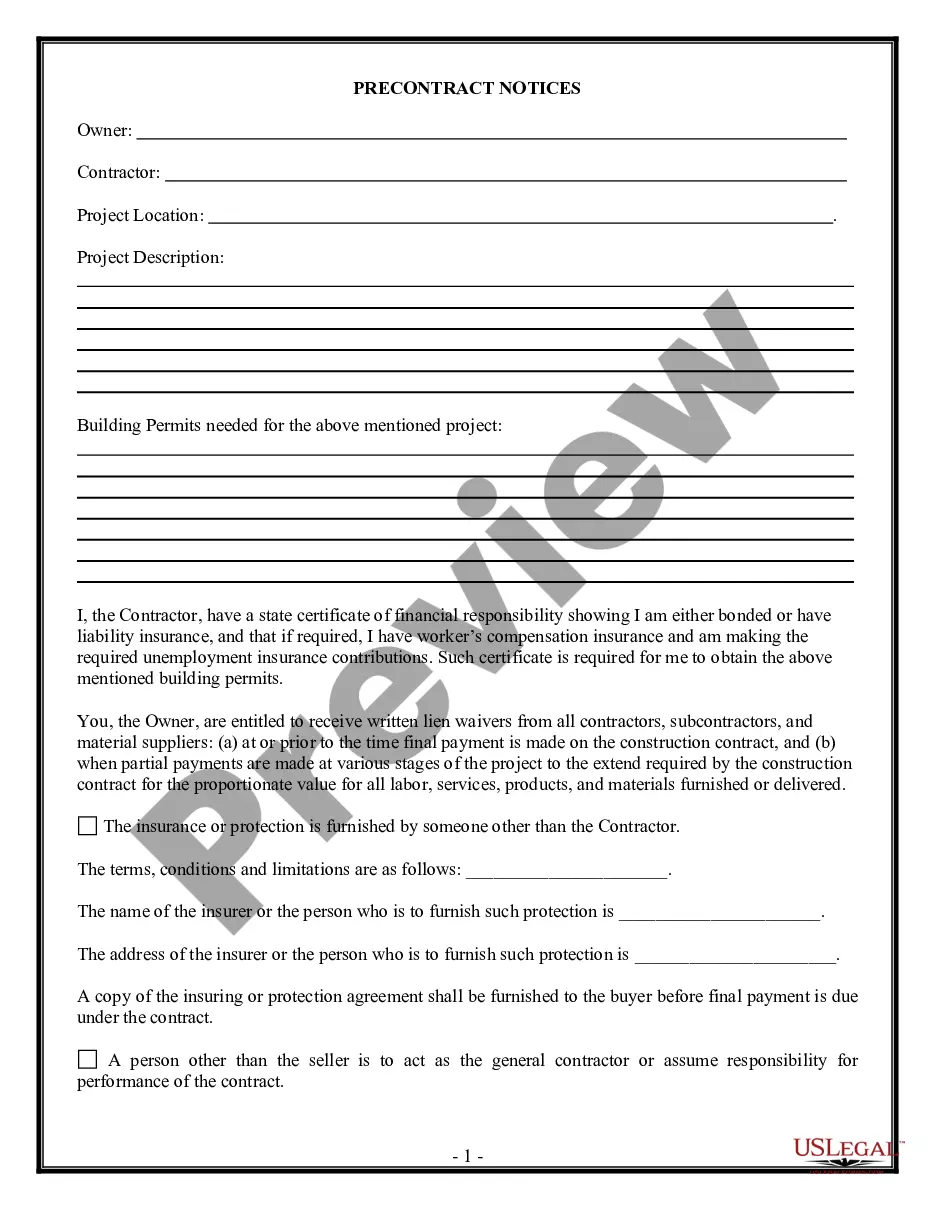

How to fill out Hawaii Order Of Notice?

- Start by previewing the form descriptions in our library. Make sure to choose the document that aligns with the requirements specific to Hawaii state.

- If necessary, utilize the Search feature to find alternative templates that better match your criteria.

- To proceed, select your preferred subscription plan by clicking the Buy Now button and create an account for full access.

- Complete your purchase using a credit card or PayPal, ensuring your subscription is valid for uninterrupted access.

- Finally, download your chosen forms to your device. You can find them later in the My Forms section of your profile.

In conclusion, US Legal Forms is your go-to resource for obtaining legal documents efficiently, particularly in Hawaii state. With its extensive library and user-friendly platform, you're empowered to handle legal matters with confidence.

Take the first step in making your legal processes simpler by exploring our library today!

Form popularity

FAQ

The deadline to file taxes in Hawaii generally falls on April 20th each year, similar to federal timelines. Be mindful, though, as this date may shift due to holidays. For precise information regarding your specific tax situation, refer to official announcements or seek assistance through platforms like US Legal Forms.

Yes, tax filing deadlines can be extended under certain circumstances in Hawaii. During specific years, such as those impacted by disasters, authorities may announce extensions. Always check official resources or consult a tax professional to confirm if the deadline has changed for your situation.

If you file your Hawaii state taxes late, you may incur penalties, which can add up quickly. The penalty is usually calculated based on the amount of tax owed and the length of the delay. Additionally, interest accrues on unpaid taxes. To avoid these potential fees, consider using resources like US Legal Forms to streamline your filing process.

The deadline for filing Hawaii state taxes typically aligns with the federal tax deadline. Usually, it falls on April 20th. However, if this date lands on a weekend or holiday, the deadline may shift. Keep an eye on official announcements to ensure timely filings.

Filing your state taxes late in Hawaii is possible, but it may not be the best choice. While you can still submit your tax return after the deadline, you will likely face penalties and interest on any unpaid taxes. It's always a good idea to prepare your filings on time to avoid complications. Consider using US Legal Forms to help you with your tax documents efficiently.

The Hawaii General Excise Tax (GET) applies to various business activities, including sales, services, and rental income. Understanding what is subject to GET is essential for compliance and tax planning. If you have further questions, uslegalforms can provide detailed insights into GET and how it may affect you.

Yes, you can file Hawaii state taxes online. The state offers various platforms and options for online submissions. Using uslegalforms can simplify this process, allowing you to file accurately and on time without any hassle.

Yes, Hawaii provides efile forms that you can use to submit your tax return electronically. These forms are part of the state's efforts to make tax filing easier for everyone. With uslegalforms, you can access and fill out the necessary efile forms with confidence.

Yes, you can file your Hawaii state taxes electronically by yourself. The process is designed to be straightforward, allowing individuals to handle their taxes without professional assistance. With uslegalforms, you receive step-by-step guidance to ensure a smooth filing experience.

In general, any resident earning a certain income threshold is required to file a Hawaii state tax return. Specific conditions involve both full-time residents and part-time residents. Check with uslegalforms to determine your filing requirement based on your unique situation.