Hawaii Formation

Description

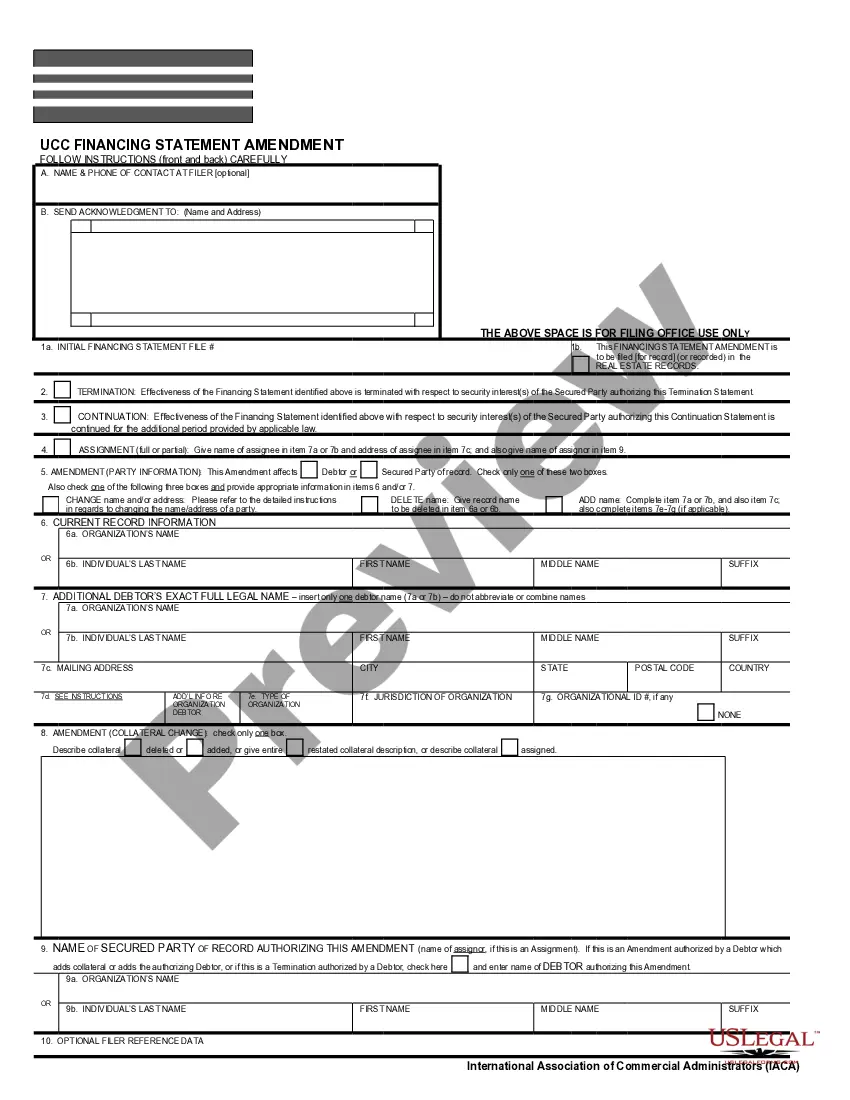

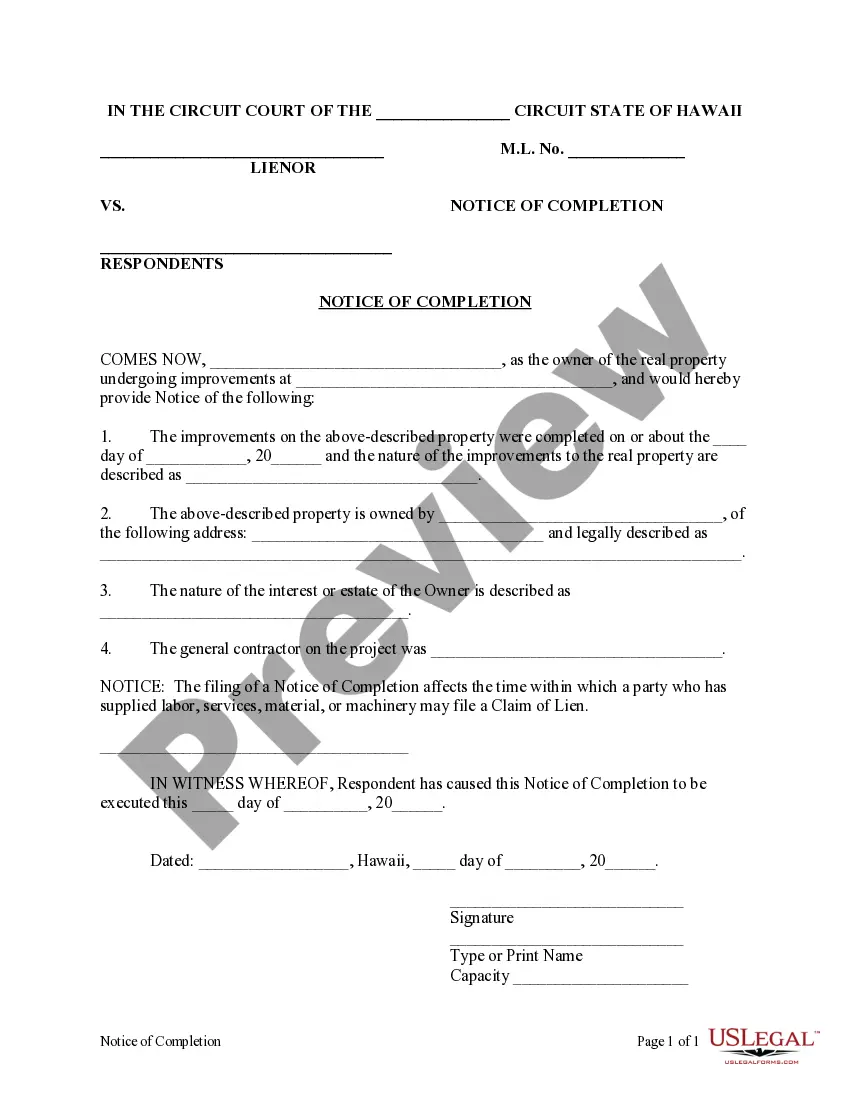

How to fill out Hawaii Notice Of Completion?

- Log in to your account if you've previously used US Legal Forms. Verify your subscription status to ensure uninterrupted access to the documents.

- If you're new to the service, start by browsing the extensive collection of over 85,000 forms. Check the Preview option and form description to select the right template that complies with your local laws.

- If you need to look for a different template, utilize the Search tab to find a form that meets your specific requirements.

- Once you've identified the right form, click on the Buy Now button and select a subscription plan that best suits your needs. An account registration will be necessary.

- Complete the purchase by entering your payment details through credit card or PayPal, securing your access to the library.

- Finally, download the selected form to your device. You can jederzeit retrieve your documents from the My Forms menu in your account for future use.

With US Legal Forms, you can enjoy the benefits of having access to a robust collection of legal templates, enabling you to create legally sound documents quickly. The platform also connects you to premium experts for assistance, ensuring accuracy and compliance.

Take control of your legal needs today! Visit US Legal Forms and begin your journey towards hassle-free document preparation.

Form popularity

FAQ

Hawaii was created as a result of geological processes involving the movement of the Earth's crust. The islands emerged from underwater volcanoes due to lava spewing from the volcanic hotspot beneath the Pacific Plate. This process is ongoing, which means that the story of Hawaii formation continues to evolve over time. For those interested in the natural beauty and history of Hawaii, understanding its creation adds depth to your appreciation of this unique destination.

Hawaii was formed through volcanic activity that began millions of years ago. As tectonic plates moved over a hotspot, molten rock erupted, creating the islands we know today. This dynamic process of Hawaii formation involved the gradual buildup of lava flows, which solidified, giving rise to lush landscapes and unique geological features. Through this fascinating journey of nature, Hawaii became a vibrant paradise that attracts many.

Whether you need to fill out a Hawaii agriculture form depends on your specific business activities. If your LLC plans to engage in agricultural activities or products, you may be required to submit additional forms related to agriculture. Before proceeding, it's important to consult with an expert or utilize resources like uslegalforms to ensure compliance during your Hawaii formation journey.

The process of forming an LLC in Hawaii typically takes between 1 to 2 weeks. After filing the necessary paperwork, you can track the status online. If you're looking for a quicker solution, using a professional service like uslegalforms can streamline your Hawaii formation process and ensure everything is completed accurately and efficiently.

Starting an LLC in Hawaii offers several advantages. First, it provides personal liability protection, meaning your assets are shielded from business liabilities. Additionally, LLCs in Hawaii benefit from pass-through taxation, which can often result in tax savings. By choosing Hawaii formation, you position your business to enjoy these protective and financial benefits.

Yes, Hawaii does allow the formation of single member LLCs. This means that you can operate your business as a sole individual while still enjoying the benefits of limited liability protection. With Hawaii formation, you can protect your personal assets from business debts and liabilities. It's a great option for entrepreneurs looking to simplify their business structure.

Hawaii's formation as a state involved many years of history, culminating in its admission to the United States on August 21, 1959. The process of forming Hawaii was influenced by numerous cultural, political, and social developments throughout its history. Understanding this historical context can enhance your appreciation of Hawaii formation.

Yes, you can file Hawaii state tax online through authorized e-filing services and the Hawaii Department of Taxation's website. Online filing is a fast and efficient option that simplifies managing your tax matters. This solution can greatly assist in navigating the complexities of Hawaii formation.

To send tax documents in the mail, use a sturdy envelope and ensure all papers are securely attached and neatly folded. Include sufficient postage and consider using a mailing service that provides tracking. Keeping copies of your documents can also help track your submissions related to Hawaii formation.

You should mail Hawaii Form N-15 to the Department of Taxation, P.O. Box 1409, Honolulu, HI 96806-1409. This address is designated for non-resident and part-year resident tax returns. It’s important to mail to the correct address to avoid processing delays during your Hawaii formation journey.