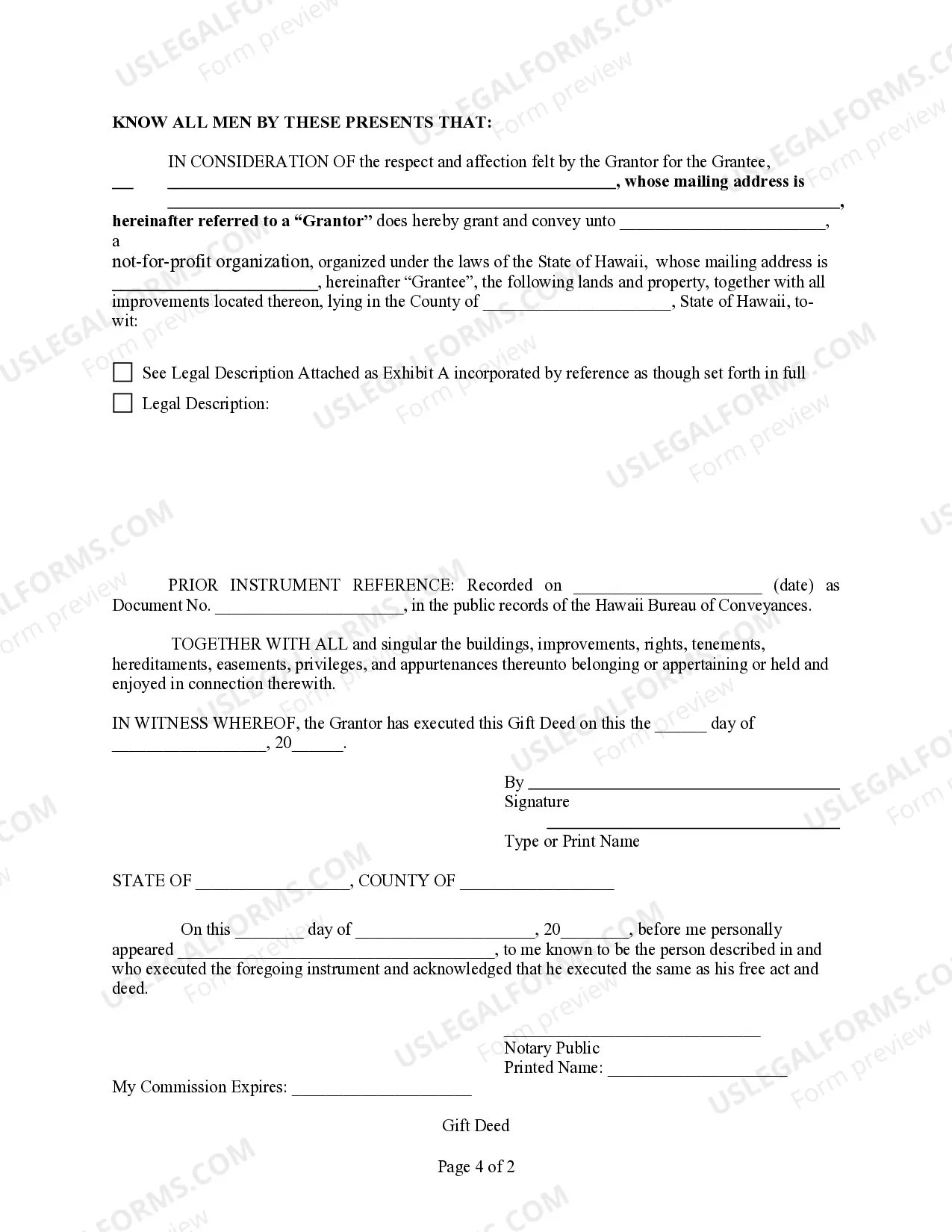

This form is a Gift Deed where the grantor is an individual and the grantee is an Unincorporated Association or a Not-for-Profit Organization. Grantor conveys and grants the described property to the grantee. This deed complies with all state statutory laws.

Hawaii Unincorporated Printable With Tax

Description

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- Log in to your account if you're a returning user, ensuring your subscription is active. If not, take a moment to renew it as needed.

- For new users, begin by exploring the Preview mode and form description to verify you're selecting the correct form that aligns with local jurisdiction requirements.

- If adjustments are needed, utilize the Search tab above to find a different template suitable for your circumstances.

- Once you've confirmed the correct form, click on the Buy Now button and select your preferred subscription plan. Remember, an account registration is required.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Finally, download your document to your device. You can access it anytime from the My Forms section of your profile.

By following these straightforward steps, you can ensure that you have the necessary legal forms at your fingertips, tailored to your specific needs.

Ready to simplify your legal process? Visit US Legal Forms today and unlock the power of their extensive library of legal documents.

Form popularity

FAQ

To get your own tax ID number, you must apply through the IRS or your state’s tax agency, depending on your needs. For Hawaii, this involves going through the Hawaii Department of Taxation. Remember, this number is important for anyone, especially unincorporated businesses, and using resources like USLegalForms can simplify the application process.

Hawaii tax forms are available on the Hawaii Department of Taxation's official website. They provide a comprehensive selection of forms needed for compliance with state tax requirements. If you are looking for unincorporated printable with tax forms, USLegalForms also offers templates that you can easily fill out and print.

You can obtain a Hawaii tax ID number by filling out the required forms available from the Hawaii Department of Taxation. Make sure to have your business information ready, as this will help streamline your application. Understanding the process is vital, especially for unincorporated businesses, and USLegalForms provides resources to assist you.

Getting a Hawaii tax ID number involves completing an application through the Hawaii Department of Taxation. This number is essential for businesses operating in Hawaii, especially in unincorporated sectors. You will need to provide basic information about your business. Websites like USLegalForms make it easy to navigate this application process efficiently.

To obtain a Hawaii tax clearance certificate, you need to apply through the Hawaii Department of Taxation. This certificate verifies that you have settled any outstanding tax obligations, which is often required for business activities. For businesses, especially those unincorporated, this certificate can streamline compliance with local regulations, and USLegalForms can provide guidance on the process.

Printable tax forms for Hawaii can be obtained directly from the Hawaii Department of Taxation website. This resource is perfect for individuals or businesses needing unincorporated printable with tax forms for filing. Additionally, you can find helpful templates on USLegalForms, which simplifies the process of obtaining the necessary documentation.

Yes, if you plan to start a business in Hawaii, you will likely need an Employer Identification Number (EIN). This is essential for tax purposes and to identify your business entity. An EIN is particularly important for unincorporated businesses looking to comply with Hawaii tax regulations. You can easily obtain your EIN through the IRS website or through services like USLegalForms.

For printing your income tax forms, consider local print shops or office supply stores that offer printing services. Another option is to use the US Legal Forms platform, where you can find Hawaii unincorporated printable with tax forms that are ready for print. This online service simplifies the process, ensuring you have the correct forms at your convenience.

You can obtain paper IRS forms at various locations, including public libraries and some government offices. It's important to confirm the availability of specific forms you need, such as those related to Hawaii unincorporated printable with tax. Additionally, consider visiting the IRS website to print forms directly at home.

Yes, you can file your Hawaii tax return electronically. Electronic filing options are available for many tax forms, including those for Hawaii unincorporated printable with tax. This method is efficient, safe, and often leads to faster processing and refunds.