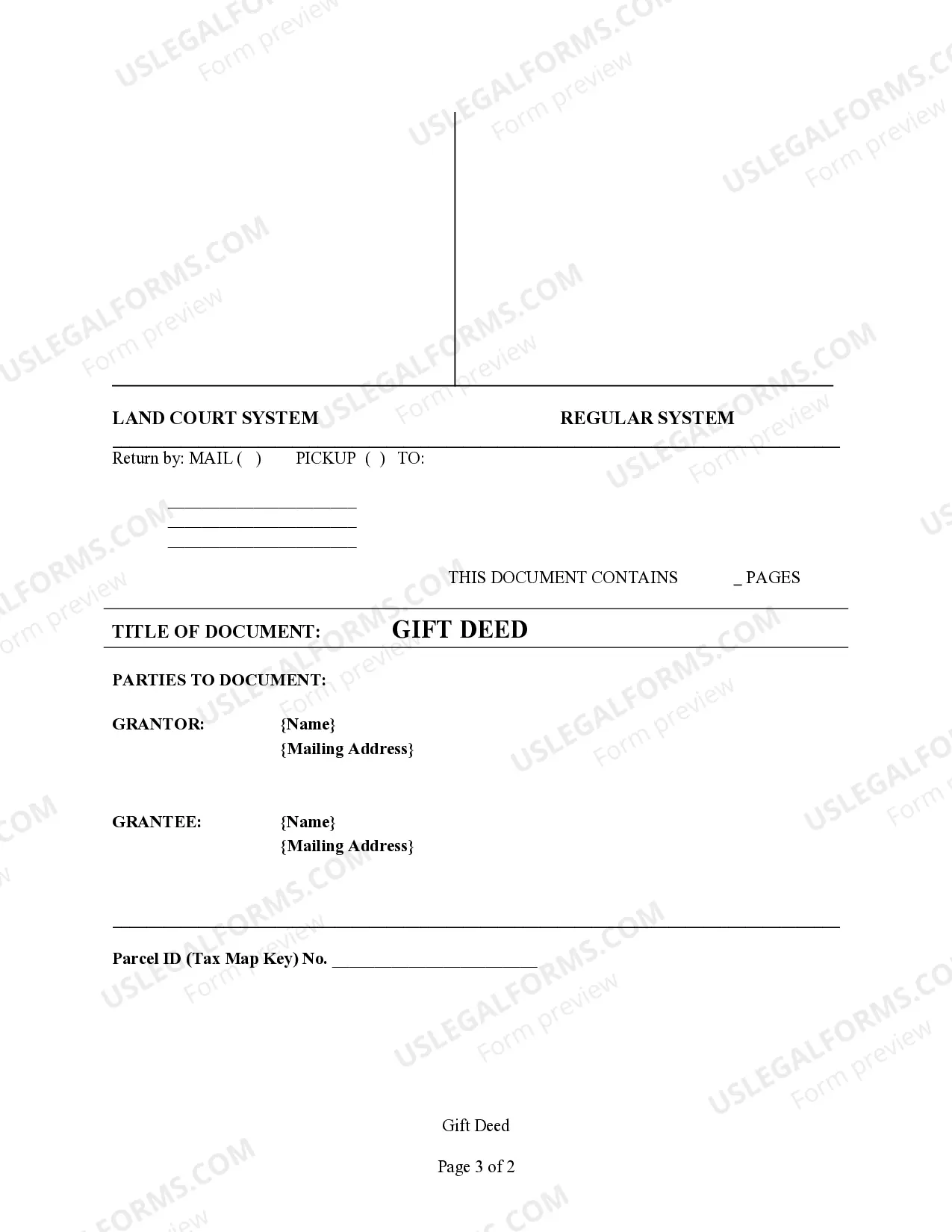

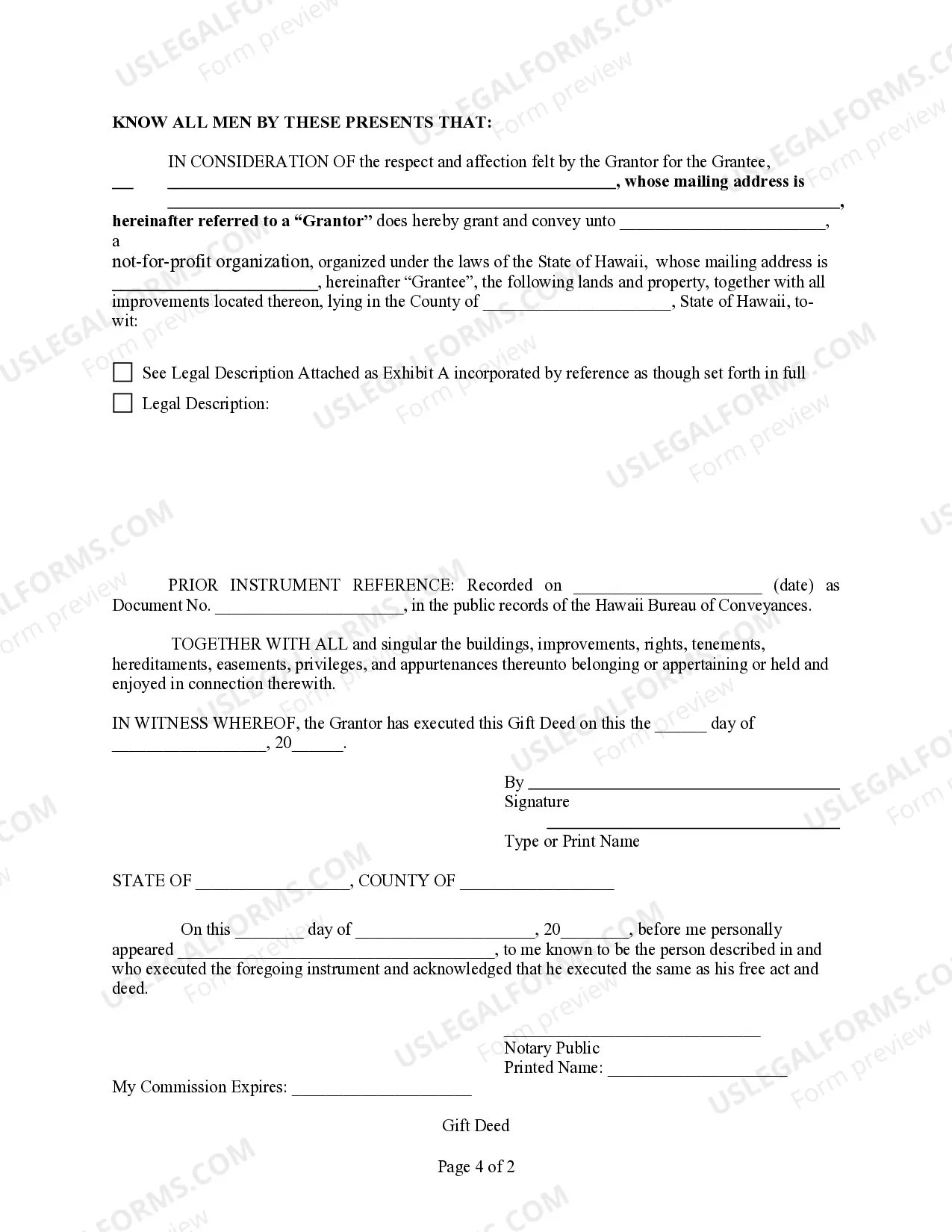

This form is a Gift Deed where the grantor is an individual and the grantee is an Unincorporated Association or a Not-for-Profit Organization. Grantor conveys and grants the described property to the grantee. This deed complies with all state statutory laws.

Hawaii Unincorporated Printable With Answers

Description

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- Login to your US Legal Forms account if you're a returning user and access your required form template by clicking the Download button. Ensure your subscription is up to date.

- For first-time users, browse the library to locate the ideal form. Double-check the Preview mode and description to confirm it aligns with your specific local jurisdiction.

- If necessary, utilize the Search tab to find a different template that meets your criteria before proceeding.

- Select and purchase your desired document by clicking the Buy Now button, choosing an appropriate subscription plan, and registering for an account.

- Complete your transaction by entering your payment details through credit card or PayPal for proper subscription access.

- Finally, download your form and save it for completion; you can always retrieve it later from the My Forms section in your profile.

US Legal Forms offers an unparalleled collection of over 85,000 legal forms and packages, enabling users to navigate their legal needs effortlessly.

With expert assistance readily available, you can confidently ensure completion accuracy and legal compliance. Start utilizing US Legal Forms today for efficient legal document solutions!

Form popularity

FAQ

Hawaii tax form N-11 is the standard income tax return form for residents of Hawaii. This form is vital for reporting your income, claiming deductions, and determining your tax liability. By using Hawaii unincorporated printable with answers, you can access this form easily, ensuring your tax submission is handled efficiently.

You can live in Hawaii for up to 183 days without being considered a resident for tax purposes. This time frame is crucial because it helps determine your tax obligations to the state. For more detailed information about residency status, explore Hawaii unincorporated printable with answers, which provides comprehensive guidance.

The N11 form in Hawaii is a resident individual income tax return form. This form is essential for individuals who meet residency requirements and need to report their income to the state. You can find the N11 form among the Hawaii unincorporated printable with answers, making it easy to file your taxes correctly.

If you earn income from Hawaii sources but are not a resident, you will need to file a Hawaii nonresident tax return. This ensures you report any income earned while staying in the state. To simplify the process, consider using Hawaii unincorporated printable with answers, which can provide clarity on filing as a nonresident.

Form N-139 is a specific tax form for Hawaii residents who are requesting a refund or adjustment. This form allows taxpayers to make adjustments to prior tax returns, which can help maximize their tax benefits. You can use the Hawaii unincorporated printable with answers to locate this form easily and ensure your tax filings are accurate.

You can file a G49 in Hawaii typically within the required deadlines set by the state government. Each year, these deadlines can vary, so it's essential to stay updated on the latest regulations. To make things easier, access resources like Hawaii unincorporated printable with answers to ensure you have the right information at your fingertips.

Yes, you can file Hawaii taxes online through various platforms, including UsLegalForms. This convenient option allows you to submit your tax returns quickly and securely from the comfort of your home. You can easily access and use Hawaii unincorporated printable with answers for your online filings.

The state form for non-residents in Hawaii is the N-15 tax form. This form is specifically designed for individuals who earn income in Hawaii but do not reside there. Completing this form accurately is vital for reporting your income and obligations. For more assistance, refer to our Hawaii unincorporated printable with answers for detailed instructions.

Yes, if you engage in business activities in Hawaii, you likely need a General Excise (GE) license. The GE license applies to various business operations, including selling goods and services. Acquiring this license is crucial to ensure compliance with state tax regulations. For further details, our Hawaii unincorporated printable with answers can provide you with essential information.

You should mail Hawaii form N-15 to the Hawaii Department of Taxation. The mailing address is typically included in the form instructions. This ensures that your tax documents are processed efficiently and accurately. Don't forget to use our Hawaii unincorporated printable with answers for additional guidance.