Hawaii Unincorporated Application For The Process

Description

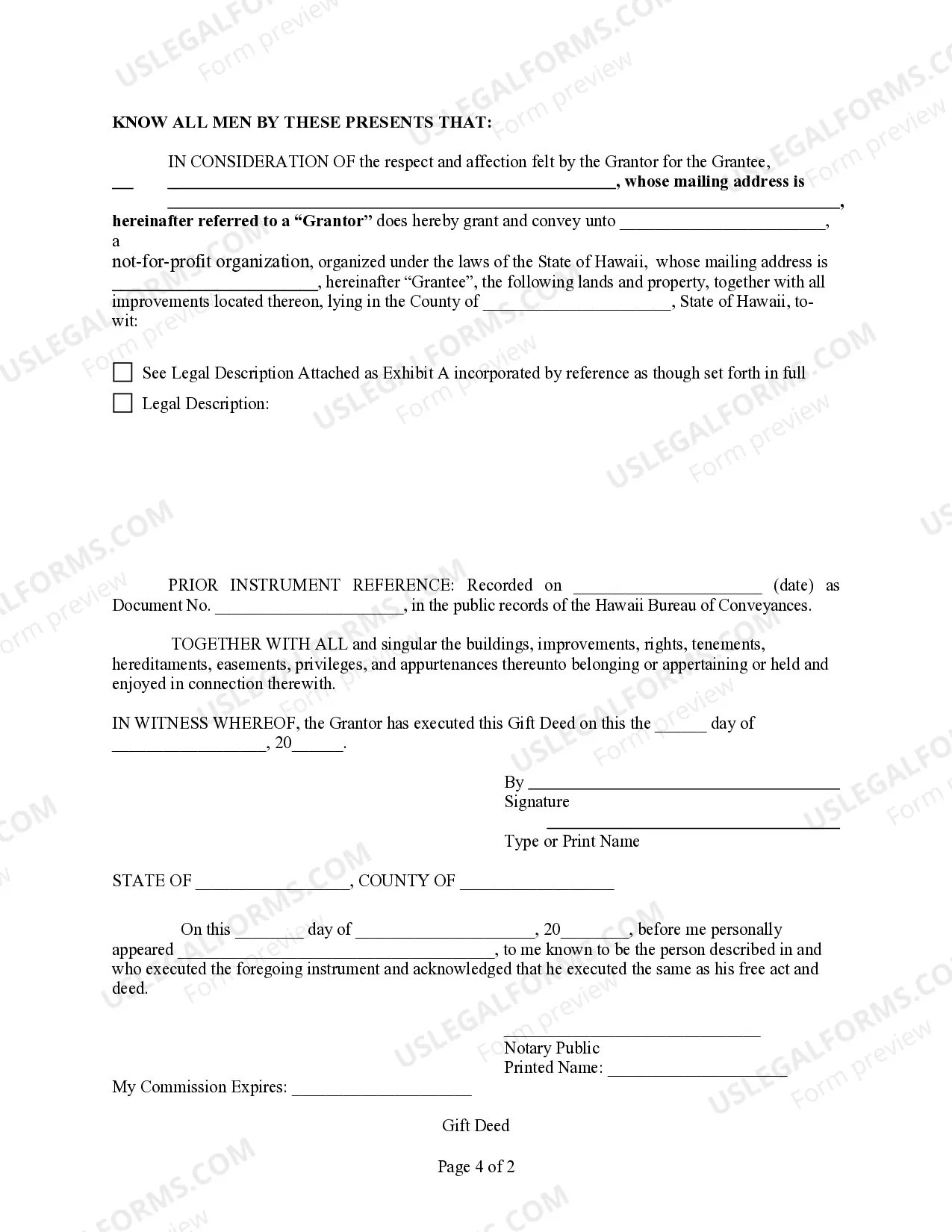

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- Visit the US Legal Forms website and log in to your existing account. If you are new, create a new account to get started.

- Browse the extensive collection of forms, specifically checking for the Hawaii unincorporated application that meets your jurisdictional needs.

- Confirm your selection through the Preview mode to ensure it's the right document.

- Choose the appropriate subscription plan and click on the Buy Now button.

- Complete your purchase using your credit card or PayPal, ensuring your subscription is active.

- Download the document directly to your device, and access it anytime in the My Forms section of your account.

With US Legal Forms, you benefit from a robust collection of legal forms, more extensive than competitors, making it a top choice for legal documentation. Our library houses over 85,000 editable forms, ensuring you find exactly what you need.

Get started today to simplify your legal process. Visit US Legal Forms and take the first step toward obtaining your Hawaii unincorporated application seamlessly.

Form popularity

FAQ

Starting an LLC in Hawaii offers several advantages, such as personal liability protection for business owners and tax flexibility. An LLC can provide a simpler management structure and greater credibility with clients and vendors. Additionally, understanding the Hawaii unincorporated application for the process can enhance your confidence in establishing a successful business in the state.

Creating an LLC in Hawaii can be done relatively quickly, often within a week if all documents are ready and accurate. If you file online, you might receive approval even sooner. For efficient execution of the Hawaii unincorporated application for the process, consider leveraging uslegalforms to handle the paperwork for you.

The time it takes to form an LLC in Hawaii typically ranges from a few days to a couple of weeks. After filing your application, it generally takes around 10 to 20 business days for processing. If you need a quicker turnaround, consider using expedited services. To simplify the Hawaii unincorporated application for the process, uslegalforms can expedite your filing.

To incorporate in Hawaii, you need to follow a structured process. Begin by choosing a unique business name and confirming its availability with the State of Hawaii. Next, file the Articles of Incorporation with the Department of Commerce and Consumer Affairs. Utilizing a reliable platform like uslegalforms can streamline the Hawaii unincorporated application for the process.

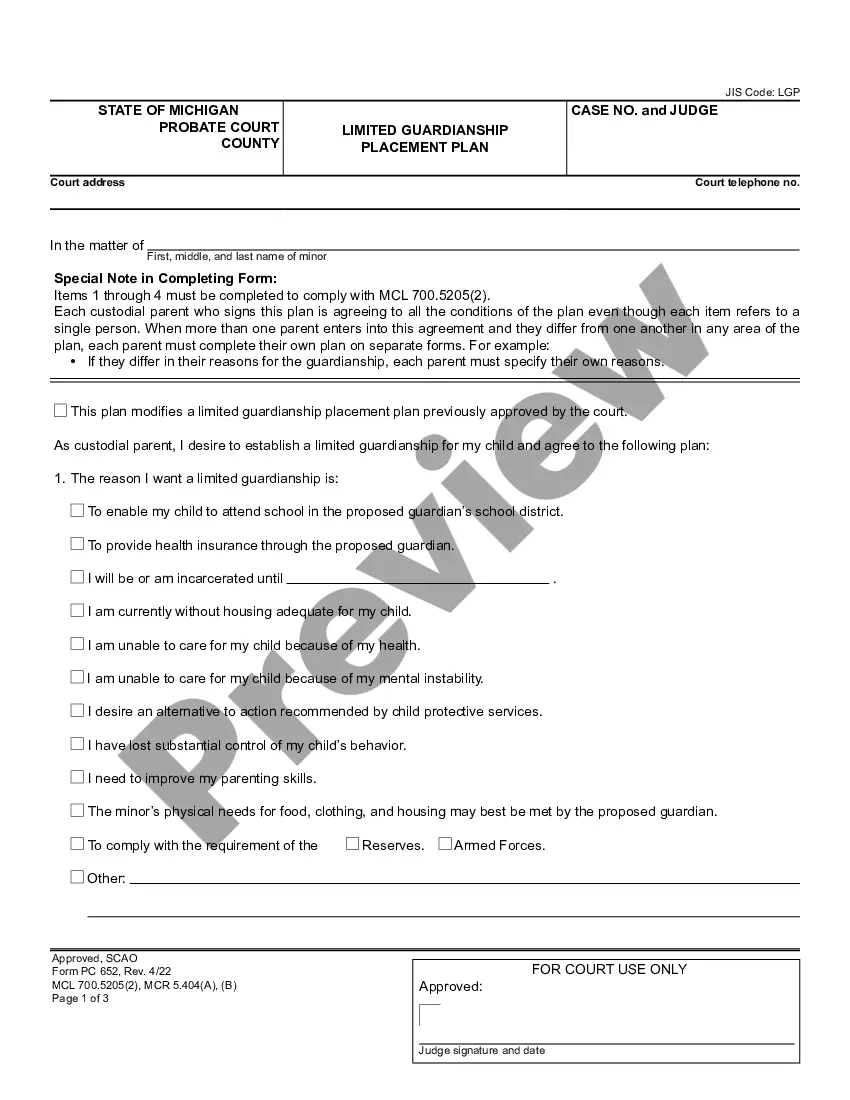

G 45 and G 49 are forms that nonprofits in Hawaii must file, but they serve different purposes. The G 45 form is for registering your organization as a nonprofit corporation, while the G 49 form is an annual report that provides updates about your organization’s activities. Both are critical in maintaining your nonprofit’s compliance and status within the state. Understanding these differences helps you navigate the Hawaii unincorporated application for the process more effectively.

In Hawaii, a nonprofit organization is required to have at least three board members. This ensures that your organization has diverse perspectives and effective governance. Each member should also have a clear understanding of their roles and responsibilities. When you file your Hawaii unincorporated application for the process, be sure to include the names and details of your board members.

An organization qualifies as a nonprofit if it operates for a charitable purpose and does not distribute profits to shareholders or owners. Your mission should provide a public benefit, such as educational or social programs. Additionally, you must comply with state regulations and successfully complete a Hawaii unincorporated application for the process to receive nonprofit status. Understanding these requirements is essential for your organization's success.

To become a nonprofit in Hawaii, you first need to complete a Hawaii unincorporated application for the process. This involves establishing your mission, selecting a board of directors, and drafting bylaws. Once your application is ready, you will file it with the state along with the required fees. It's a straightforward process that ensures your organization can operate as a recognized nonprofit.

To start a business in Hawaii, begin by choosing a suitable business structure and registering it. You'll need to file the Hawaii unincorporated application for the process with the state. After that, obtain any necessary permits or licenses, and consider setting up a business bank account. Using resources from uslegalforms can guide you through these steps effectively and help you set up your business right.

Yes, Hawaii does allow single member LLCs, providing flexibility for individuals to structure their business. A single member LLC benefits from liability protection while enjoying pass-through taxation. To form one, you will still need to complete the Hawaii unincorporated application for the process. This structure is ideal for entrepreneurs looking to establish their business with ease.