Hawaii Life Estate Deed With Full Powers

Description

How to fill out Hawaii Warranty Deed To Child Reserving A Life Estate In The Parents?

Managing legal paperwork and tasks can be a lengthy addition to your schedule.

Hawaii Life Estate Deed With Full Powers and similar forms often necessitate you to locate them and comprehend how to fill them out accurately.

Thus, if you are overseeing financial, legal, or personal affairs, utilizing a comprehensive and functional online catalog of forms readily available will considerably assist.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific forms and various tools to help you complete your documents with ease.

Simply Log In to your account, locate Hawaii Life Estate Deed With Full Powers, and obtain it instantly from the My documents section. You can also reach previously downloaded forms.

- Explore the array of pertinent documents accessible to you with just one click.

- US Legal Forms provides you with state- and county-specific forms that are available for download at any time.

- Streamline your document management processes by utilizing a reputable service that enables you to prepare any form within minutes without any extra or concealed costs.

Form popularity

FAQ

Revoking the deed. If you later change your mind about who you want to inherit the property, you are not locked in. You have two options: (1) sign and record a revocation or (2) record another TOD deed, leaving the property to someone else. You cannot use your will to revoke or override a TOD deed.

A remainder is a future interest in land. It is the right to own and possess the land after the fixed interest of current holder expires. Thus, a remainder can follow a life estate or a term of years. It is created by the use of the phrase "then to" or similar language.

Your transfer-on-death deed will be subject to Hawaii's 120-hour survival rule, which states that your beneficiary must survive you by 120 hours (or 5 days) to receive the property.

Hawaii is a lien theory state and uses mortgages instead of deeds of trust.

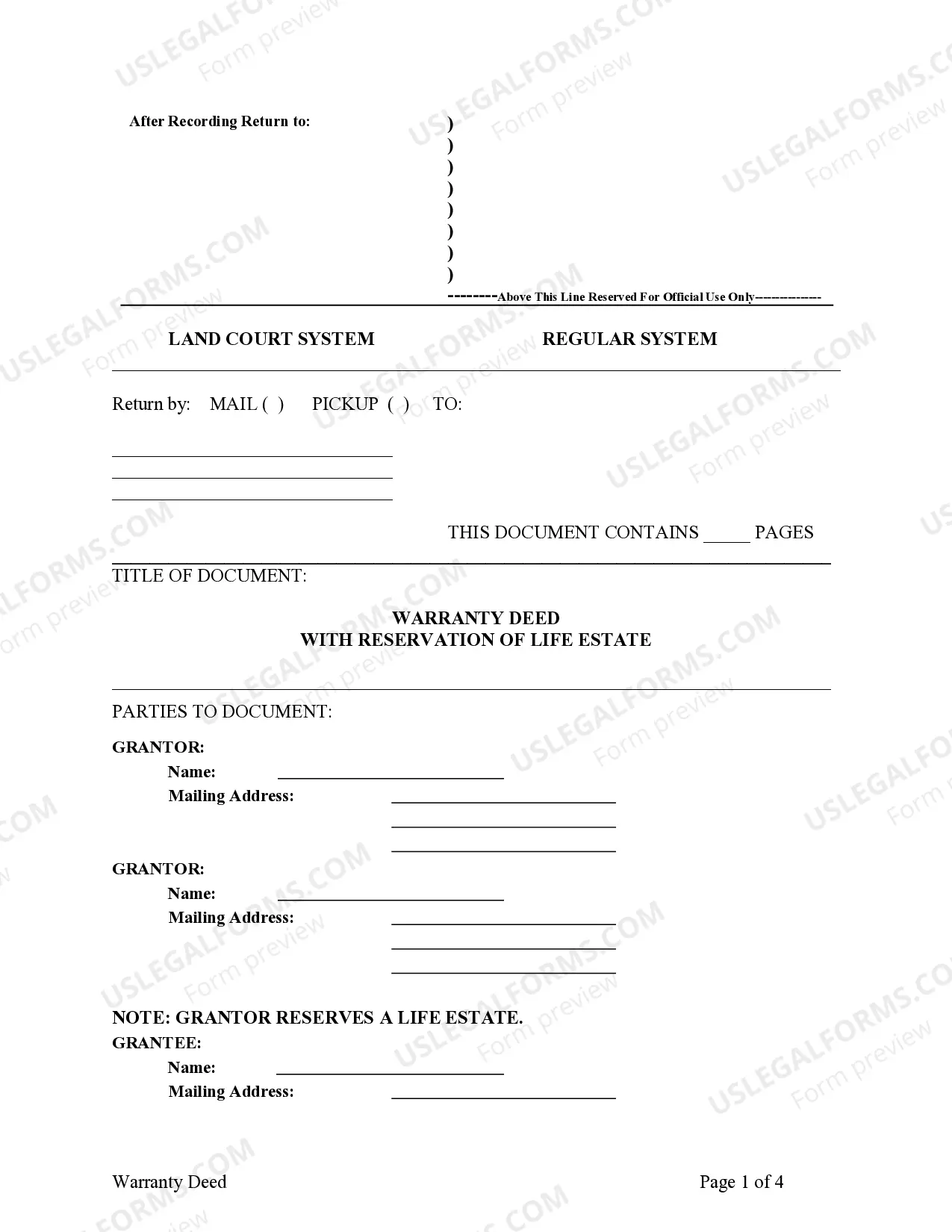

The deed or assignment of lease must be signed (in black ink) by the current owner and the new owner before a notary public. The deed or assignment of lease must be recorded in the State of Hawaii Bureau of Conveyances or Land Court. A Conveyance Tax Certificate must be filed and any tax due must be paid.