Hawaii Quitclaim Deed With Power Of Attorney

Description

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Two Individuals Or Husband And Wife?

What is the most dependable service to obtain the Hawaii Quitclaim Deed With Power Of Attorney and other current versions of legal documents? US Legal Forms is the answer!

It's the largest compilation of legal forms for any purpose. Each template is skillfully prepared and verified for alignment with federal and state guidelines. They are organized by field and jurisdiction, making it easy to find the one you require.

US Legal Forms is an outstanding solution for anyone needing to manage legal documentation. Premium users can enjoy even more benefits since they can complete and endorse previously saved documents electronically at any time within the integrated PDF editing tool. Discover it now!

- Experienced users of the platform only need to Log In to the system, confirm the validity of their subscription, and click the Download button next to the Hawaii Quitclaim Deed With Power Of Attorney to acquire it.

- Once saved, the template remains accessible for future use within the My documents section of your profile.

- If you still do not have an account with us, here are the steps you need to follow to get one.

- Form compliance review. Before obtaining any template, you must verify if it meets your use case requirements and your state or county's regulations. Read the form description and use the Preview if available.

Form popularity

FAQ

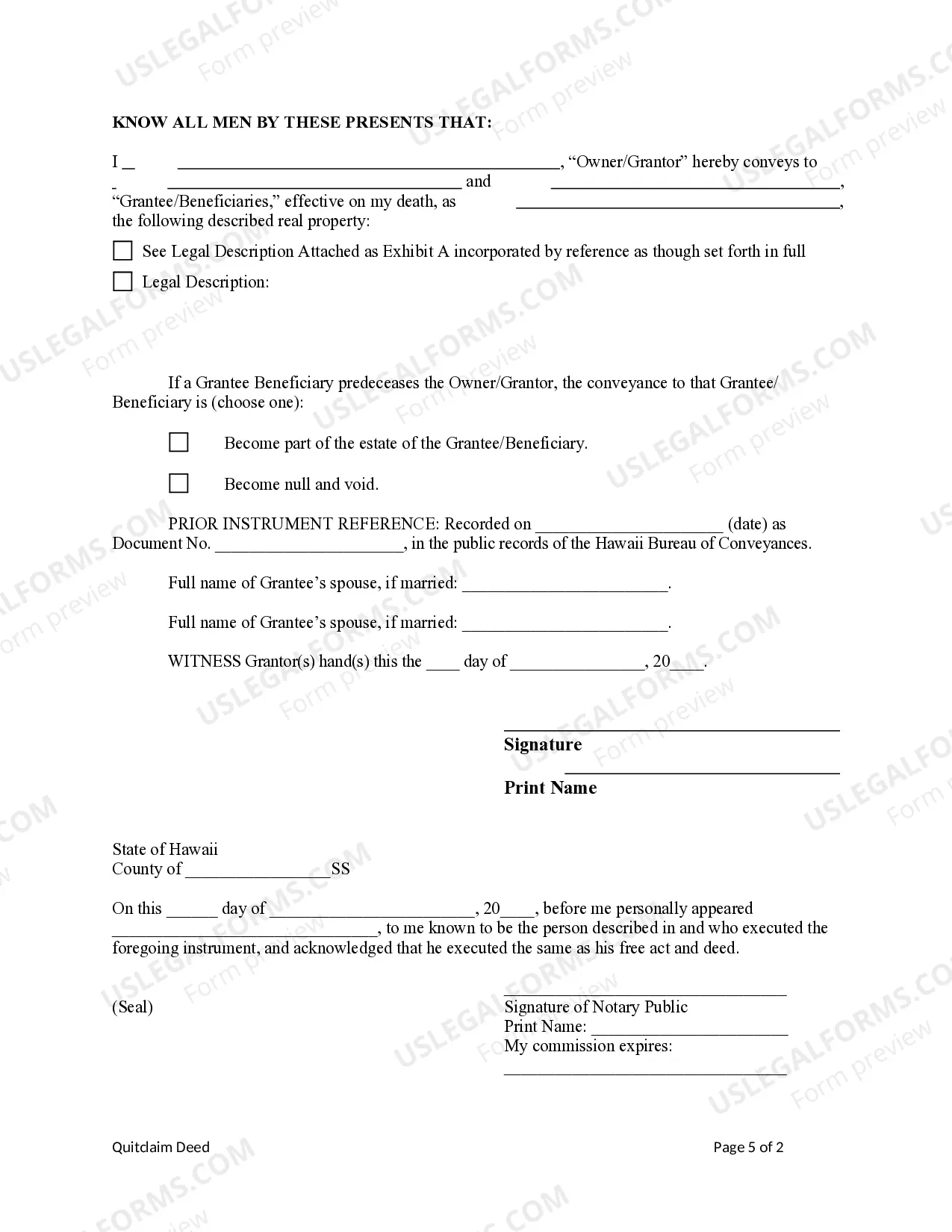

Use full legal names when you fill out the deed, and describe the property by both address and parcel number. Date and sign in front of a notary. To properly record the quitclaim deed, take the notarized document to the county recorder's office and file it with the clerk, paying applicable fees.

Under the law, any person who owns a property and is competent to contract can transfer it in favour of another. If the owner gives another individual a power of attorney (POA), that person can sell it under this authority. A POA gives another person the power to act on behalf of the owner.

How to Write a Texas Quitclaim DeedPreparer's name and address.Full name and mailing address of the person to whom recorded deed should be sent.The consideration paid for the real property.Grantor's name and status (single, married, or legal entity type)Grantor's mailing address.More items...

Filing: Hawaii quitclaim deeds are filed either with the Hawaii Land Court or the Hawaii County Clerk, in the county where the property resides. Filing Fees: The state of Hawaii charges a recording fee based on the number of pages. If the document is 50 pages or less, it is $36 to record it.

The deed or assignment of lease must be signed (in black ink) by the current owner and the new owner before a notary public. The deed or assignment of lease must be recorded in the State of Hawaii Bureau of Conveyances or Land Court. A Conveyance Tax Certificate must be filed and any tax due must be paid.