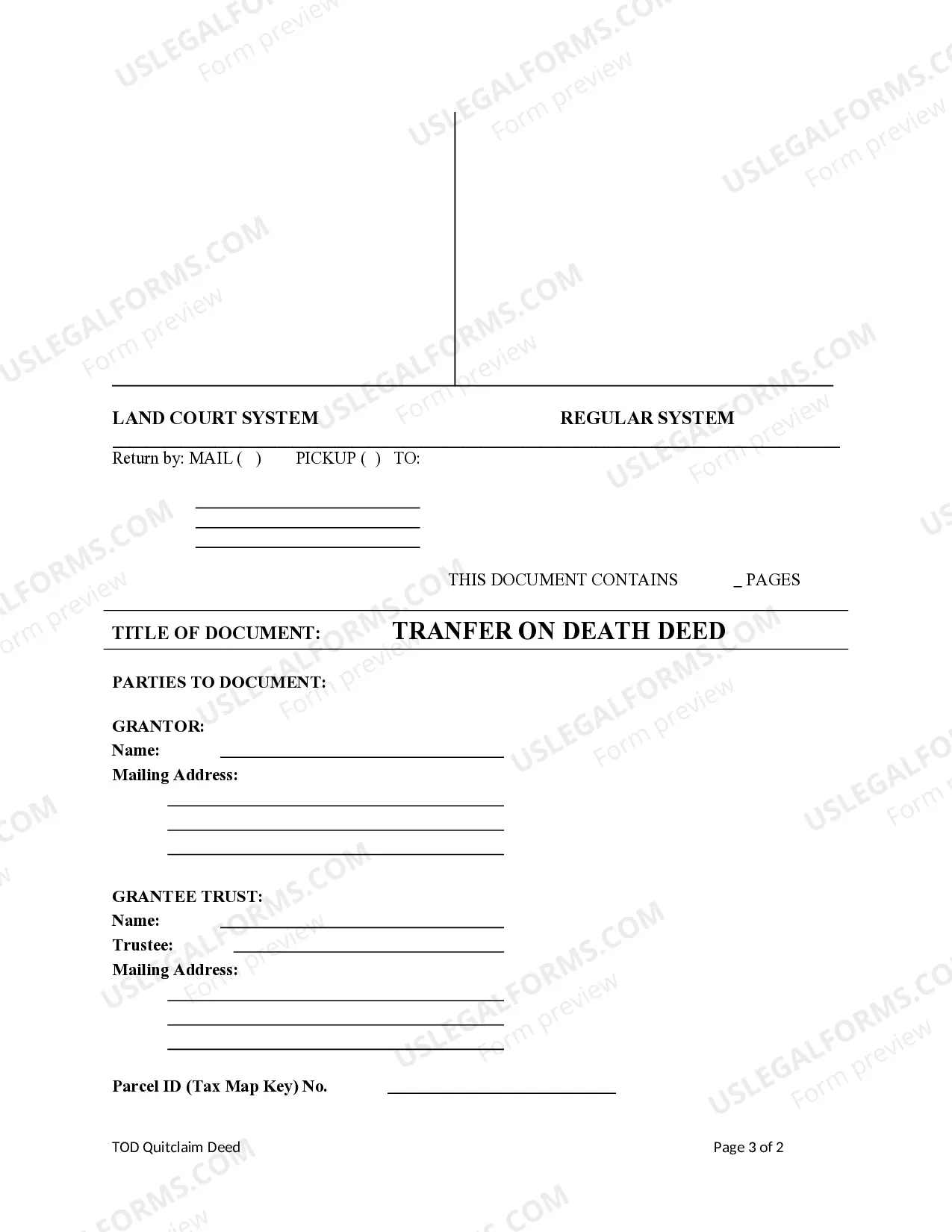

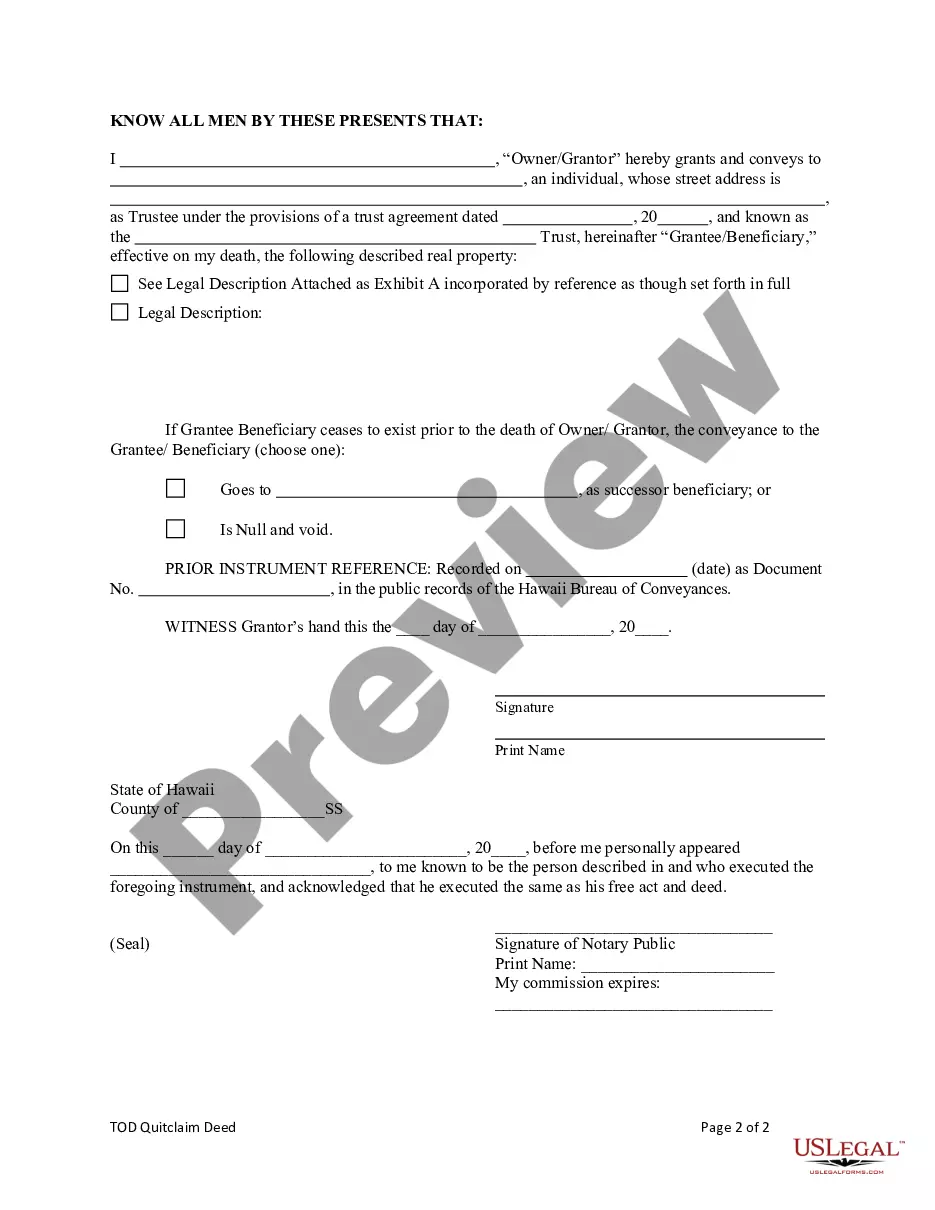

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is a Trust. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Transfer On Death Deeds For Real Estate Hawaii

Description

Form popularity

FAQ

One of the main disadvantages of a transfer on death deed is that it does not provide protection against creditors. If the property owner has outstanding debts, creditors may still make claims against the property after death. Additionally, a TOD deed does not transfer ownership until death, which means the property remains part of the owner’s estate until that time. To better understand the implications of transfer on death deeds for real estate in Hawaii, consulting with legal resources, such as US Legal Forms, can be beneficial.

Filling out a transfer on death designation affidavit requires specific information about the property and the beneficiaries. Start by including the full legal description of the real estate in Hawaii, followed by the names and addresses of the beneficiaries. It's crucial to ensure all information is accurate to avoid complications later. For a smooth process, consider using the US Legal Forms platform, which offers templates and guidance tailored to transfer on death deeds for real estate in Hawaii.

Transfer on death deeds are permitted in several states across the U.S., including Hawaii, California, Arizona, and Maryland, among others. Each state has its own specific regulations regarding the execution and validity of these deeds. It is essential to understand your state's requirements to ensure your transfer on death deed for real estate is legally sound. For comprehensive information and easy-to-use templates, consider exploring uslegalforms to assist you with state-specific requirements.

While you are not legally required to hire a lawyer for a transfer on death deed in Hawaii, it is often beneficial to consult one. An attorney can ensure that your deed meets all legal requirements and accurately reflects your wishes. This can help prevent disputes among heirs and make the transfer process smoother. Utilizing uslegalforms can also provide you with the necessary resources to create a valid deed if you prefer a more hands-on approach.

Yes, Hawaii does allow transfer on death deeds for real estate. This legal tool enables property owners to transfer their real estate assets to beneficiaries upon their death, bypassing the probate process. Such deeds simplify estate planning and provide peace of mind, knowing that your property will go directly to your chosen heirs. If you are considering this option, uslegalforms can guide you through the process of creating a valid transfer on death deed for real estate in Hawaii.

While you can complete a transfer on death deed for real estate in Hawaii without an attorney, seeking legal advice can be beneficial. An attorney can offer guidance on proper execution and ensure compliance with local laws, which can prevent future disputes. Additionally, utilizing resources like USLegalForms can simplify the process, providing templates and instructions tailored to transfer on death deeds for real estate in Hawaii.

While it is not legally required to have a lawyer to file transfer on death deeds for real estate Hawaii, seeking legal advice can be beneficial. A lawyer can help ensure that the deed complies with local laws and address any specific concerns pertaining to your situation. Utilizing platforms like USLegalForms can simplify the process and provide necessary resources.

While transfer on death deeds for real estate Hawaii offer benefits, they may also pose drawbacks. A key concern is that once a TOD deed is executed, owners cannot change their mind later without specific legal actions. Furthermore, if the property owner has ongoing debts, creditors may still seek claims against the property, complicating matters for heirs.

Yes, Hawaii allows transfer on death deeds for real estate. This means that property owners can easily transfer their real estate to beneficiaries without going through probate. Understanding the specific requirements and regulations is crucial to ensure a smooth transfer process.

Transfer on death deeds for real estate Hawaii are a popular option for avoiding probate. They allow property owners to designate beneficiaries who receive the real estate directly upon the owner’s death, streamlining the transfer process. Compared to traditional wills, TOD deeds can expedite the transition of property, minimizing potential legal complexities.