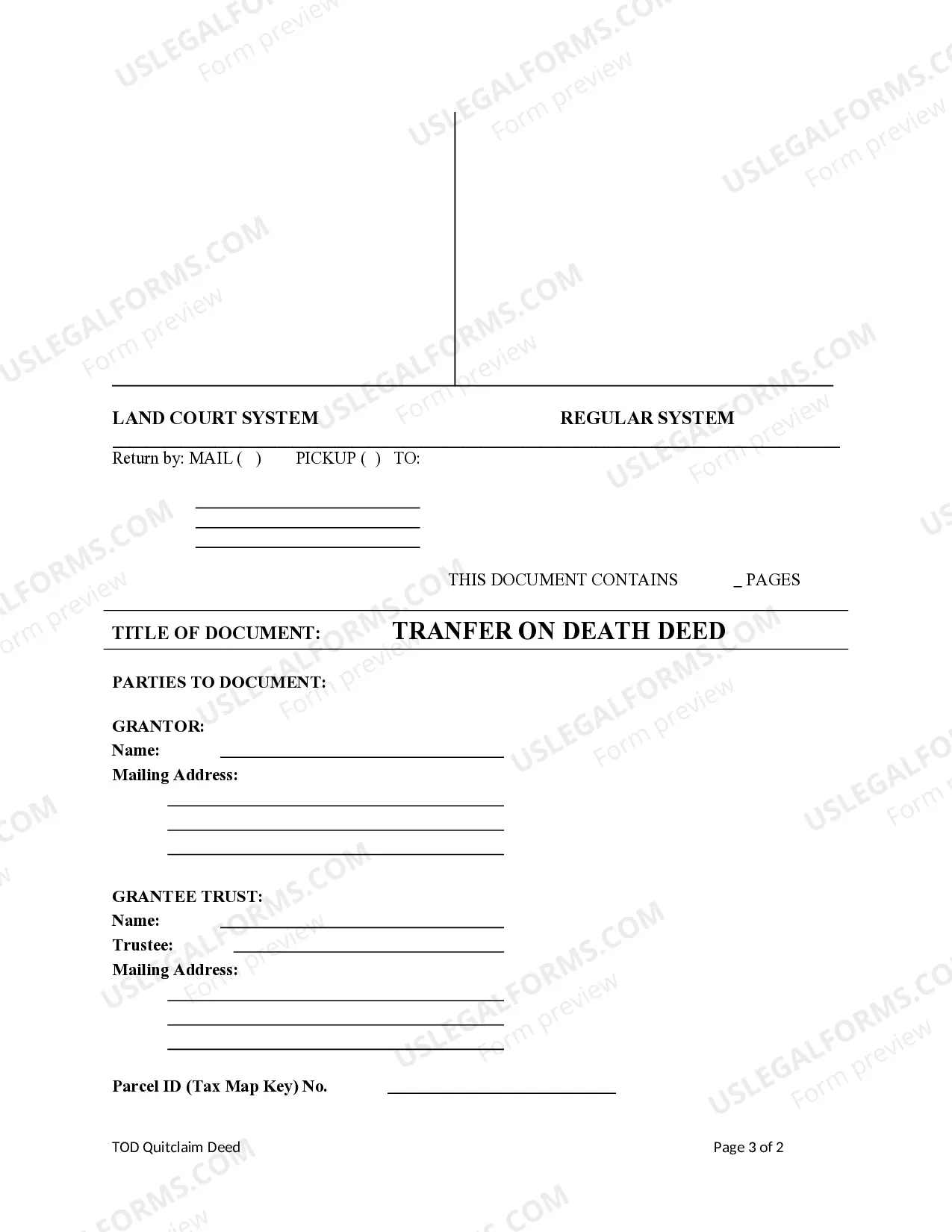

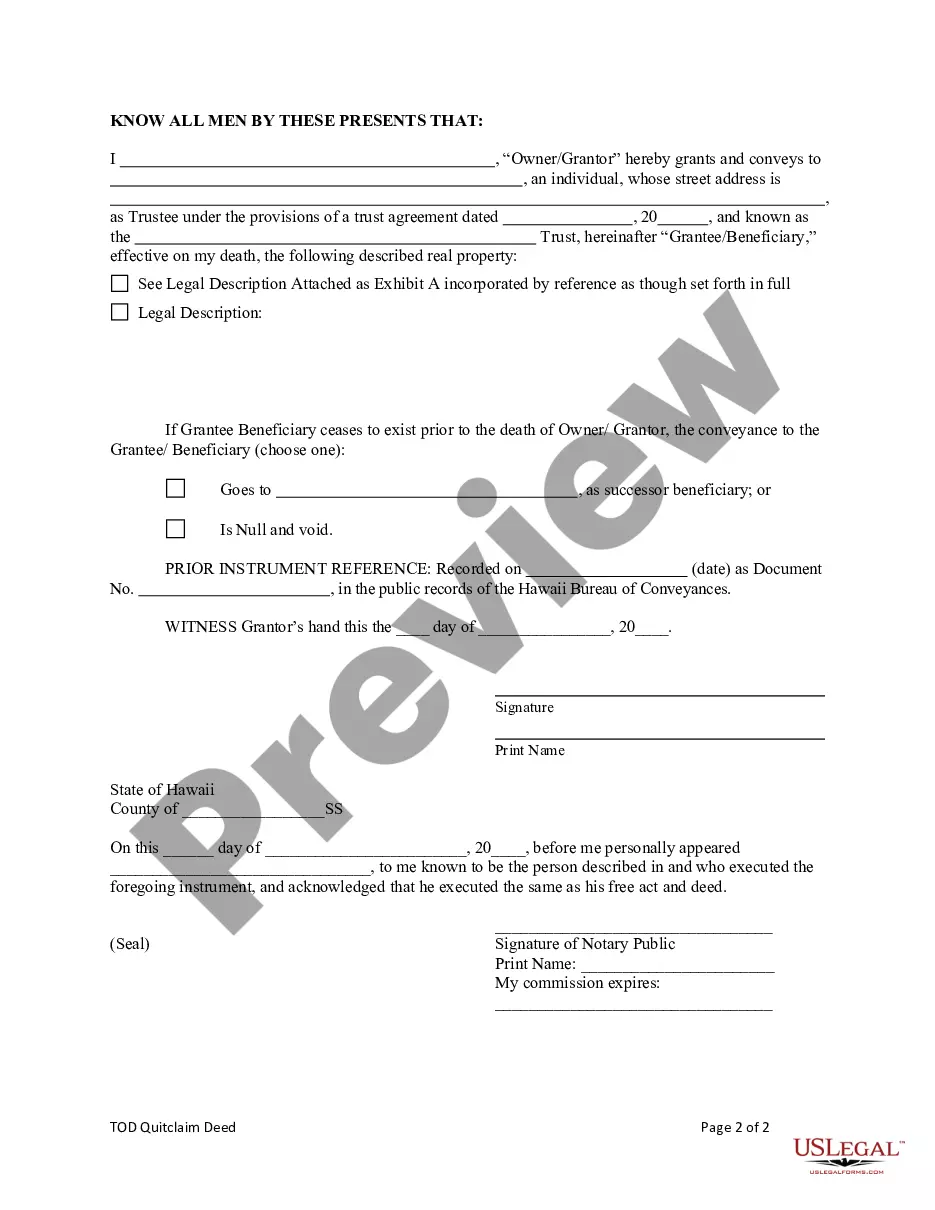

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is a Trust. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Transfer On Death Deed With Multiple Beneficiaries

Description

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To A Trust?

- If you are a returning user, log in to your account and check for the required form template. Ensure your subscription is active, and renew if necessary.

- For new users, explore the Preview mode and read the form description to confirm it meets your needs and complies with your jurisdiction.

- Use the Search tab to find any additional templates if your initial choice doesn't fit your requirements.

- Select the Buy Now button to acquire the document and choose your preferred subscription plan. You'll need to create an account for full access to our legal library.

- Complete your purchase by entering your credit card details or opting for PayPal.

- Download the form once your transaction is complete. You can also access it later through the My Forms section of your profile.

With US Legal Forms, you gain access to a vast library of over 85,000 legal documents, ensuring you're equipped with everything you need. Our robust collection of forms allows for easy editing and filling out, making legal tasks straightforward.

Don't navigate your legal complexities alone. Visit US Legal Forms today and empower yourself with the right tools for efficient and effective legal documentation.

Form popularity

FAQ

One significant disadvantage of a transfer on death deed with multiple beneficiaries is that it may create disputes among heirs if shares are not clearly defined. Additionally, property transferred via this deed does not bypass any debts owed by the deceased. It’s also important to remember that not all states recognize this type of deed, which can complicate the process. For guidance, you can explore resources on platforms like USLegalForms to navigate these potential issues.

A transfer on death deed with multiple beneficiaries does not inherently avoid inheritance tax; rather, it directs asset transfer upon death. The tax implications depend on your jurisdiction and the total value of the estate. While TOD deeds can help bypass probate, they do not automatically exempt assets from taxation. It is advisable to consult a tax professional to understand your potential tax liabilities.

The number of beneficiaries you can have on a TOD account typically varies by state law, but many states allow for multiple beneficiaries. It is essential to clearly specify each beneficiary in the documentation to avoid ambiguity. This clarity ensures that your intentions are honored and that all parties understand their inheritance. Utilizing legal assistance from platforms like uslegalforms can simplify this process.

Yes, you can have multiple beneficiaries on a TOD account. This allows you to divide your assets among several individuals, ensuring that everyone you wish to benefit receives a share. Careful consideration of how these shares are divided can help prevent conflict among beneficiaries after your passing. Consulting uslegalforms can guide you through the process effectively.

The potential disadvantages of a TOD account include limited control over asset management before death and challenges arising from the lack of a comprehensive estate plan. If a beneficiary is unable or unwilling to accept the inheritance, complications may arise. Additionally, relying on a TOD account alone might not address complex family or financial dynamics, which is where professional legal advice can be beneficial.

To transfer on death deed to two beneficiaries, you must prepare the deed document and include both beneficiaries’ names. You should ensure the wording specifies the distribution terms clearly, whether equally or in specified proportions. After completing the deed, you must file it with your local county recorder's office to make the transfer effective. Using legal forms from uslegalforms streamlines this process.

Yes, a TOD account can have multiple beneficiaries. This feature allows you to designate more than one person to receive the assets upon your death. However, it is important to clearly outline how the assets will be distributed among them to avoid potential disputes. For clarity, using a platform like uslegalforms can help ensure all legal criteria are appropriately met.

The disadvantages of a transfer on death deed with multiple beneficiaries include potential conflicts among beneficiaries and limitations in asset management during the owner's lifetime. Furthermore, it may not provide the same level of control as a trust, since the beneficiaries receive the assets automatically upon the owner's death. Additionally, some states may have specific requirements that complicate the process.

One potential downside of a transfer on death deed with multiple beneficiaries is the possibility of conflicts among beneficiaries regarding the property. Additionally, if the beneficiaries are unable to agree on how to manage or distribute the property, it may lead to legal disputes. Another concern is that a TOD does not provide protection against creditors, which means beneficiaries could face claims against the property after your death. Understanding these aspects can help you make informed decisions with tools like USLegalForms.

Yes, you can designate two or more beneficiaries on a transfer on death deed with multiple beneficiaries. This flexibility allows you to ensure that your property is passed on according to your wishes after your death. It’s essential to clearly outline each beneficiary's share to avoid any confusion in the future. Using a reliable platform like USLegalForms can help you easily set up a TOD that includes multiple beneficiaries.