Transfer On Death Deed For Joint Owners

Description

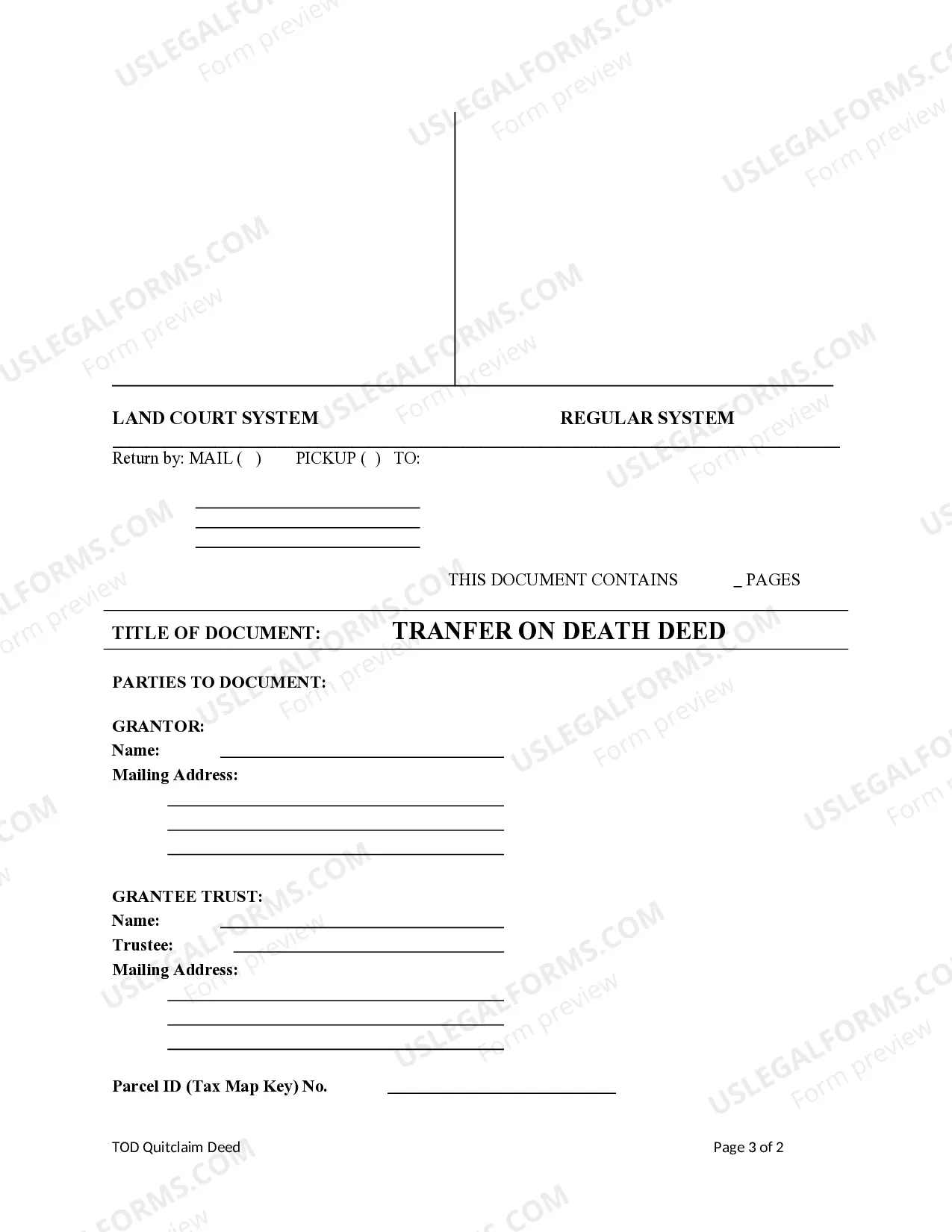

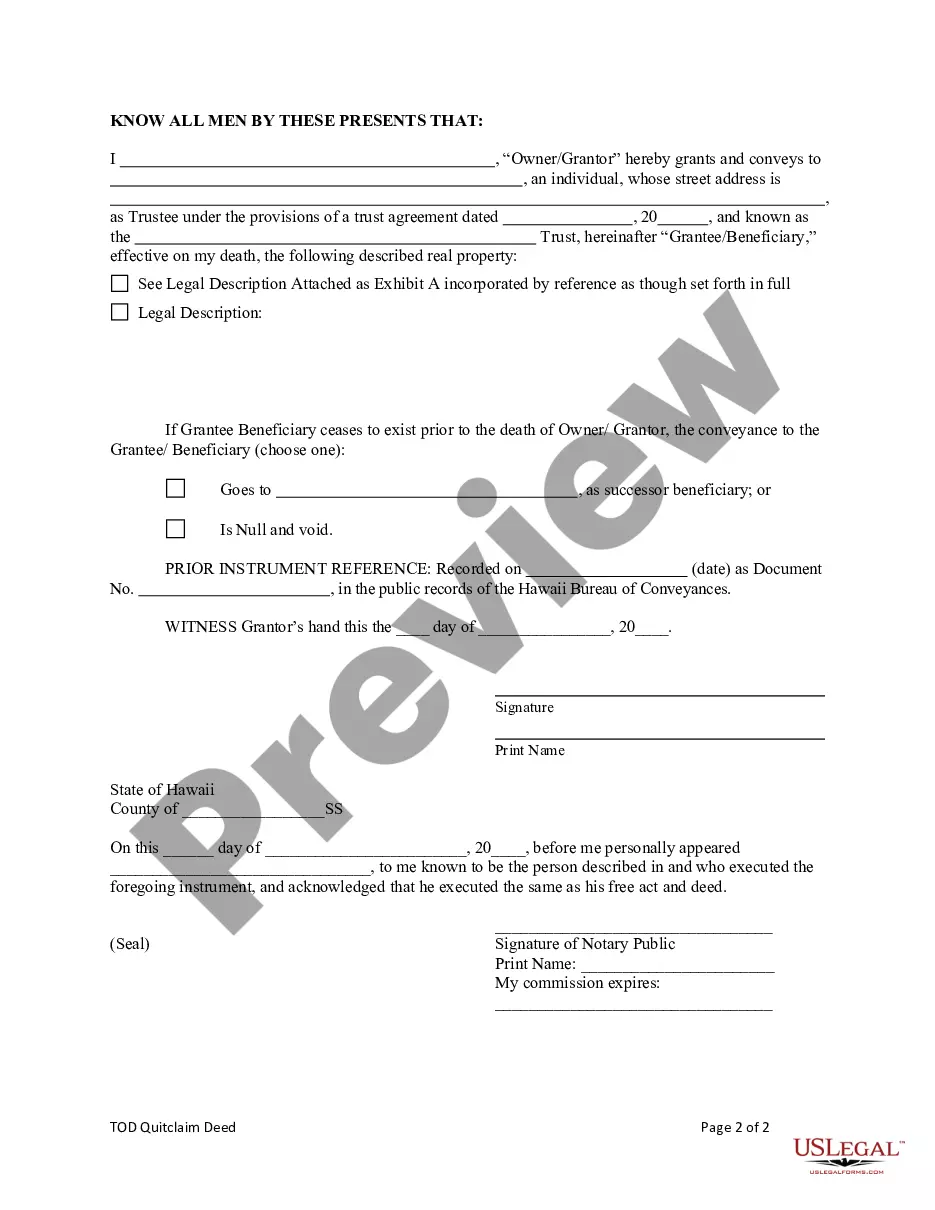

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To A Trust?

- If you are a returning user, log in to your US Legal Forms account and download your needed form template by clicking the Download button. Confirm your subscription is active. If it's expired, renew according to your payment plan.

- For first-time users, start by checking the Preview mode and form descriptions to ensure you've selected the correct form that aligns with your jurisdiction's requirements.

- If you need a different template, utilize the Search tab to find the precise document needed for your case.

- Once you find the right template, proceed to purchase it by clicking the Buy Now button and selecting a subscription plan.

- Complete the payment process by entering your credit card details or using your PayPal account.

- After your purchase, download the form to your device and keep it accessible in your My Forms menu, ensuring you can return to it whenever needed.

Using US Legal Forms offers numerous advantages, including access to a robust collection of over 85,000 fillable and editable legal documents tailored for various needs. Beyond that, the service provides users with opportunities to consult premium experts for assistance, guaranteeing legally sound documents.

In conclusion, obtaining a Transfer on Death Deed for joint owners is straightforward with US Legal Forms. By following these steps, you can ensure a smooth transition of property ownership. Start your process today and secure your estate with confidence!

Form popularity

FAQ

Transfer on death accounts, while convenient, can lead to complications. Many people misunderstand the legal implications, resulting in unexpected tax burdens or disputes among heirs. Moreover, these accounts require you to keep your beneficiary information current. A reliable resource like USLegalForms can help guide you through the complexities and ensure your choices align with your estate planning needs.

While a transfer on death deed for joint owners offers benefits, it also has drawbacks. This type of deed doesn't cover all assets, potentially leaving other important properties unaddressed in your estate plan. Additionally, if one owner faces legal issues or debt, it could complicate the transfer. It’s wise to seek professional advice to fully understand how a TOD deed aligns with your overall estate strategy.

When considering the transfer on death deed for joint owners versus naming someone as a beneficiary, it’s essential to weigh your options. A TOD deed allows for a smoother transfer of property without the hassle of probate. However, a beneficiary designation might be better for specific accounts or assets. Ultimately, the choice depends on your unique situation and estate planning goals.

Yes, you can have more than one person listed on a transfer on death deed for joint owners. This feature allows multiple beneficiaries, making the distribution of assets more straightforward after one owner dies. Consider using platforms like USLegalForms to streamline the process and ensure all legal requirements are met.

While it is not strictly necessary to involve an attorney for a transfer on death deed for joint owners, it can be beneficial. An attorney can offer guidance on the specific legal language and state regulations involved. Their expertise can help ensure the deed is correctly executed, reducing potential issues later.

Indeed, you can put a transfer on death deed for joint owners on a joint account. This allows both individuals to hold ownership while ensuring a seamless transition of assets after one passes away. It simplifies the process for the surviving owner, avoiding probate delays and costs.

Generally, a transfer on death deed for joint owners does not create an immediate tax obligation. However, after the transfer, the property may be subject to estate taxes, depending on its value and the overall estate. It is wise to consult a tax professional to understand how taxes may apply in specific situations.

While a transfer on death deed for joint owners provides benefits, it also has disadvantages. One key issue is that it may not protect your assets from creditors, which could impact the surviving owner. Additionally, misunderstandings about the deed could arise among joint owners, leading to potential conflicts.

Yes, a transfer on death deed for joint owners can be placed on a joint account. This allows both owners to benefit from the account during their lifetime. Upon the death of one owner, the remaining owner retains full rights without the account going through probate. This setup simplifies the transfer process significantly.

A downside of a transfer on death deed for joint owners is the potential for disputes among family members. If there are multiple joint owners, disagreements regarding the deed can arise. Additionally, the specific rules governing TODs can vary, so understanding your local laws is crucial.