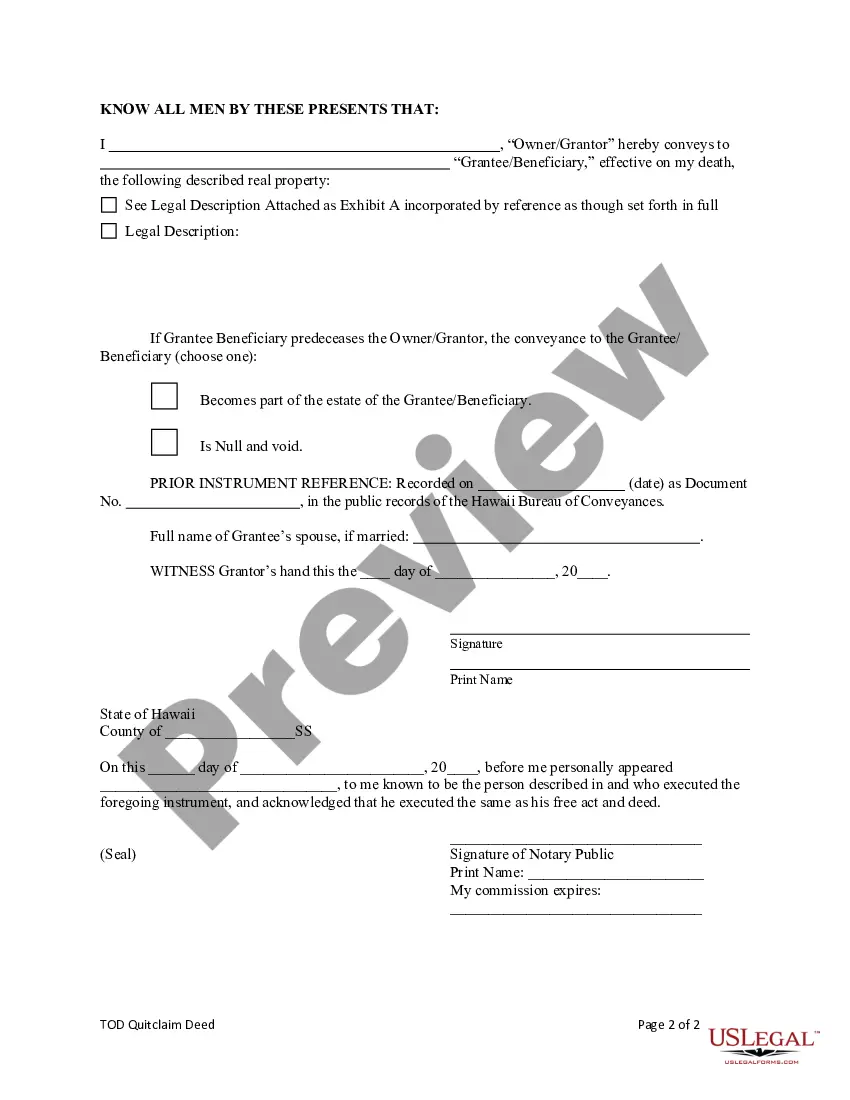

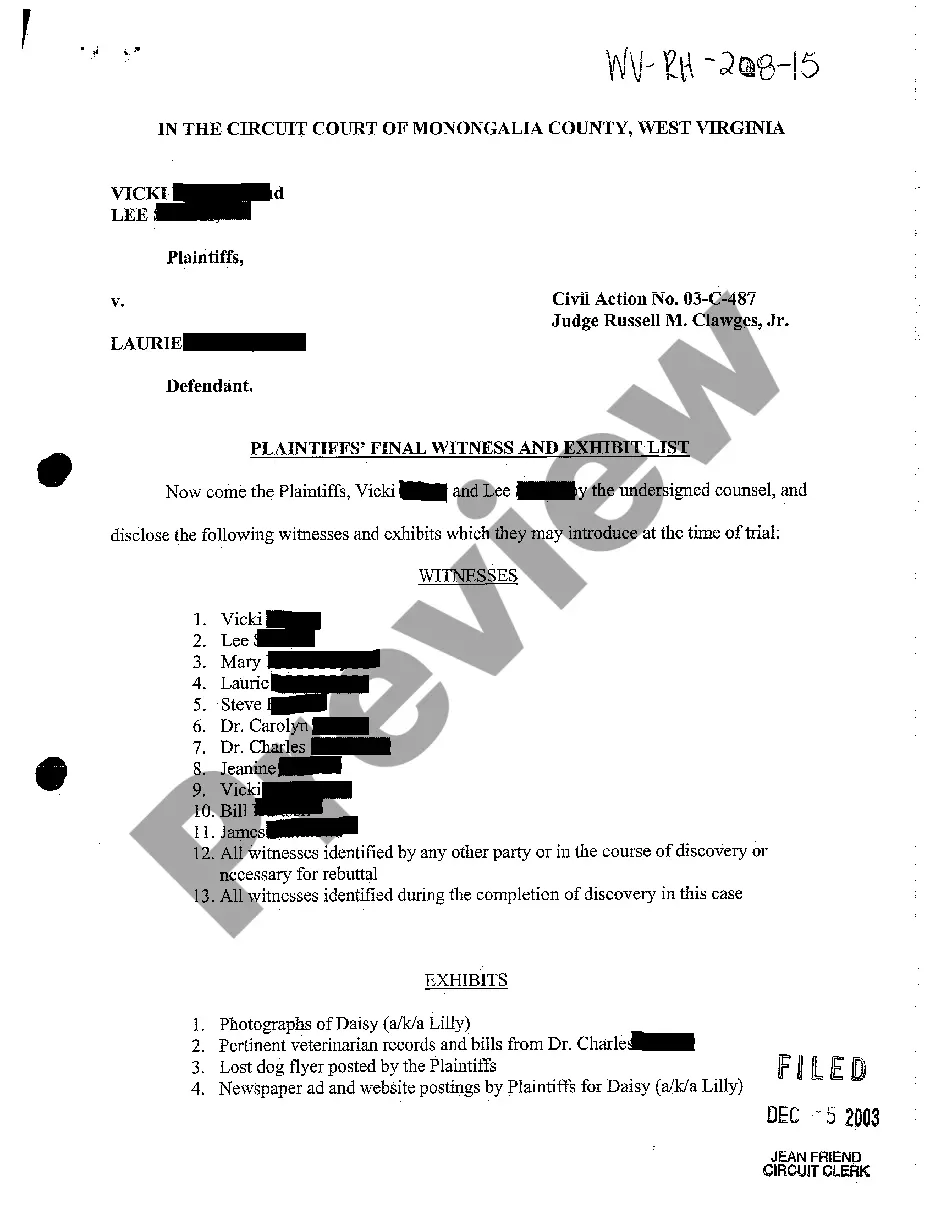

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is also an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Hawaii Transfer On Death Deed With Mortgage

Description

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Individual?

Locating a reliable source for the latest and pertinent legal templates is a significant part of managing red tape. Securing the appropriate legal paperwork requires accuracy and meticulousness, which clarifies the necessity of obtaining samples of Hawaii Transfer On Death Deed With Mortgage solely from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and prolong your circumstances.

With US Legal Forms, you can feel reassured. You are able to access and review all the information regarding the document’s applicability and significance for your needs as well as within your local jurisdiction.

Once you have the document on your device, you can modify it using the editor or print it out and fill it in by hand. Eliminate the hassles associated with your legal paperwork. Explore the comprehensive collection of US Legal Forms where you can discover legal samples, assess their applicability to your situation, and download them immediately.

- Use the library navigation or search box to locate your template.

- Check the form’s description to confirm if it meets the specifications of your state and county.

- Preview the form, if available, to ensure the template is what you require.

- Return to the search and find the correct template if the Hawaii Transfer On Death Deed With Mortgage does not fulfill your needs.

- If you are confident about the form’s applicability, download it.

- When you are a registered user, click Log in to verify and gain access to your chosen templates in My documents.

- If you have not yet created an account, click Buy now to purchase the form.

- Select a pricing plan that suits your requirements.

- Proceed with the account setup to finalize your purchase.

- Complete your transaction by choosing a payment option (credit card or PayPal).

- Select the file format for downloading Hawaii Transfer On Death Deed With Mortgage.

Form popularity

FAQ

Yes, Hawaii does allow transfer on death deeds, which can greatly simplify the transfer process of real estate. This legal tool enables property owners to establish beneficiaries who will inherit their property directly upon their passing. By using a transfer on death deed, individuals can bypass probate and make the transition smoother for their heirs. If you are considering this option, a Hawaii transfer on death deed with mortgage can address specific property interests effectively.

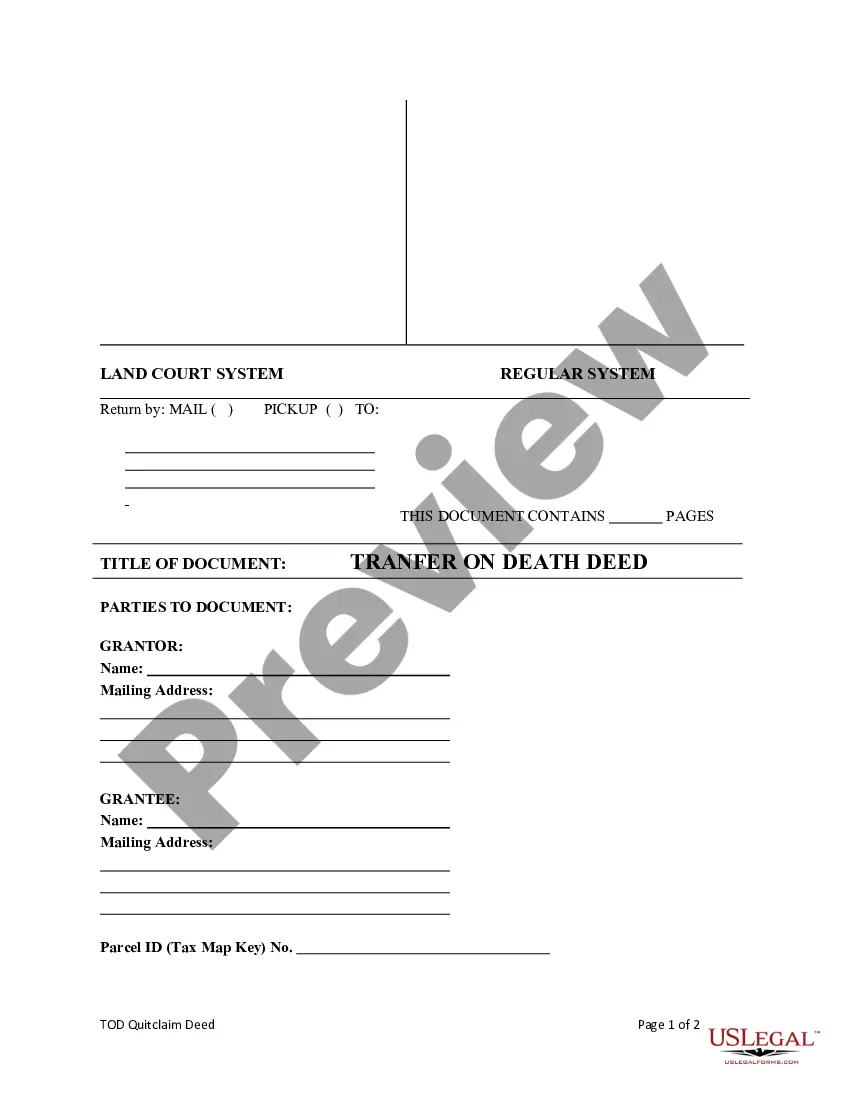

To file a transfer on death deed in Hawaii, you must first complete the appropriate form, ensure it is signed by you in the presence of a notary, and then record it with the Bureau of Conveyances. This form allows you to designate a beneficiary who will inherit your property, including when there is a mortgage in place. Filing this deed properly avoids probate and streamlines the transfer process. If you need assistance, consider using US Legal Forms, which provides the necessary forms and guidance tailored to Hawaii transfer on death deed with mortgage.

Hawaii is a lien theory state and uses mortgages instead of deeds of trust.

Transfer-on-Death deeds also do not allow for naming a contingent beneficiary on the deed like a trust document that owns the property does. Secondly, if the intended beneficiary is a minor, the minor would not be able to manage or transfer the property until they reach the age of 18.

An individual may transfer property, effective at the transferor's death, to one or more beneficiaries by a transfer on death deed; provided that, with respect to property of which any portion is registered in the land court, transfer is subject to the requirement in section 527-13(a)(1) regarding submittal of a ...

Hawaii Transfer on Death Deeds You must sign the deed and get your signature notarized, and then record (file) the deed with either the Bureau of Conveyances or the Office of the Assistant Registrar of the Land Court (see "Recording Your Deed" below to determine which) before your death. ... The beneficiary's rights.

A Revocable Living Trust A trust can be a great mechanism to avoid probate and is the recommended method. While there are some upfront fees for creating a trust, the fees are typically much less than probate costs. Generally, you, as trustee, retain control of the assets held within the trust during your lifetime.