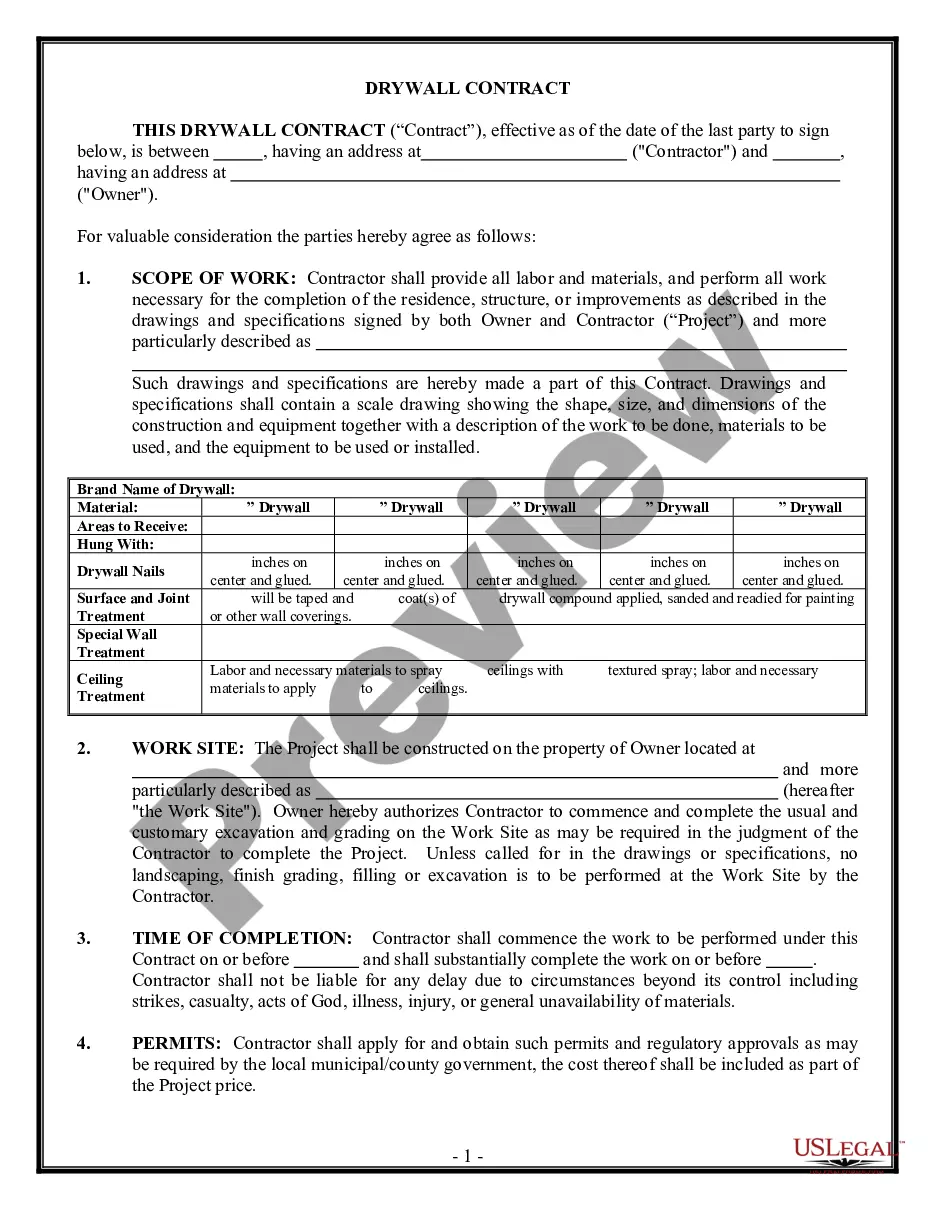

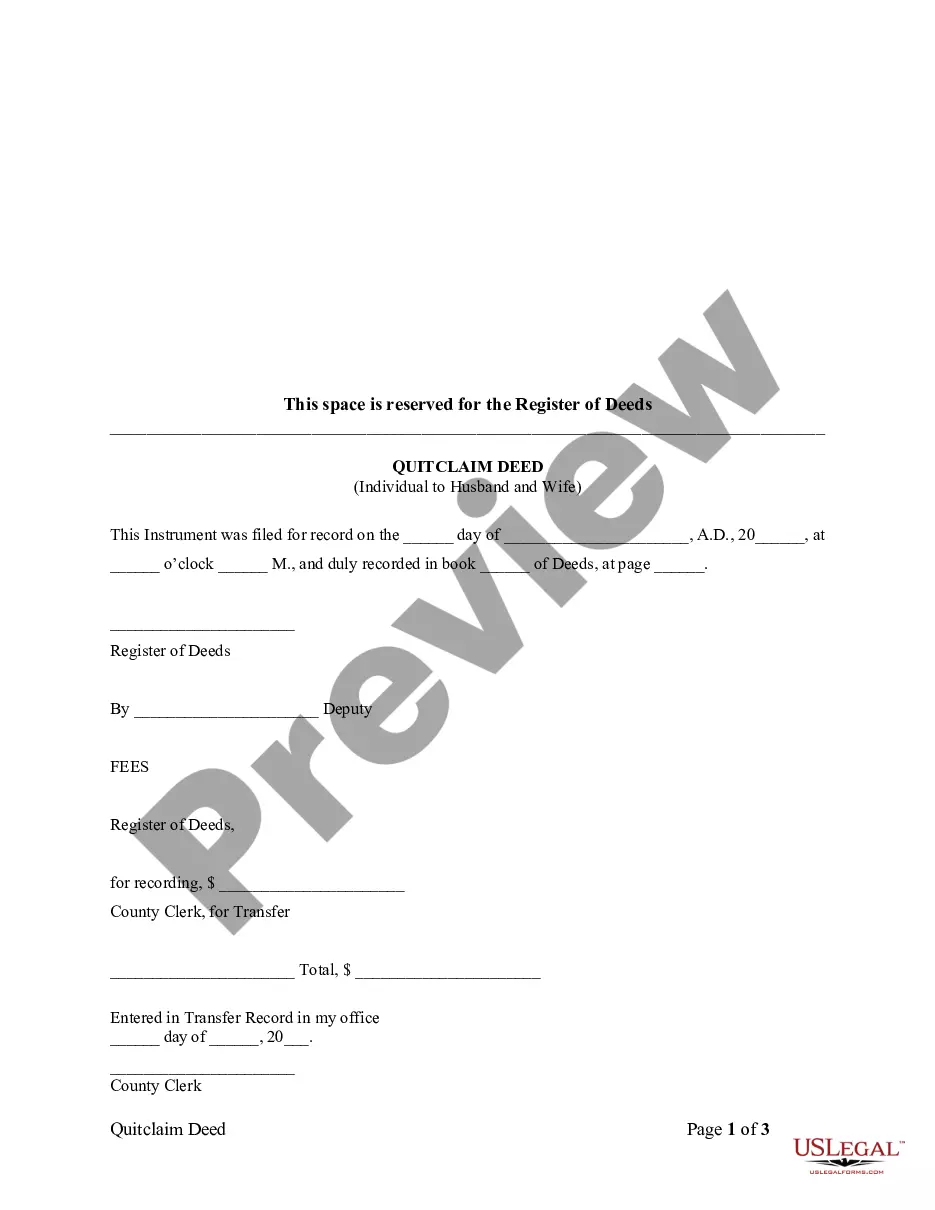

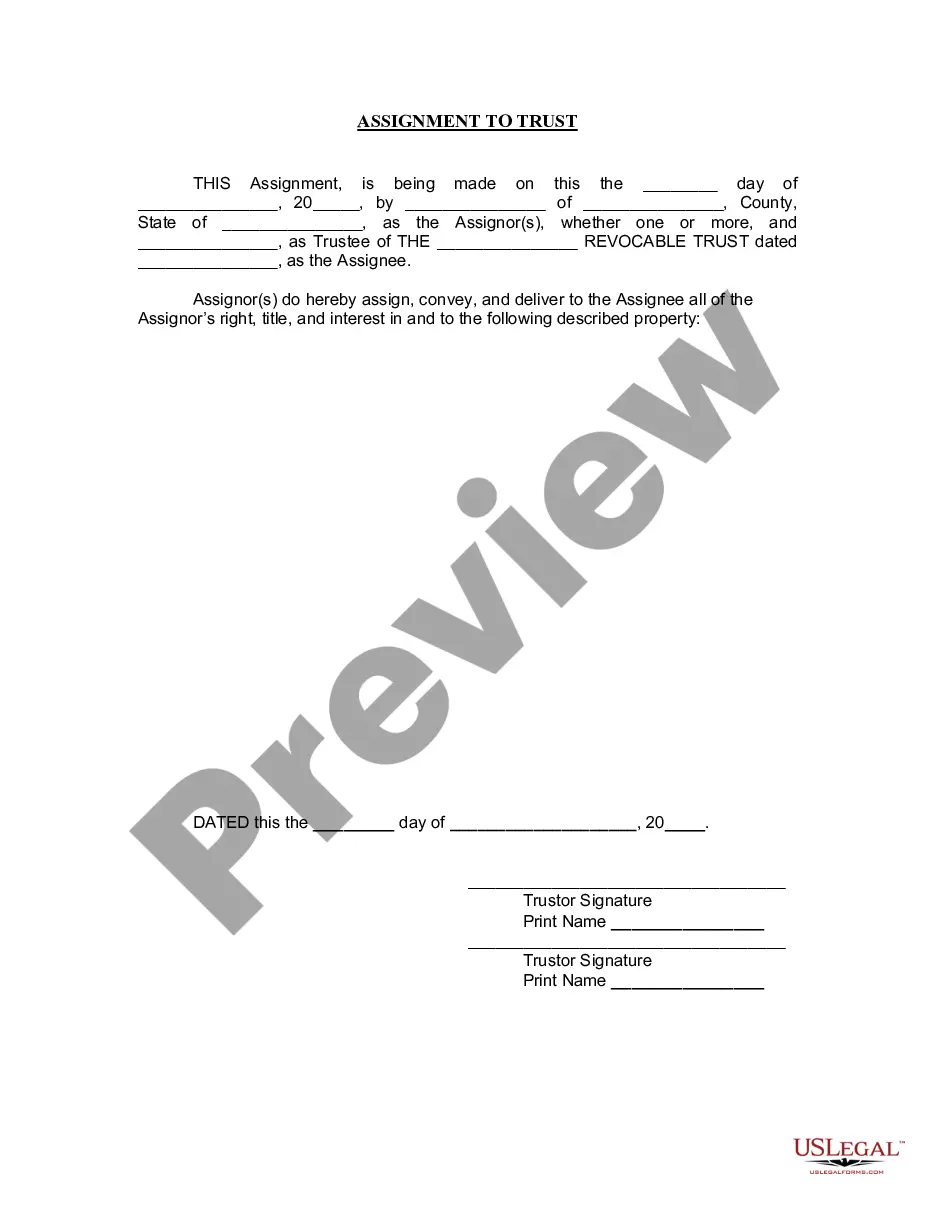

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is also an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Hawaii Transfer On Death Deed Form With Beneficiaries

Description

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Individual?

Legal oversight can be overwhelming, even for seasoned professionals.

If you are seeking a Hawaii Transfer On Death Deed Form With Beneficiaries and lack the time to dedicate to finding the correct and current version, the procedures can be stressful.

Leverage a helpful resource center of articles, guides, and materials relevant to your situation and needs.

Save effort and time searching for the documents you require, and use US Legal Forms’ sophisticated search and Review feature to locate the Hawaii Transfer On Death Deed Form With Beneficiaries and download it.

Benefit from the US Legal Forms web library, backed by 25 years of experience and reliability. Streamline your everyday document management into a straightforward and user-friendly process today.

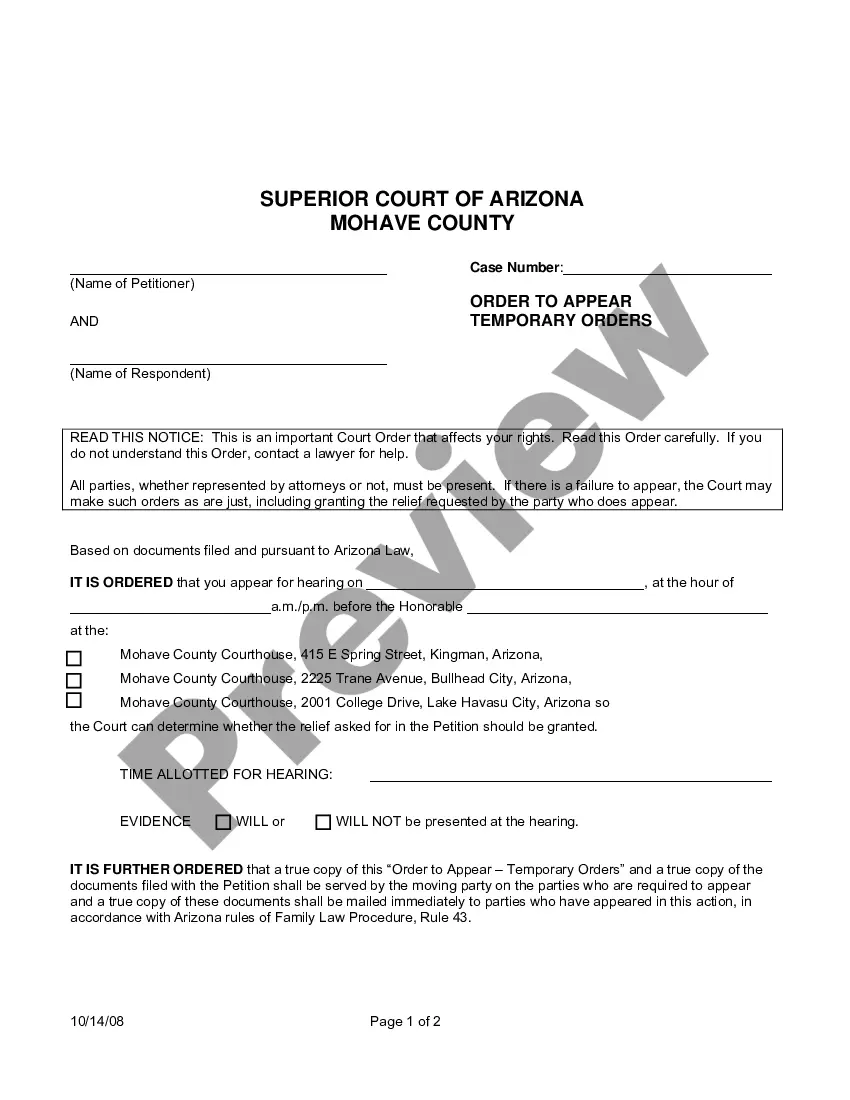

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to review the documents you previously saved and manage your folders as desired.

- If this is your first time using US Legal Forms, create an account to gain unlimited access to all the benefits of the library.

- Here are the steps to follow after downloading the form you need.

- Ensure it is the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and organizational documents.

- US Legal Forms meets any needs you may have, from personal to business paperwork, all in one location.

- Utilize advanced tools to complete and manage your Hawaii Transfer On Death Deed Form With Beneficiaries.

Form popularity

FAQ

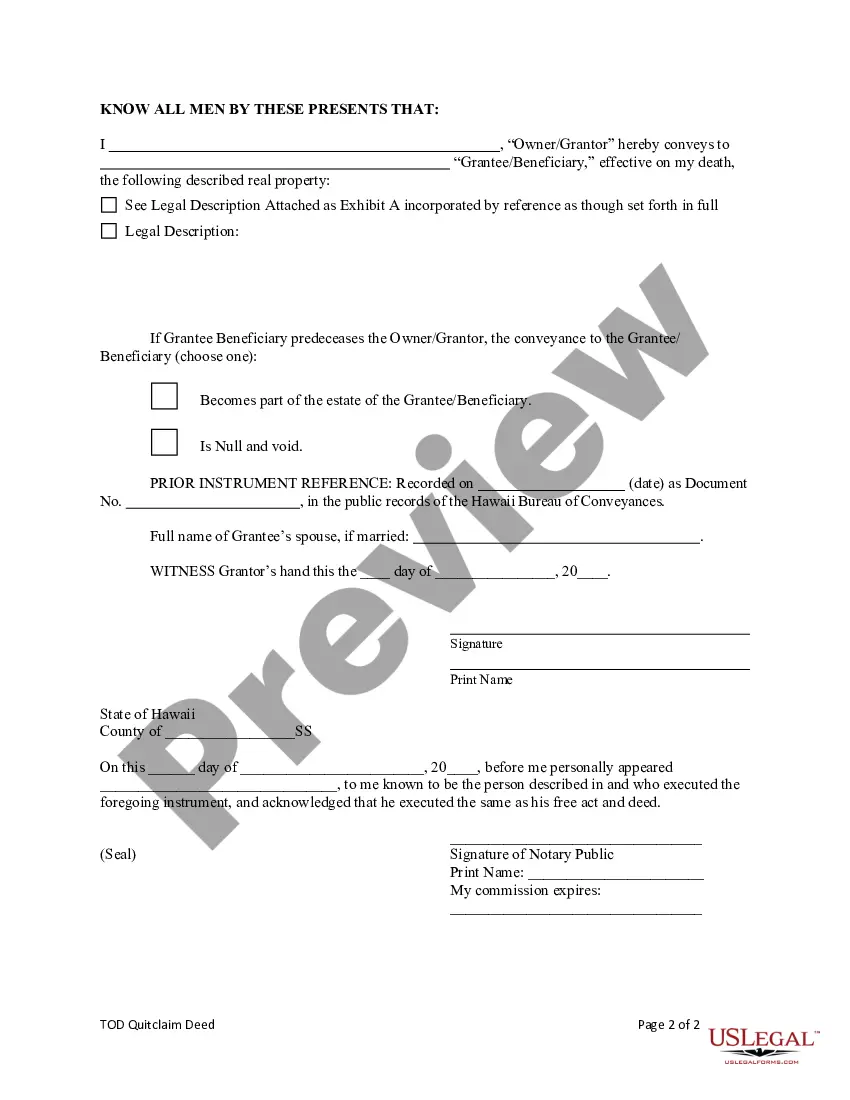

Transfer-on-Death deeds also do not allow for naming a contingent beneficiary on the deed like a trust document that owns the property does. Secondly, if the intended beneficiary is a minor, the minor would not be able to manage or transfer the property until they reach the age of 18.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

Cons To Using Beneficiary Deed Estate taxes. Property transferred may be taxed. No asset protection. The beneficiary receives the property without protection from creditors, divorces, and lawsuits. Medicaid eligibility. ... No automatic transfer. ... Incapacity not addressed. ... Problems with beneficiaries.

A Revocable Living Trust A trust can be a great mechanism to avoid probate and is the recommended method. While there are some upfront fees for creating a trust, the fees are typically much less than probate costs. Generally, you, as trustee, retain control of the assets held within the trust during your lifetime.

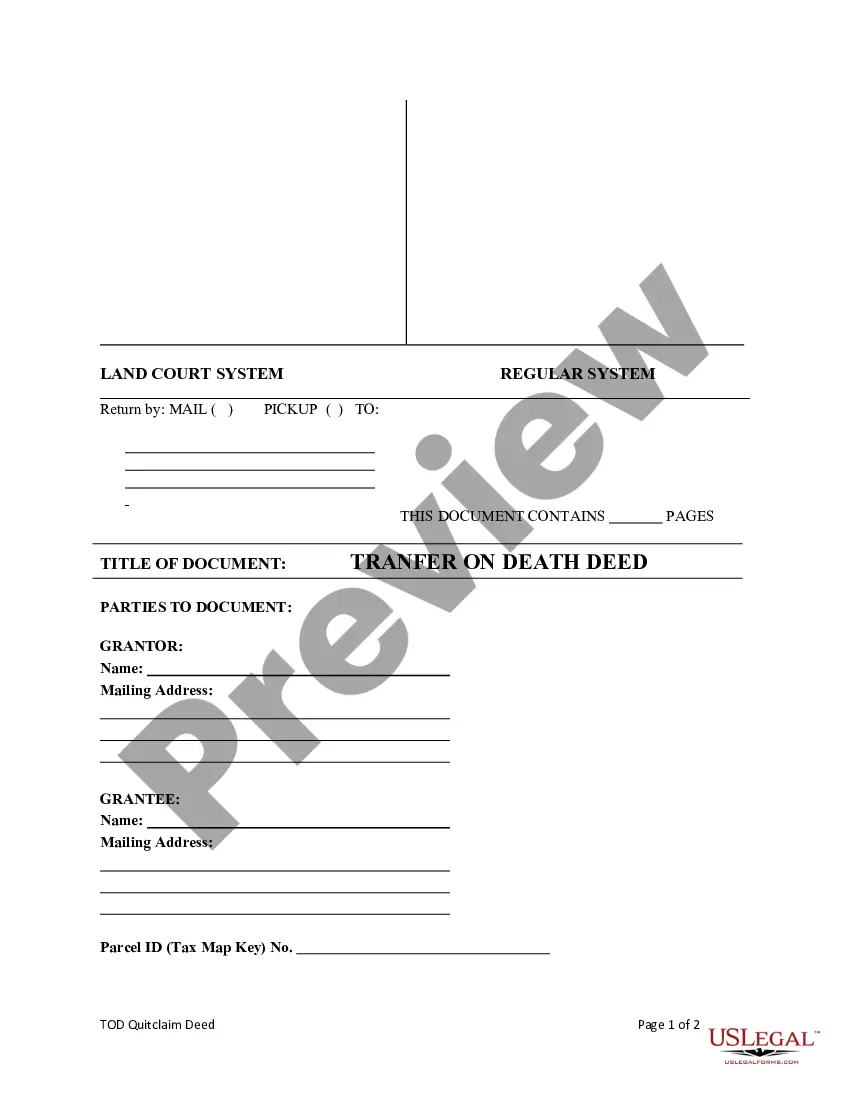

Hawaii Transfer on Death Deeds You must sign the deed and get your signature notarized, and then record (file) the deed with either the Bureau of Conveyances or the Office of the Assistant Registrar of the Land Court (see "Recording Your Deed" below to determine which) before your death. ... The beneficiary's rights.