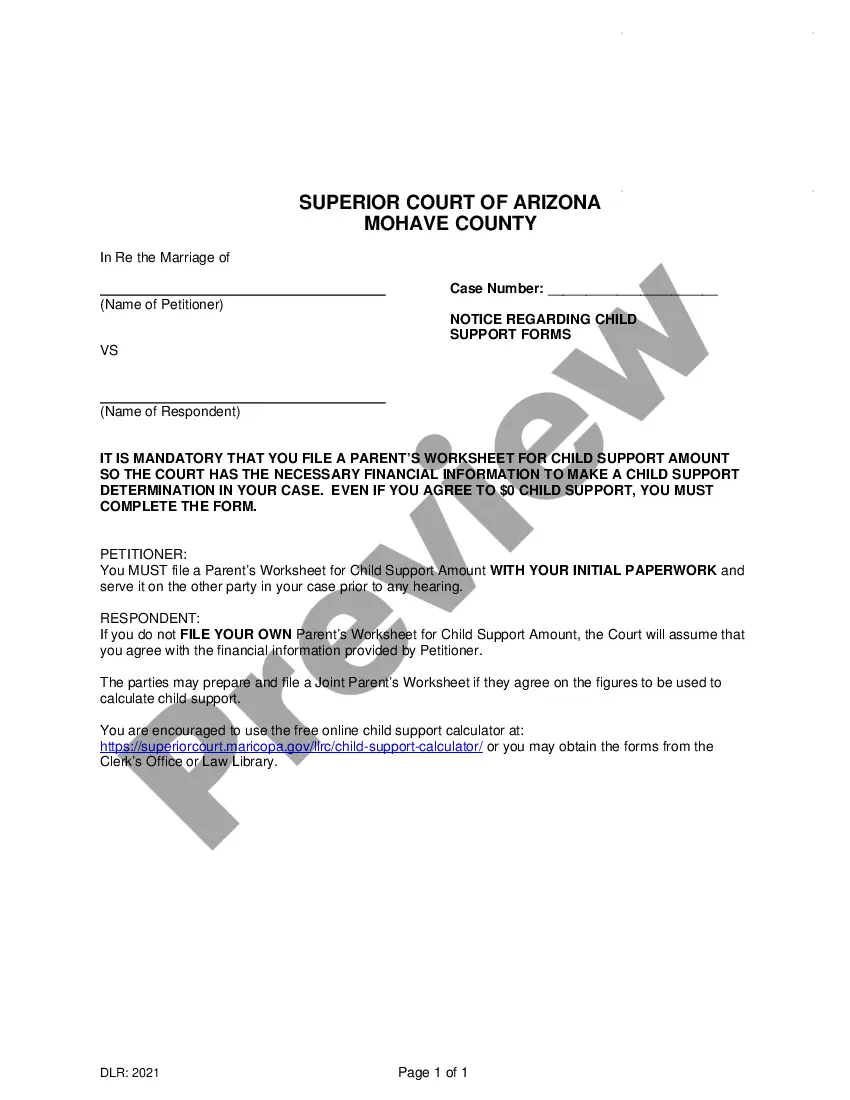

UCC1 - Financing Statement - Georgia - For use after July 1, 2001. This form is a financing statement used to cover certain collateral as specified in the form. This Financing Statement complies will all applicable state laws.

Ucc 1 Form Georgia Format

Description

How to fill out Georgia UCC1 Financing Statement?

Creating legal documents from beginning can frequently be somewhat daunting.

Certain circumstances may require extensive research and a significant financial investment.

If you’re seeking a simpler and more economical method of preparing Ucc 1 Form Georgia Format or any other paperwork without the hassle, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal affairs.

However, before proceeding directly to downloading Ucc 1 Form Georgia Format, consider these suggestions: Review the document preview and descriptions to confirm that you have located the document you seek. Ensure that the template you choose adheres to the rules and regulations of your state and county. Select the most appropriate subscription plan to acquire the Ucc 1 Form Georgia Format. Download the form, then complete, verify, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and simplify your document processing!

- With just a few clicks, you can quickly obtain state- and county-specific templates meticulously crafted by our legal experts.

- Utilize our platform whenever you require trustworthy and dependable services to effortlessly locate and download the Ucc 1 Form Georgia Format.

- If you’re familiar with our services and have previously created an account, simply Log In to your account, choose the form and download it immediately or re-download it later in the My documents section.

- Don’t possess an account? No issue.

- It takes minimal time to sign up and explore the library.

Form popularity

FAQ

A Uniform Commercial Code filing, also known as a UCC filing, is a document that lenders use to establish their legal right to assets that a borrower uses to secure a loan. This notice allows the lender to seize the borrower's collateral in the case of default.

Most financing statements are filed in the office of the Clerk of Court in the county where the debtor lives. All financing statements, no matter where they are filed and recorded in Georgia, are scanned into a state-wide database accessible via a publicly available computer link in the Clerk of Court's office.

Typical collateral For example, if you take out a loan to buy new machinery, the lender might file a UCC-1 lien and claim that new machinery as collateral on the loan. You would, of course, work with your lender to designate what the collateral will be before you sign any documentation committing to the loan.

DO: Always use the Debtor's exact Legal Name and Address. The debtor's name should match what is listed on their legal license along with the correct address, or on the most recently filed corporate documents. Include the Lender's Name and Address. Provide a description of the collateral.

Most financing statements are filed in the office of the Clerk of Court in the county where the debtor lives.