Power Attorney For Vehicle

Description

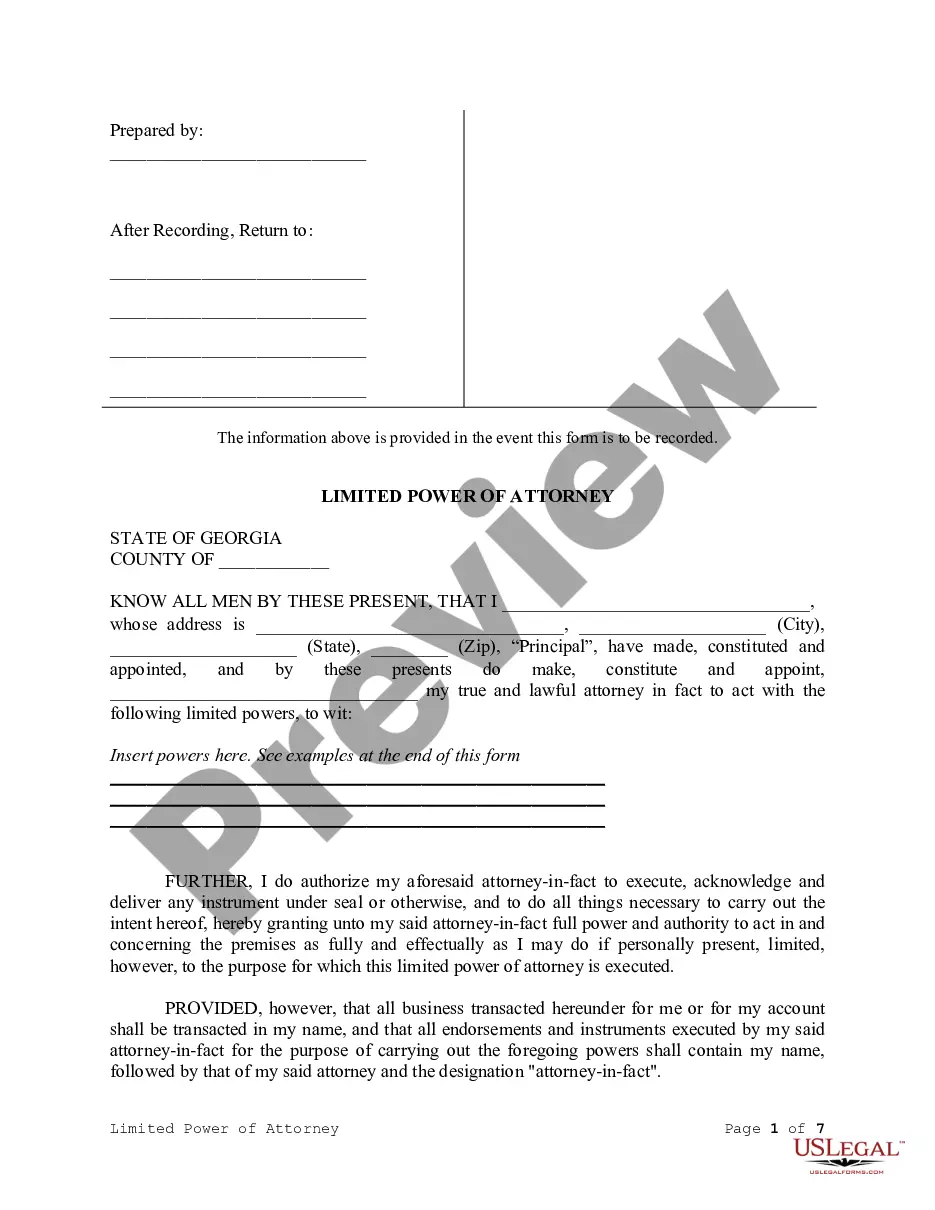

How to fill out Georgia Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; renew it if necessary.

- For new users, start by exploring the extensive library of legal forms. Use the Preview mode to confirm you choose the right power attorney for vehicle that meets your local legal requirements.

- If you don't find a suitable template, use the search tool to locate an alternative that fits your needs.

- Purchase the selected document by clicking the Buy Now button and selecting your desired subscription plan. Create an account to unlock premium resources.

- Make your payment using your credit card or PayPal to finalize your purchase.

- Download the completed form directly to your device. You can also access it anytime from the My Forms section of your account.

In conclusion, US Legal Forms provides a user-friendly platform to acquire vital legal documents like a power attorney for vehicle use. With over 85,000 forms and expert assistance, your legal needs are efficiently met.

Start your journey today by visiting US Legal Forms and ensure you have the right paperwork for your vehicle authority!

Form popularity

FAQ

In North Carolina, you do not necessarily need a lawyer to create a power of attorney for vehicle. You can use standardized forms available online, such as those from US Legal Forms, to draft your document. However, if you have complex situations or specific needs, consulting a lawyer can provide additional peace of mind. Ensuring that your power of attorney is valid under state law is essential for smooth transactions.

The best person to give power of attorney depends on your trust and the specific situation. Typically, you would appoint someone who is responsible and understands the matters related to your vehicle. This could be a family member or a close friend who can handle tasks on your behalf. It's important to choose someone who will act in your best interests when using the power attorney for vehicle.

Yes, most dealerships accept power of attorney for vehicle transactions. This legal document allows someone to act on your behalf in matters related to the vehicle, such as signing documents or transferring title. However, it's crucial to ensure that your power of attorney for vehicle is properly formatted and includes all necessary information. If you're unsure, consulting resources like US Legal Forms can help you create a compliant document.

The purpose of a power of attorney for car insurance is to grant authority to someone else to handle insurance-related matters on your behalf. This includes filing claims, negotiating settlements, or making necessary policy changes. By appointing an agent, you ensure that your vehicle’s insurance is managed effectively during your absence. In this way, a power attorney for vehicle ensures your interests are represented when you cannot act personally.

A power of attorney is generally not held liable for a car accident if they were acting within the scope of their authority. If your agent made a decision impacting your vehicle while exercising their power, the liability typically remains with you, the principal. Therefore, it is crucial to choose a responsible individual as your agent. Having a power attorney for vehicle management can help clarify responsibilities in such situations.

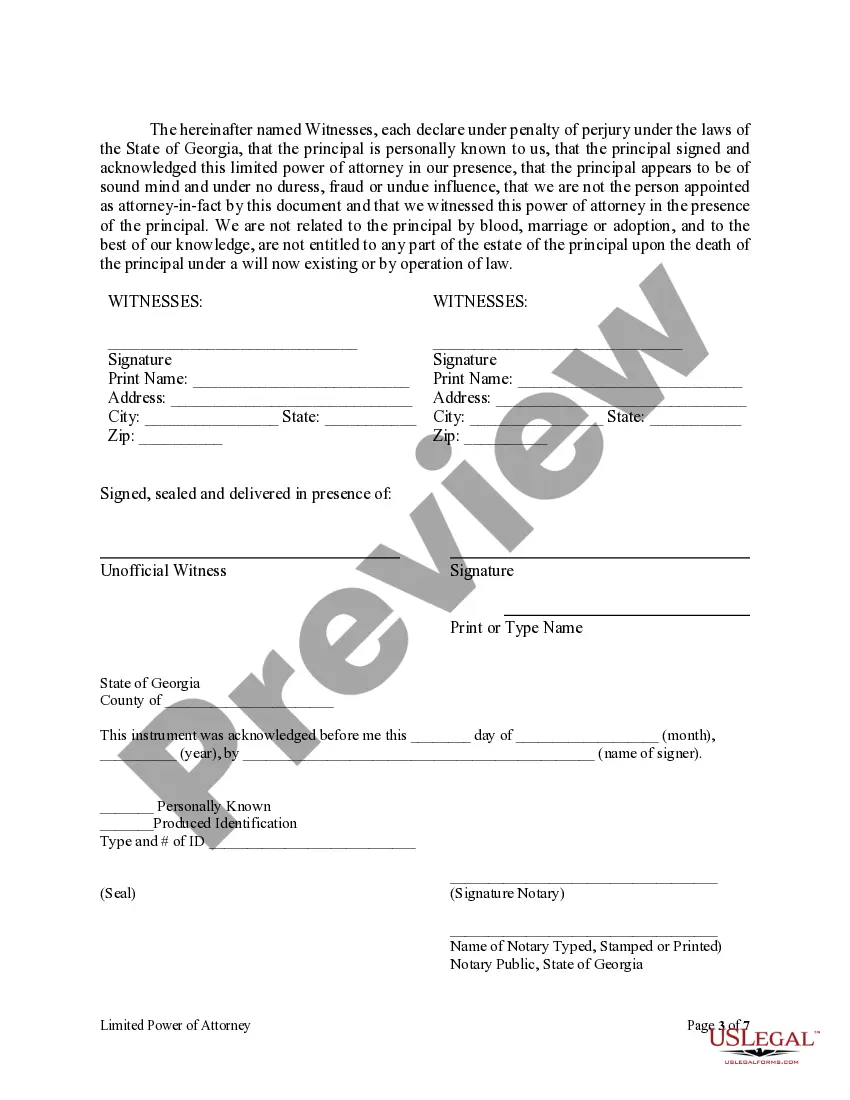

To obtain a power of attorney for vehicle transactions, start by selecting a trusted person to act as your agent. Next, create a written document that clearly states your intentions and powers granted. Many online platforms, like USLegalForms, offer templates to simplify this process. After completing the document, ensure it is signed and notarized to meet legal requirements in your state.

Car insurance may require a power of attorney to facilitate seamless claim processing or policy adjustments. By designating a trusted individual with this authority, you enable them to communicate directly with the insurance company on your behalf. This is particularly beneficial if you are unavailable or incapacitated. Overall, a power attorney for vehicle matters can save you time and reduce the stress associated with these processes.

In car insurance, POA stands for power of attorney. This legal document allows an individual to act on your behalf when dealing with insurance matters, such as claims or policy changes, for your vehicle. Assigning a POA can simplify the process, especially if you are unable to handle your affairs due to various reasons. Consequently, having a power attorney for vehicle tasks can ensure your interests are protected.

In Arizona, the rules for power of attorney for vehicle transactions require the document to be in writing, signed, and notarized. You must assign a trusted person as your agent to act on your behalf concerning your vehicle. This power can be specific to one transaction or broad, covering multiple actions. It's essential to ensure the document complies with Arizona law to avoid complications.

In Maryland, a valid power of attorney document must be in writing and signed by the principal. It should clearly identify the agent and specify the powers granted. Additionally, it is wise to have the document notarized to avoid potential disputes, ensuring that your power of attorney for vehicle holds up in various situations.