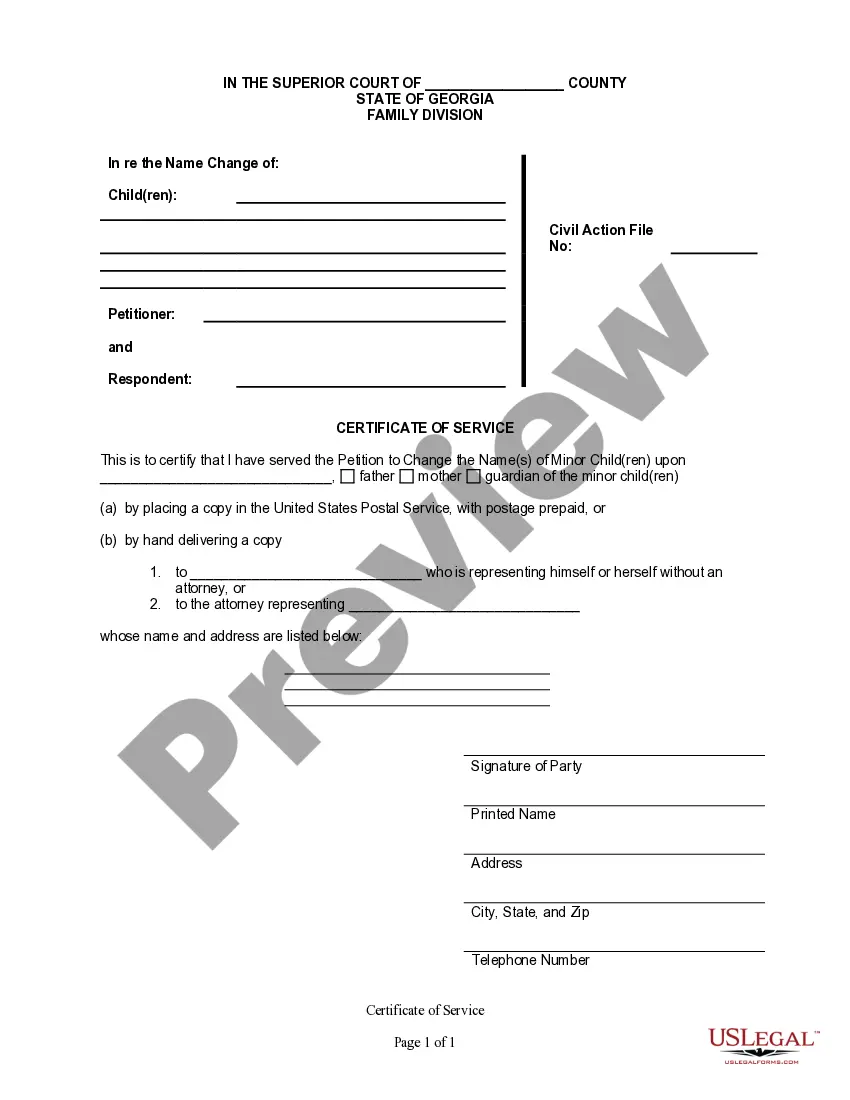

If the non-party parent is unwilling to complete the Acknowledgement of Service and the Petitioner must serve then either by mail or in person, the serving party then completes this form and files with the court to establish that the non-party parent was in fact sent or given a copy of the Petition.

Georgia Certificate Service Withholding Allowance

Description

How to fill out Georgia Certificate Service Withholding Allowance?

When you are required to finalize the Georgia Certificate Service Withholding Allowance in line with your local state's guidelines, there could be several alternatives to choose from.

There's no necessity to scrutinize every document to ensure it meets all legal standards if you are a US Legal Forms subscriber.

It is a dependable service that can assist you in acquiring a reusable and current template on any subject.

Using the US Legal Forms, obtaining well-drafted official documents becomes easy. Additionally, Premium users can also take advantage of the robust integrated tools for online PDF editing and signing. Try it today!

- US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use forms for business and personal legal matters.

- All templates are confirmed to comply with each state's regulations.

- Thus, when you download the Georgia Certificate Service Withholding Allowance from our site, you can be confident that you possess a valid and current document.

- Acquiring the required sample from our platform is exceedingly straightforward.

- If you already hold an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- Subsequently, you can access the My documents tab in your profile and maintain access to the Georgia Certificate Service Withholding Allowance anytime.

- If this is your first time using our website, please follow the instructions below.

- Review the recommended page and verify it for consistency with your needs.

Form popularity

FAQ

Yes, you should fill out the employee's withholding allowance certificate to accurately reflect your tax situation. This certificate helps your employer determine the correct amount to withhold from your paycheck based on the Georgia certificate service withholding allowance guidelines. Completing this form can prevent under-withholding or over-withholding, which affects your financial planning. You can easily access and fill out the necessary forms through the US Legal Forms platform, simplifying the process.

When determining how much to withhold for Georgia state taxes, you should consider your total income, filing status, and number of allowances. The Georgia certificate service withholding allowance can greatly influence the amount you need to withhold. For accurate estimates, use the Georgia withholding tax tables provided by the Georgia Department of Revenue. Additionally, consulting with an accounting professional can help ensure you meet your tax obligations effectively.

To claim withholding allowances, start by filling out the correct form provided by the Georgia Department of Revenue. Ensure that you accurately complete the Georgia certificate service withholding allowance form, as it determines how much tax will be withheld from your paycheck. After filling it out, submit the form to your employer, who will then adjust your payroll accordingly. Utilizing services like uslegalforms can simplify this process, helping you ensure that all necessary details are correctly handled.

To set up a Georgia withholding account, you need to register online with the Georgia Department of Revenue. You'll complete the necessary forms and provide your business information. Additionally, utilizing the services provided by uslegalforms can make this registration process easier and more efficient. This tool guides you through each step, ensuring you meet all regulatory requirements associated with your Georgia certificate service withholding allowance.

When determining your withholding allowances, consider the number of dependents you have, your filing status, and any additional deductions you expect. The Georgia certificate service withholding allowance form allows you to specify these details accurately. Completing this form correctly can help ensure that the appropriate amount is withheld from your paycheck. Using tools like the uslegalforms platform can simplify this process and provide clarification on your specific situation.

The number you should put for your withholding allowance depends on your personal financial circumstances. Evaluate your income, deductions, and whether you have dependents. If unsure, tools like the Georgia certificate service withholding allowance can assist in determining this number based on your situation, helping you avoid surprises during tax season.

Claiming 3 allowances may or may not be excessive, depending on your unique financial landscape. If you have several dependents or other deductions, it could be appropriate. However, if your tax situation changes and you claim too many, you might owe taxes at year-end. The Georgia certificate service withholding allowance can guide you in assessing the right number of allowances.

Allowances and dependents are related but not the same. Dependents refer to individuals you claim on your tax return, typically children or other relatives. Allowances, on the other hand, dictate how much tax is withheld from your paycheck. Clarifying this difference is essential, and the Georgia certificate service withholding allowance can help shed light on your specific situation.

Determining the right number of allowances involves assessing your financial situation, income, and any deductions you might qualify for. Resources like the Georgia certificate service withholding allowance calculator can offer valuable insights. This tool evaluates your tax situation and recommends an appropriate number of allowances to claim.

Filling out a withholding allowance certificate involves providing personal information and your desired number of allowances. It is essential to complete the form accurately to ensure proper withholding. Using the Georgia certificate service withholding allowance can simplify this process by guiding you through the necessary steps and calculations.