Limited Liability Company With One Member

Description

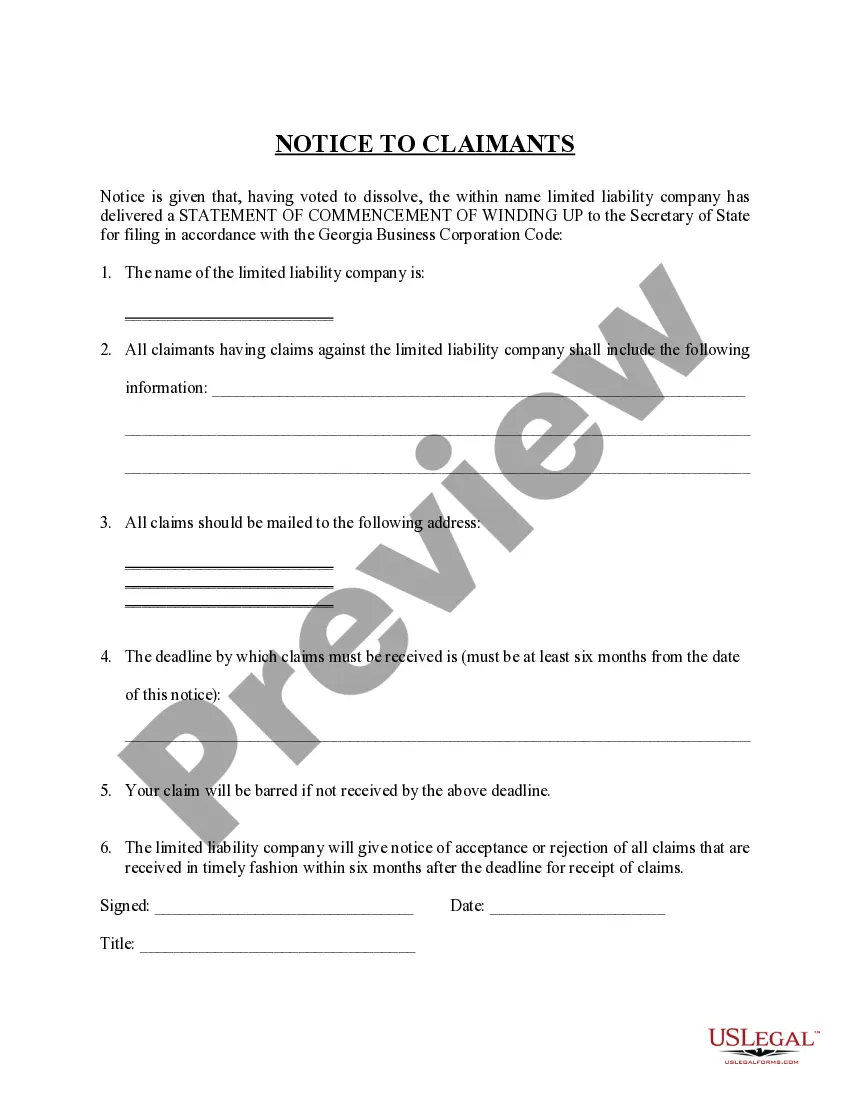

How to fill out Georgia Dissolution Package To Dissolve Limited Liability Company LLC?

- If you are a returning user, log in to your account at US Legal Forms and navigate to your dashboard. Ensure your subscription is active before proceeding.

- For first-time users, start by reviewing the form preview and descriptions. Verify that you have selected the correct document that aligns with your needs and local regulations.

- In case the selected form doesn’t meet your criteria, utilize the Search feature to find alternatives that suit your requirements.

- Purchase the desired document by clicking the Buy Now button. Select a subscription plan that fits your needs, and be sure to create an account to unlock extensive resources.

- Complete your transaction by entering your payment details through credit card or PayPal. This secures your access to the forms repository.

- Upon successful purchase, download your document and save it to your device. You can also find it in the My Forms section of your profile for future reference.

Following these straightforward steps ensures you can swiftly acquire the necessary legal forms for your limited liability company.

US Legal Forms streamlines the document process, allowing you to focus on your business. Start your journey towards establishing your LLC today!

Form popularity

FAQ

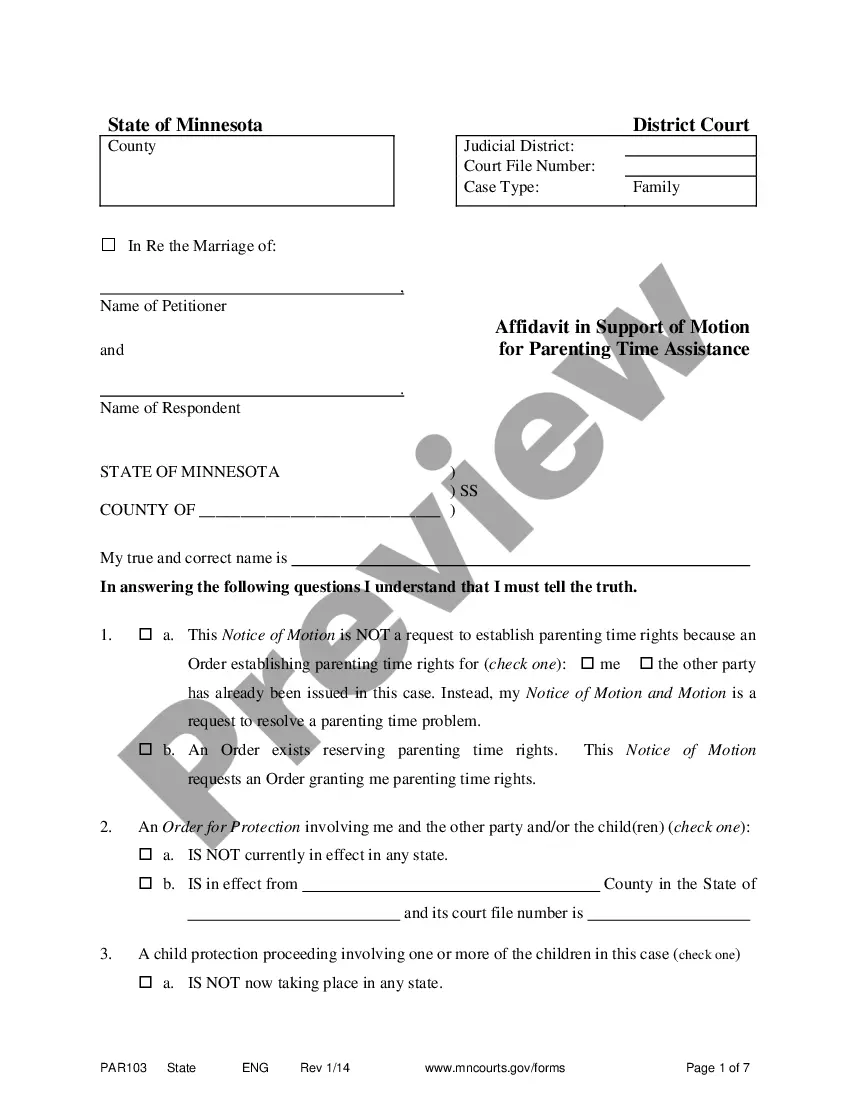

Yes, a limited liability company with one member is completely legal and common in many states. This structure provides liability protection while allowing for more straightforward management. You can operate your business independently without the need for partners or shareholders. For those considering this option, our platform at uslegalforms offers resources to help you establish your limited liability company with one member effectively.

A limited liability company with one member often enjoys pass-through taxation, meaning the income is not taxed at the company level. Instead, it appears on your personal tax return, simplifying the filing process. Additionally, you may qualify for certain deductions, potentially reducing your overall tax liability. Overall, a limited liability company with one member provides a tax-efficient structure for your business activities.

An LLC with one person is known as a limited liability company with one member. This structure is specifically designed for individuals who want the benefits of limited liability without dealing with multiple owners. It offers flexibility in management and taxation, making it a popular choice for solo entrepreneurs and freelancers.

As the owner of a limited liability company with one member, your title is often 'Member' or 'Owner'. In formal documents, you may also refer to yourself as the 'Managing Member' if you have operational control. It's essential to use accurate titles in business communications to maintain professionalism and clarity.

When completing a W-9 for a limited liability company with one member, you should enter your LLC's name on line 1. In line 2, include your personal name, as the sole owner. Be sure to check the box indicating your tax classification as either 'Individual' or 'Sole Proprietor' depending on your tax situation. This ensures proper tax reporting for your business income.

A single member LLC is commonly referred to as a limited liability company with one member. This structure allows you to enjoy the benefits of limited liability while maintaining full control over your business. This designation is important because it impacts tax treatment and legal protections.

If you own a limited liability company with one member, you are often referred to as the 'single member' or 'member' of the LLC. This title signifies your ownership and control over the business. Using the correct terminology can help clarify your role in any business dealings, so it's essential to be aware of it.

As the owner of a limited liability company with one member, you typically enjoy liability protection. This means your personal assets, like your home and savings, are generally safe from business debts and lawsuits. However, maintaining a clear separation between personal and business finances is crucial to uphold this protection. Always consult a legal expert to ensure you understand your obligations.

Yes, a limited liability company with one member can be an excellent choice for many entrepreneurs. It combines liability protection with simple tax advantages and management flexibility. This structure helps separate personal and business liabilities, making it a safer option for your assets. Consider using uslegalforms for expert help in setting one up to maximize its benefits.

To establish a limited liability company with one member, start by choosing a unique name that complies with state regulations. Then, file Articles of Organization with your state’s Secretary of State office. After that, create an operating agreement to outline the management structure. Platforms like uslegalforms simplify the process by guiding you through each step, ensuring compliance and accuracy.