Limited Company Meaning

Description

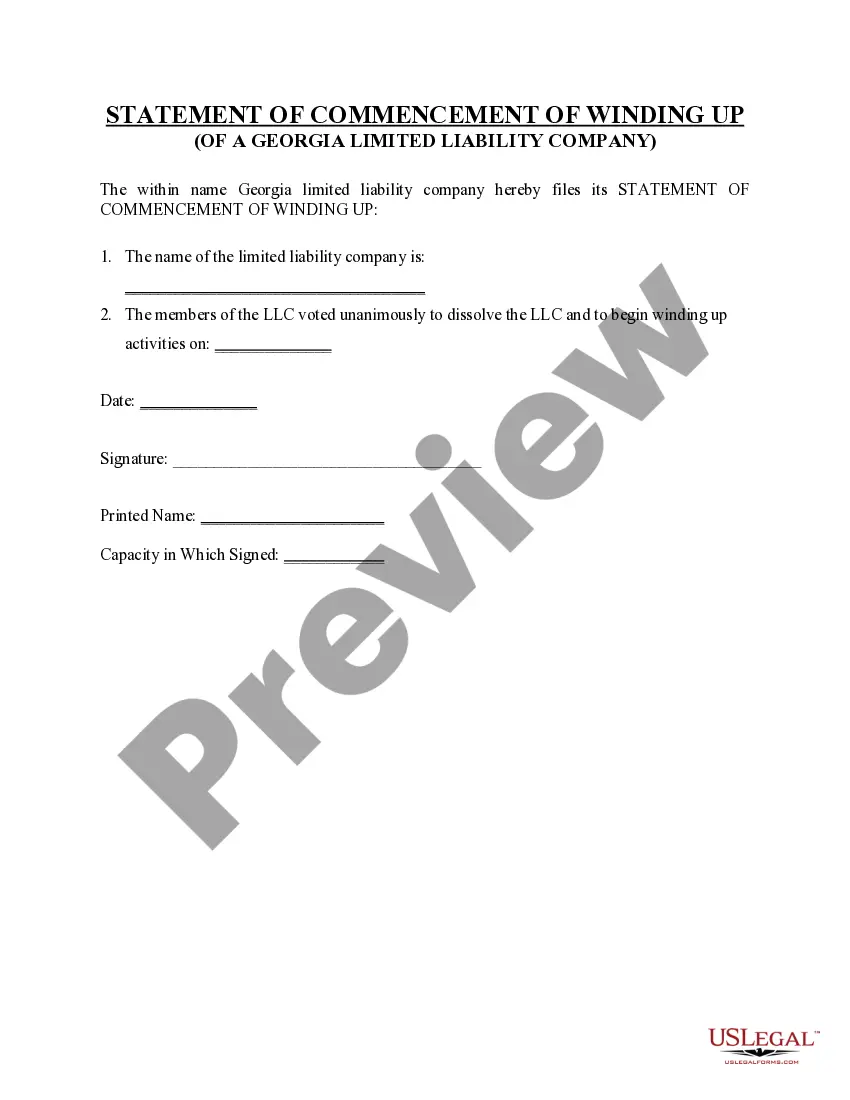

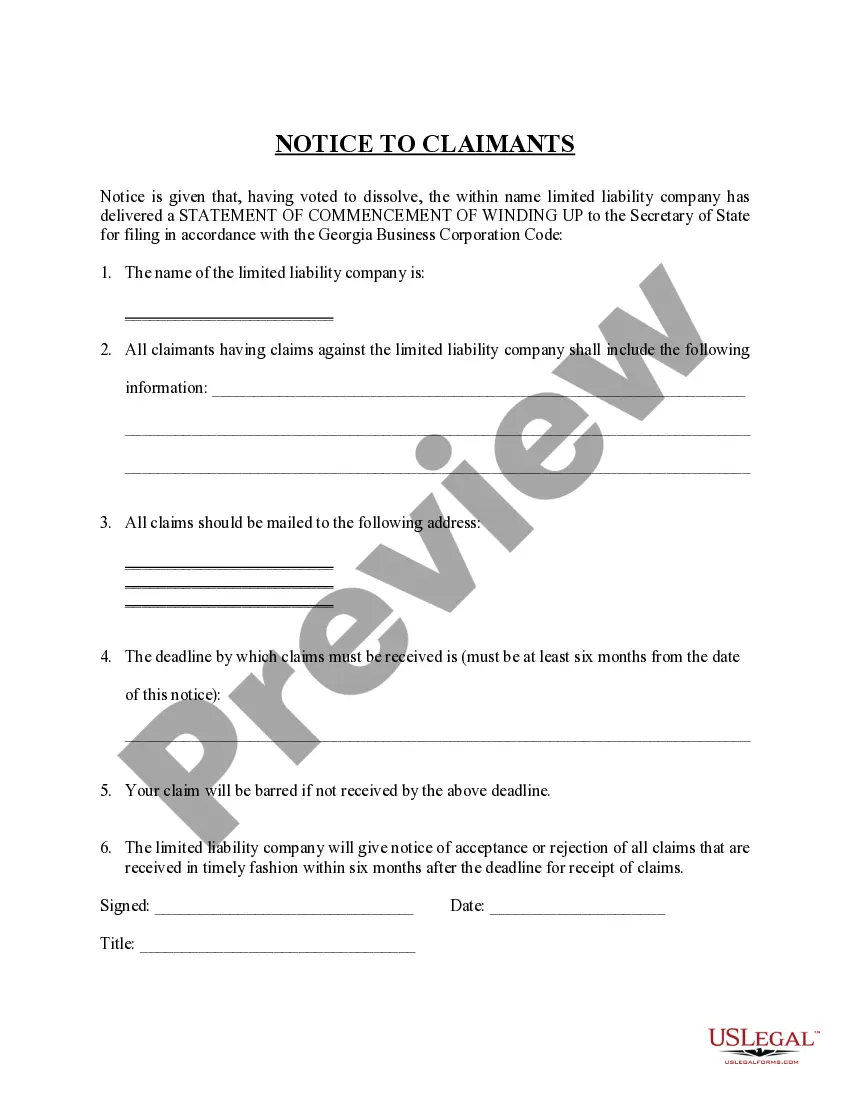

How to fill out Georgia Dissolution Package To Dissolve Limited Liability Company LLC?

- If you're a returning user, log into your account and download your required form by clicking the Download button. Ensure your subscription is still active; renew if necessary.

- For first-time users, begin by previewing the form description to confirm it meets the specific requirements of your jurisdiction.

- If the chosen template isn't right, utilize the Search function above to find a more suitable option.

- Once you’ve found the correct document, click 'Buy Now' and select your desired subscription plan. You’ll need to create an account to access our vast library.

- Proceed to purchase by entering your payment details, either through a credit card or PayPal.

- Finally, download your document to your device. You can revisit it anytime from the My Forms section of your profile.

US Legal Forms stands out with its extensive library, offering over 85,000 customizable legal forms that are easily accessible for users. This comprehensive resource not only saves time but also ensures your documents are legally sound.

Start your journey towards a successful business today by exploring US Legal Forms. Get the right documentation to support your limited company establishment!

Form popularity

FAQ

One disadvantage of operating as a limited company is the increased regulatory burden and administrative work. Limited companies must adhere to stricter compliance requirements, which can be time-consuming and costly. Additionally, profits may be subject to double taxation at both the corporate and personal levels. Recognizing these drawbacks can help you weigh the limited company meaning effectively against other business structure options.

A limited company is required to file specific documents to remain compliant with state regulations. Typically, these include annual returns, financial statements, and tax documents. Depending on the jurisdiction, additional reports may also be necessary. Using platforms like uslegalforms can simplify the filing process and ensure you meet all legal requirements related to the limited company meaning.

When a company has 'limited' in its title, it typically indicates that it is a limited liability company. This means that the owners, or shareholders, have limited liability for the debts and obligations of the business. In simpler terms, your personal assets are generally protected from business losses. Understanding the limited company meaning helps you make informed decisions about your business structure.

While a limited company offers several advantages, some disadvantages exist as well. These include stricter regulations, ongoing compliance requirements, and potential tax implications. Furthermore, setting up a limited company often requires more paperwork and administration than operating as a sole proprietor. Knowing the limited company meaning allows you to weigh these pros and cons effectively before deciding on your business structure.

The purpose of a limited company is to provide a formal business structure that helps manage financial obligations and liabilities. This structure allows for more intricate business operations and can lead to increased trust from customers and partners. In a limited company, profits can be reinvested into the business, fostering long-term sustainability. Grasping the limited company meaning is essential for anyone seeking to start a business.

The main purpose of a limited company is to conduct business activities while minimizing personal risk. It facilitates the ability to raise capital, which supports growth and expansion. By establishing a limited company, business owners can focus on their operations without the constant worry of losing their personal assets. The limited company meaning encompasses these important protective features.

A limited company is defined by its legal structure, which limits the liability of its owners. This means that shareholders are only responsible for company debts up to the amount they invested. To become a limited company, you must register with the appropriate government authority and comply with relevant laws. Familiarizing yourself with limited company meaning ensures you meet all requirements.

The objective of a limited company is to separate personal and business liabilities. This structure protects the owners’ personal assets from financial risks associated with the business. Additionally, it enhances the company's credibility and can attract investors more easily. Understanding the limited company meaning helps clarify its purpose in business operations.

The difference between a limited company and an LLC lies in their formation and regulatory requirements. A limited company could be a corporation with shareholders whereas an LLC is typically less formal with fewer regulations. Both offer limited liability, but an LLC allows for more operational flexibility. By understanding the limited company meaning, entrepreneurs can select the most beneficial structure for their business.

The difference between LLC and limited often confuses many. An LLC, or Limited Liability Company, provides personal liability protection while allowing flexibility in management and taxation. On the other hand, a limited company can refer to any incorporation where stock investors have limited liability. Knowing these distinctions helps business owners choose the best structure for their goals.