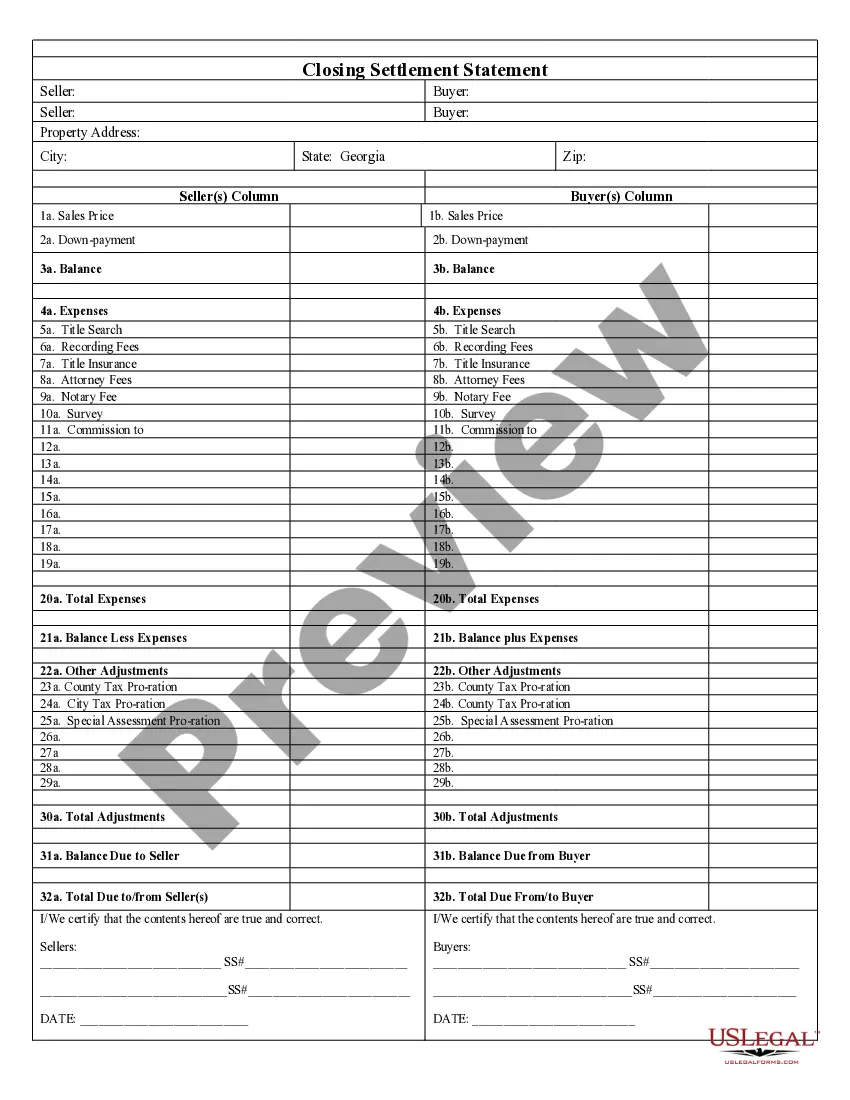

Closing Georgia Withholding Account

Description

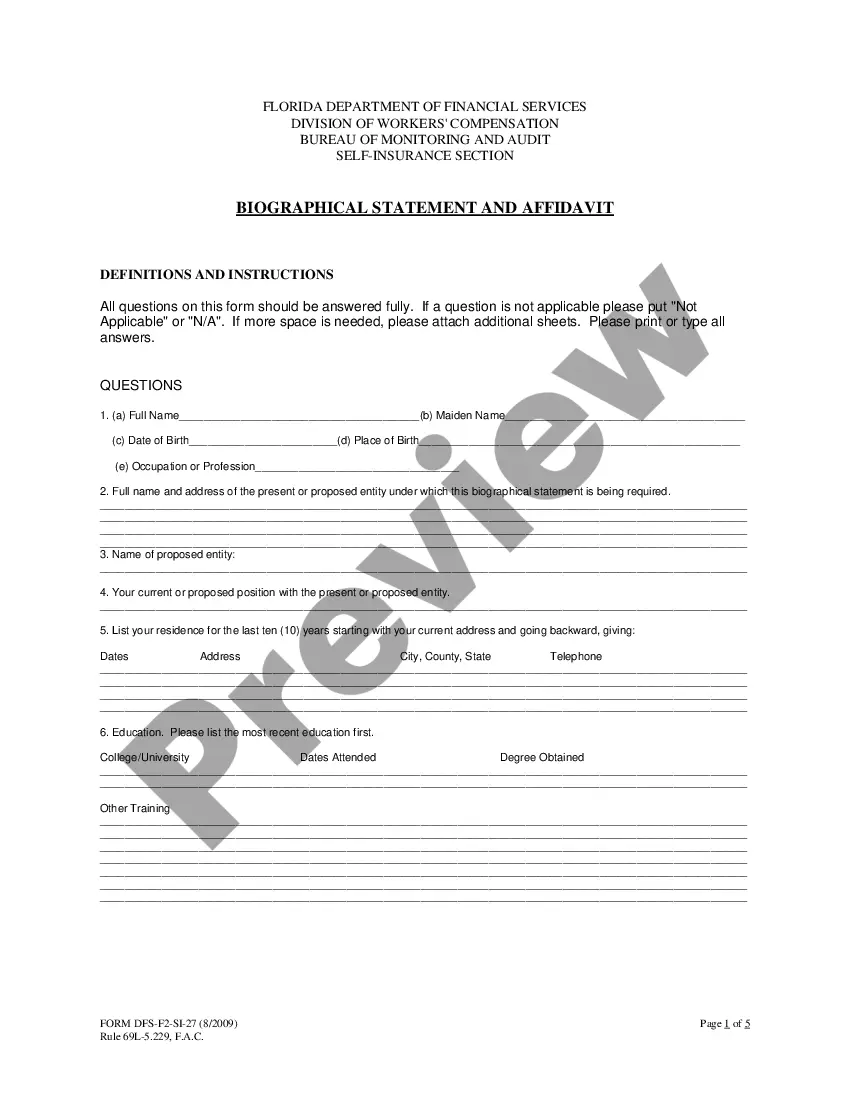

How to fill out Georgia Closing Statement?

Creating legal documents from the beginning can frequently feel somewhat daunting. Certain situations may require extensive research and significant financial investment.

If you are seeking a simpler and more economical method of preparing the Closing Georgia Withholding Account or any other documentation without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-specific templates meticulously crafted for you by our legal professionals.

Utilize our platform whenever you need dependable services through which you can effortlessly locate and download the Closing Georgia Withholding Account. If you are familiar with our site and have previously registered an account with us, simply Log In to your account, choose the template, and download it or re-download it at any time later in the My documents section.

Choose the most suitable subscription plan to acquire the Closing Georgia Withholding Account. Download the file, then complete, validate, and print it. US Legal Forms has a strong reputation and over 25 years of expertise. Join us now and make document completion simple and efficient!

- Don’t have an account? No worries. It requires minimal time to create one and explore the library.

- But before proceeding to download the Closing Georgia Withholding Account, adhere to these suggestions.

- Examine the document preview and descriptions to confirm that you are on the correct form.

- Ensure that the template you select meets the criteria of your state and county.

Form popularity

FAQ

The production company or qualified interactive entertainment production company (or their payroll service providers) shall withhold Georgia Income Tax at the rate of 5.75 percent on all payments to loan-out companies for services performed in Georgia.

To get your Georgia Withholding Number, register for an account with the Georgia Department of Revenue. You will receive your nine-character Withholding Number (0000000-XX; first seven characters are digits, the last two are letters) once you complete the registration process.

Withholding Formula (Residents) (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Georgia Tax Withholding Should Be:Over $0 but not over $5001.0%Over $500 but not over $1,500$5.00 plus 2.0% of excess over $500Over $1,500 but not over $2,500$25.00 plus 3.0% of excess over $1,5003 more rows ?

Withholding Formula (Residents) (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Georgia Tax Withholding Should Be:Over $0 but not over $5001.0%Over $500 but not over $1,500$5.00 plus 2.0% of excess over $500Over $1,500 but not over $2,500$25.00 plus 3.0% of excess over $1,5003 more rows ?

Section 48-7-128 generally requires that 3 percent of the purchase price be withheld. However, if the gain recognized on the sale is less than the purchase price, and the seller provides the buyer with an affidavit of gain (see form IT-AFF2), then the buyer may withhold 3 percent of the amount of the gain.