Ga Deed Georgia Form Ga-v

Description

How to fill out Georgia Executor's Deed?

Creating legal documents from the beginning can occasionally be overwhelming. Some situations may demand extensive research and significant expenses.

If you're looking for a simpler and more cost-effective method of preparing Ga Deed Georgia Form Ga-v or any other documents without unnecessary complications, US Legal Forms is readily accessible.

Our online collection of more than 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-specific templates meticulously crafted by our legal professionals.

Utilize our platform whenever you require dependable and trustworthy services through which you can effortlessly locate and download the Ga Deed Georgia Form Ga-v. If you’re already familiar with our services and have previously registered with us, simply Log In to your account, select the template, and download it or re-download it anytime in the My documents section.

Ensure the form you select complies with the rules and regulations of your state and county. Select the appropriate subscription plan to purchase the Ga Deed Georgia Form Ga-v. Download the form, then complete, sign, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and simplify the document completion process!

- Don’t have an account? No issue.

- Setting it up takes minimal time and allows you to explore the library.

- Before directly downloading Ga Deed Georgia Form Ga-v, adhere to these guidelines.

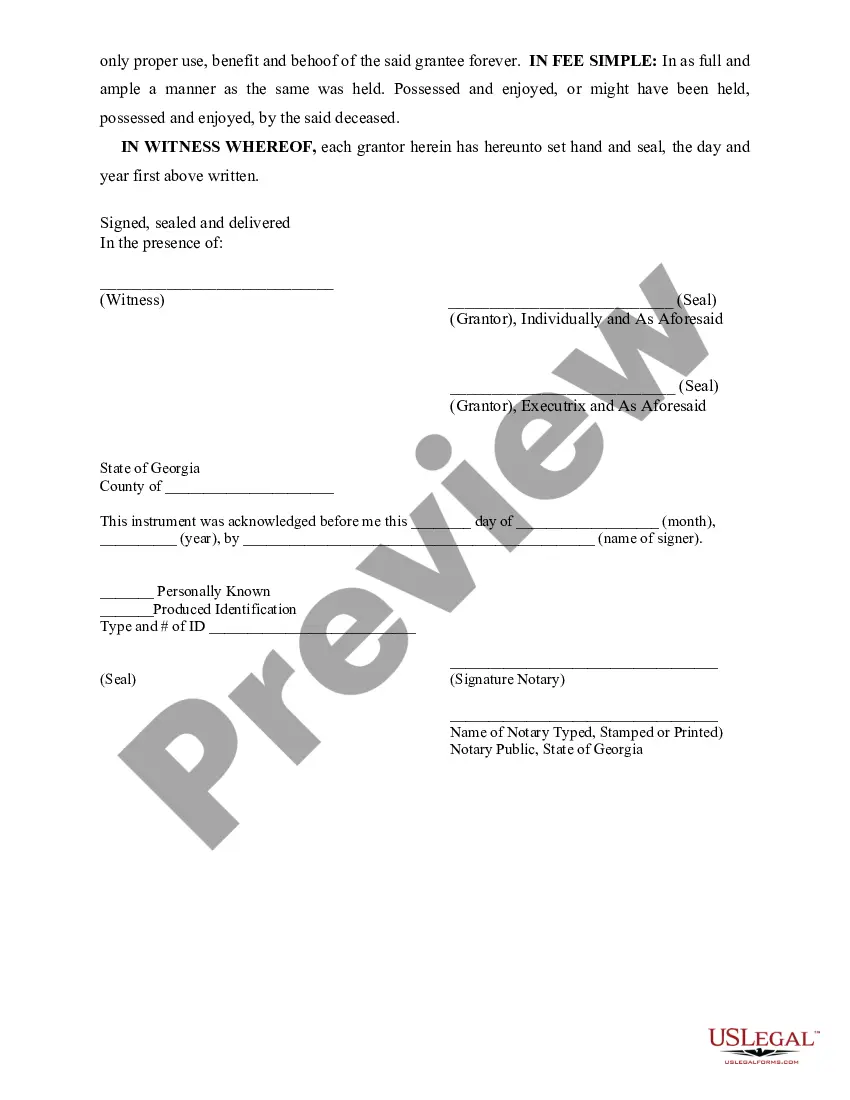

- Review the document preview and descriptions to confirm that you have located the form you seek.

Form popularity

FAQ

Georgia form 525 TV is used for reporting the tax on tangible personal property. This form is essential for individuals and businesses that own property subject to state taxation. By accurately completing this form, you can ensure compliance with Georgia tax laws. If you need help with related documents, the Ga deed georgia form ga-v can serve as a valuable resource.

When filing a Georgia tax return, you typically need to include forms such as the Georgia form 500, along with any relevant schedules and supporting documentation. This may include income statements, W-2s, and any additional forms that relate to deductions or credits. Make sure to check for any specific requirements based on your individual tax situation. For assistance with all necessary forms, including the Ga deed georgia form ga-v, consider using a reliable platform like uslegalforms.

Georgia form 500 Nol is a tax form used for reporting net operating losses in the state. This form allows taxpayers to claim deductions for losses that can offset future taxable income. By using this form, you can potentially lower your tax liability in subsequent years. To understand more about your options, consider exploring the Ga deed georgia form ga-v for comprehensive legal documentation.

A Georgia withholding ID is typically a nine-digit identification number assigned to businesses for tax withholding purposes. This number is crucial for employers when filing tax returns and making payments. To ensure you have the correct format for your Georgia withholding ID, you can explore the resources available on the US Legal Forms platform, which can simplify your tax compliance.

Filling out your Georgia G4 data involves providing your personal details, such as your name, address, and Social Security number. You will also need to indicate your filing status and the number of allowances you wish to claim. If you want guidance on completing this form accurately, the US Legal Forms platform offers resources and templates that can assist you in navigating the process.

The 525 TV payment voucher is a form used for remitting Georgia state taxes when filing certain tax returns. It helps taxpayers ensure that their payments are properly credited to their accounts. If you are looking for an efficient way to handle your tax obligations, consider using the US Legal Forms platform to obtain the correct version of the 525 TV payment voucher.

For Georgia state tax withholding, you will need to use the Georgia Form G4. This form is essential for employers to determine the amount of state tax to withhold from employees’ paychecks. You can find the Georgia Form G4 easily on the US Legal Forms platform, which provides a straightforward way to access and complete the necessary paperwork.