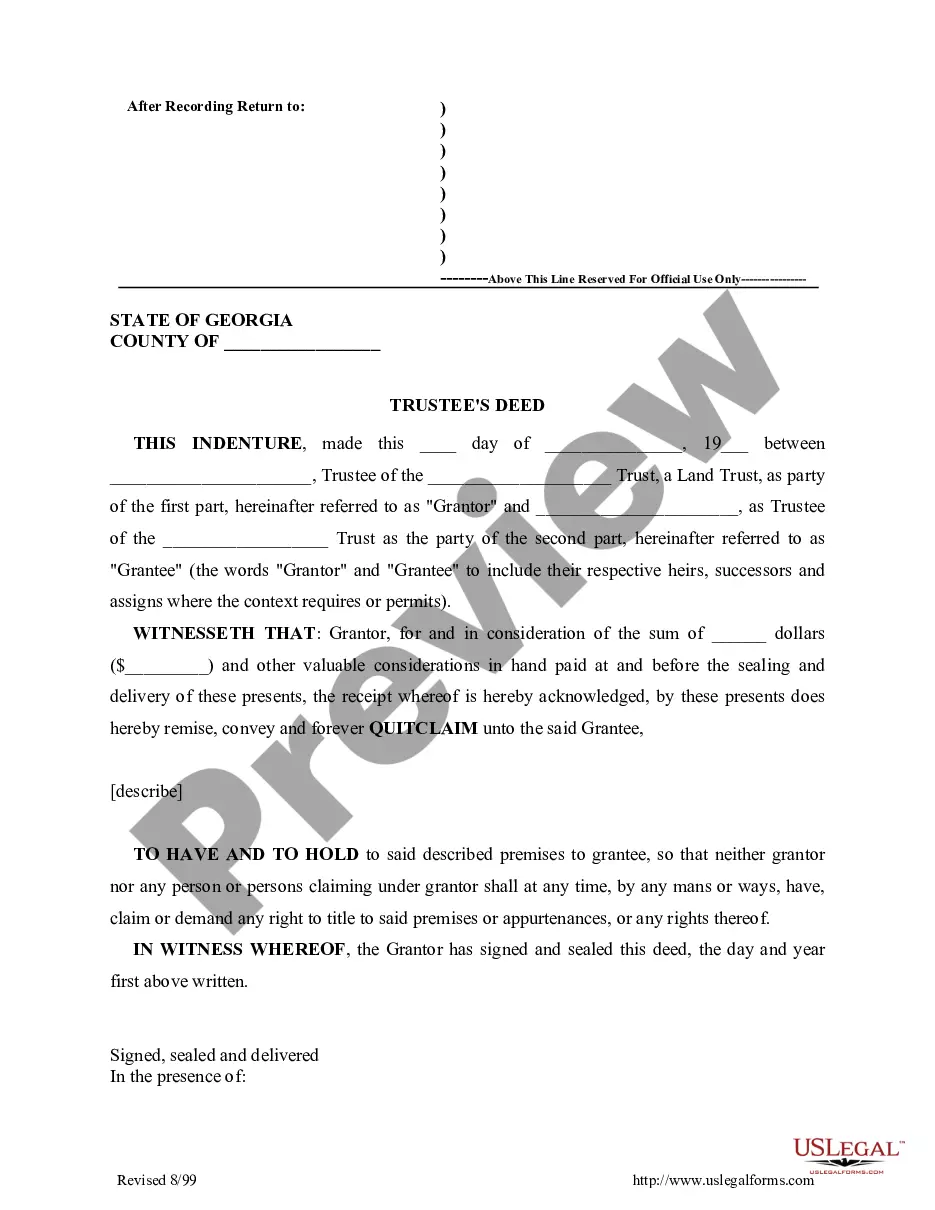

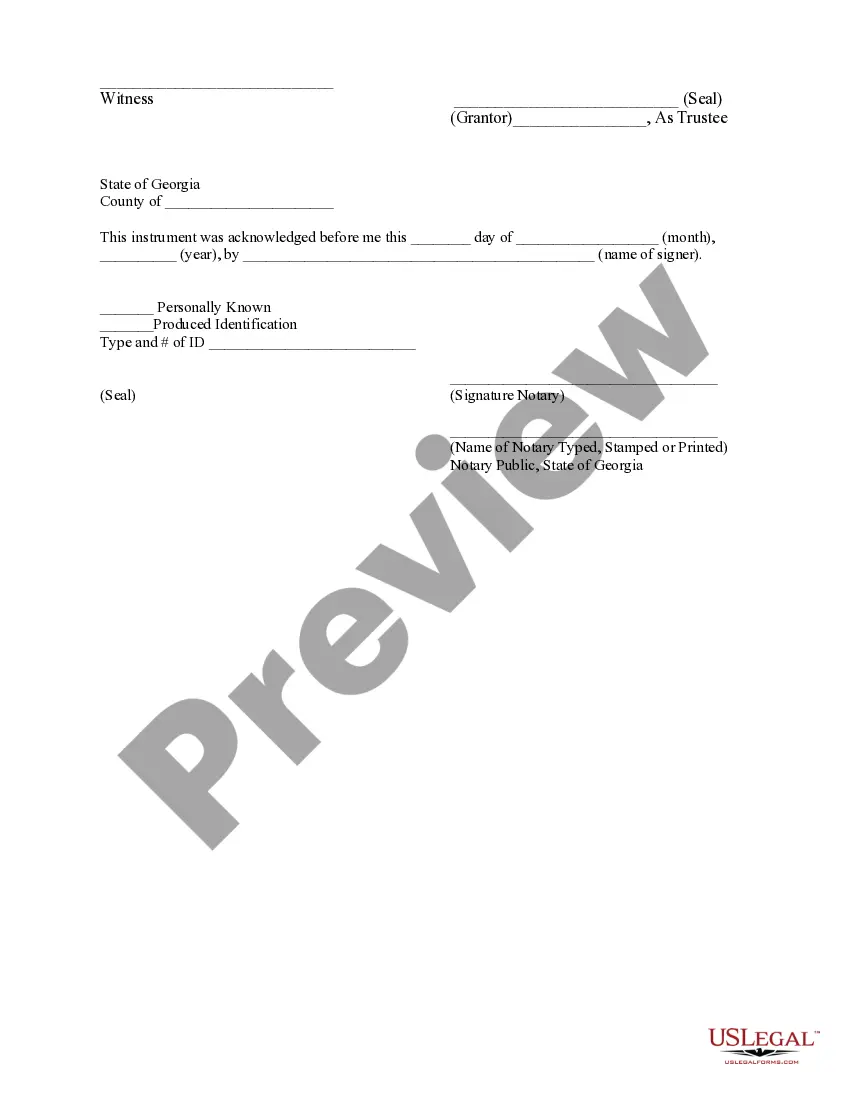

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Trustee's Deed, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. GA-A2003

Trustee Deed Of Cross Guarantee

Description

How to fill out Trustee Deed Of Cross Guarantee?

What is the most dependable service to acquire the Trustee Deed Of Cross Guarantee and other updated iterations of legal paperwork.

US Legal Forms is the solution! It boasts the largest repository of legal documents for every situation.

If you haven't yet created an account with our library, follow these steps to get started: Form compliance review. Before obtaining any template, ensure it aligns with your use case requirements and complies with your state or county regulations. Review the form details and utilize the Preview option if available. Alternative document search. If there are any discrepancies, use the search bar in the page header to locate a different template. Click Buy Now to choose the right one. Account registration and subscription acquisition. Select the most appropriate pricing plan, Log In, or create your account, and purchase your subscription via PayPal or credit card. Downloading the document. Choose your desired format for saving the Trustee Deed Of Cross Guarantee (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an excellent option for anyone needing assistance with legal documentation. Premium users can enjoy additional benefits as they fill out and sign previously saved documents electronically at any time using the integrated PDF editing tool. Explore it today!

- Each template is meticulously drafted and verified for adherence to federal and local regulations.

- They are organized by category and region of application, making it simple to find the one you require.

- Experienced platform users only need to Log In to the system, verify their subscription status, and press the Download button next to the Trustee Deed Of Cross Guarantee to access it.

- Once saved, the template is accessible for future use in the My documents section of your account.

Form popularity

FAQ

The 2016 785 instrument refers to specific documentation used in the context of the trustee deed of cross guarantee. This instrument essentially establishes a guarantee by one entity for the obligations of another, protecting lenders in the process. Understanding this instrument is crucial, as it ensures that security interests are properly documented and any liabilities are clearly addressed. By utilizing platforms like USLegalForms, you can easily generate and manage these important documents to facilitate a smooth transaction.

A Deed of guarantee is a legal document wherein one party agrees to take responsibility for the debt or obligations of another party. In essence, it acts as a safety net that lenders can rely on for repayment assurance. By implementing a Trustee deed of cross guarantee, you create a robust framework that not only protects lenders but also reinforces trust in business relationships. This ensures that commitments are fulfilled, creating a win-win situation for all parties involved.

The ASIC instrument 2016 785 is a regulatory guideline that outlines the requirements for registrar actions related to cross guarantees in Australia. This instrument ensures that companies adhering to a trustee deed of cross guarantee comply with legal standards, providing transparency and protection. Familiarity with this instrument is beneficial for companies looking to implement a cross guarantee structure with confidence.

The key difference between a guarantee and a cross guarantee lies in the number of parties involved. A guarantee typically involves one party backing another's debt, while a cross guarantee involves multiple parties supporting each other's obligations. In a trustee deed of cross guarantee, this multi-faceted support creates a more robust safety net that can significantly reduce financial risk.

A deed of guarantee is a legal commitment where one party agrees to fulfill another party’s obligation if they fail to do so. This document ensures that creditors have recourse to more than one entity, reducing their risk. Understanding this term is crucial when dealing with agreements like the trustee deed of cross guarantee, as it underpins the mutual support between group companies.

The deed of cross guarantee is a framework that allows related companies to share financial responsibilities. By signing this deed, each entity provides guarantees for the debts of others, enhancing group solvency. As a result, companies can better manage their risks, improve their borrowing capabilities, and streamline their financial processes.

The purpose of a cross guarantee is to enhance the financial standing of entities within a group by providing mutual assurance against default. In a trustee deed of cross guarantee, companies support each other’s liabilities, which can make borrowing easier and cheaper. This collaborative approach fosters trust among group members and can lead to more stable financial outcomes.

A deed of cross guarantee is a legal document that provides a financial safety net between subsidiaries within a corporate group. With this deed, each company agrees to back the debts incurred by other members, enhancing creditworthiness. This structure creates a sense of security for lenders and investors, facilitating more straightforward access to funding.

The extended closed group in the trustee deed of cross guarantee refers to a specific set of entities that are included under this legal structure. This arrangement is beneficial for managing and consolidating guarantees among various group members. By defining this group clearly, all parties understand their obligations and responsibilities, ensuring smoother operations and reducing risks.

A cross guarantee deed is a legal arrangement whereby two or more companies guarantee each other's debts and obligations. This deed fosters mutual support among corporate entities, enhancing their financial stability and lending power. By implementing a trustee deed of cross guarantee, businesses can protect themselves and bolster their creditworthiness, vital for fostering investor trust and facilitating growth.