Name Change Form For Property Tax

Description

Form popularity

FAQ

You can check property ownership online in Andhra Pradesh by visiting the respective government portal. Input the appropriate details, such as the survey number or address of the property. This process gives you instant access to ownership records, which can be essential, especially when dealing with a name change form for property tax. Staying updated on ownership details ensures all records are correct and current.

To apply for mutation of property online in Andhra Pradesh, you will need to access the official revenue department website. Fill out the required forms and upload necessary documents, including your name change form for property tax. Make sure all information is accurate to prevent any delays in the process. This online application simplifies the procedure significantly for property owners.

An unauthorized penalty in property tax generally refers to fines imposed on property owners for failing to comply with tax regulations. In Andhra Pradesh, this can occur if property owners do not update their information, like the name change for property tax, within the required time frame. Understanding these penalties helps you avoid unexpected charges. Always stay informed about your property’s compliance status.

To check your AP property tax, visit the official Andhra Pradesh government website. You can navigate to the property tax section and enter your property details. This will provide you with the necessary information, including any outstanding tax amounts. If you’re undergoing a name change for property tax, it's important to ensure your records reflect your current details.

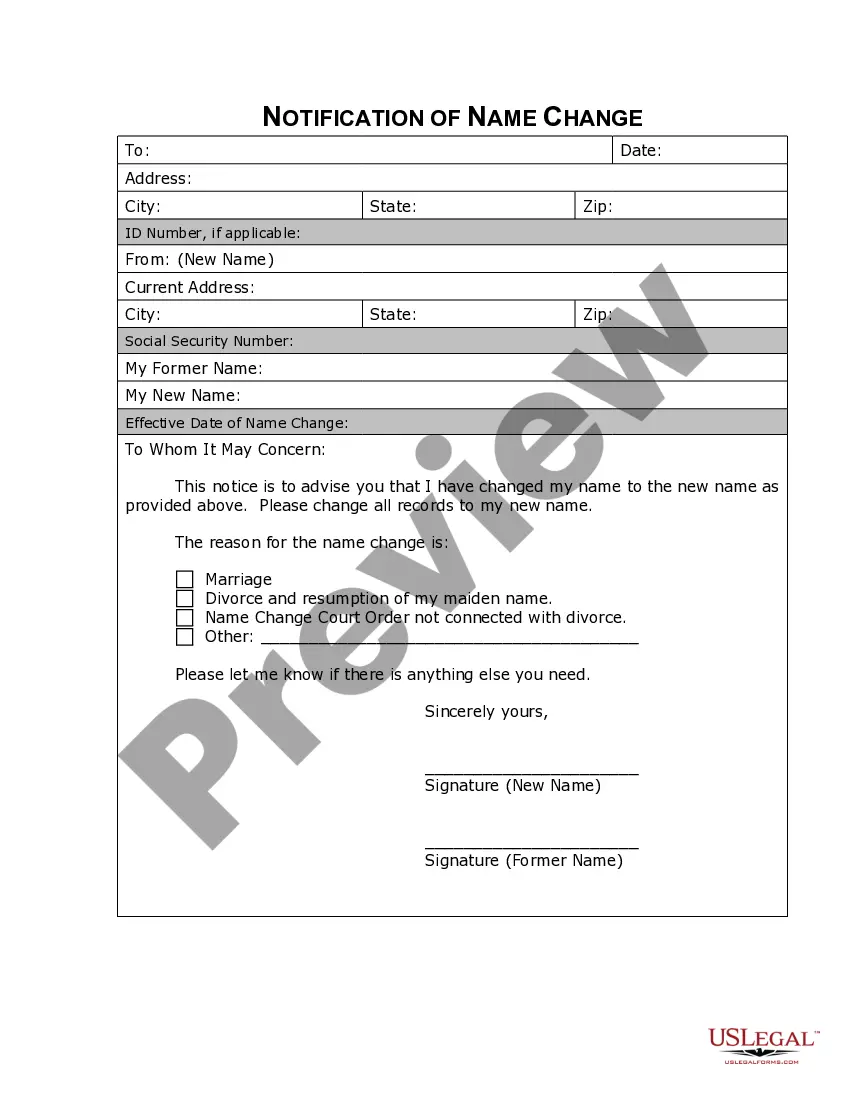

To change the name on a deed in New York, you will need to complete a name change form for property tax. First, gather all necessary documents, including the current deed and proof of the name change, such as a marriage certificate or court order. Next, fill out the appropriate forms, and then file them with the county clerk's office where the property is located. Using a reliable platform like US Legal Forms can streamline this process, ensuring you have the correct forms and instructions.

To download your land tax receipt from Kerala, visit the official website of the local revenue department. Often, there is an option to access property tax receipts using your property details. This digital service makes it convenient for you to obtain necessary documents.

Changing your house name in Kerala involves filling out the name change form for property tax. You will need to file this form at your local municipality office, accompanied by relevant documents that establish your identity and ownership. Proper completion of the form ensures that your request is processed correctly.

To change ownership of a house in a Kerala municipality, you need to submit the name change form for property tax. This form helps local authorities amend the ownership records. Remember to include supporting documents that verify your ownership transfer.

In Delhi, to change your name in property tax online, go to the official government website. Look for the name change form for property tax and fill it out carefully. Submitting your application electronically can save time and expedite the update process.

You can change your name in property tax online in Kerala by accessing the local revenue department's official portal. Locate the name change form for property tax and complete it with accurate details. Ensure you upload any necessary documents to facilitate your request.