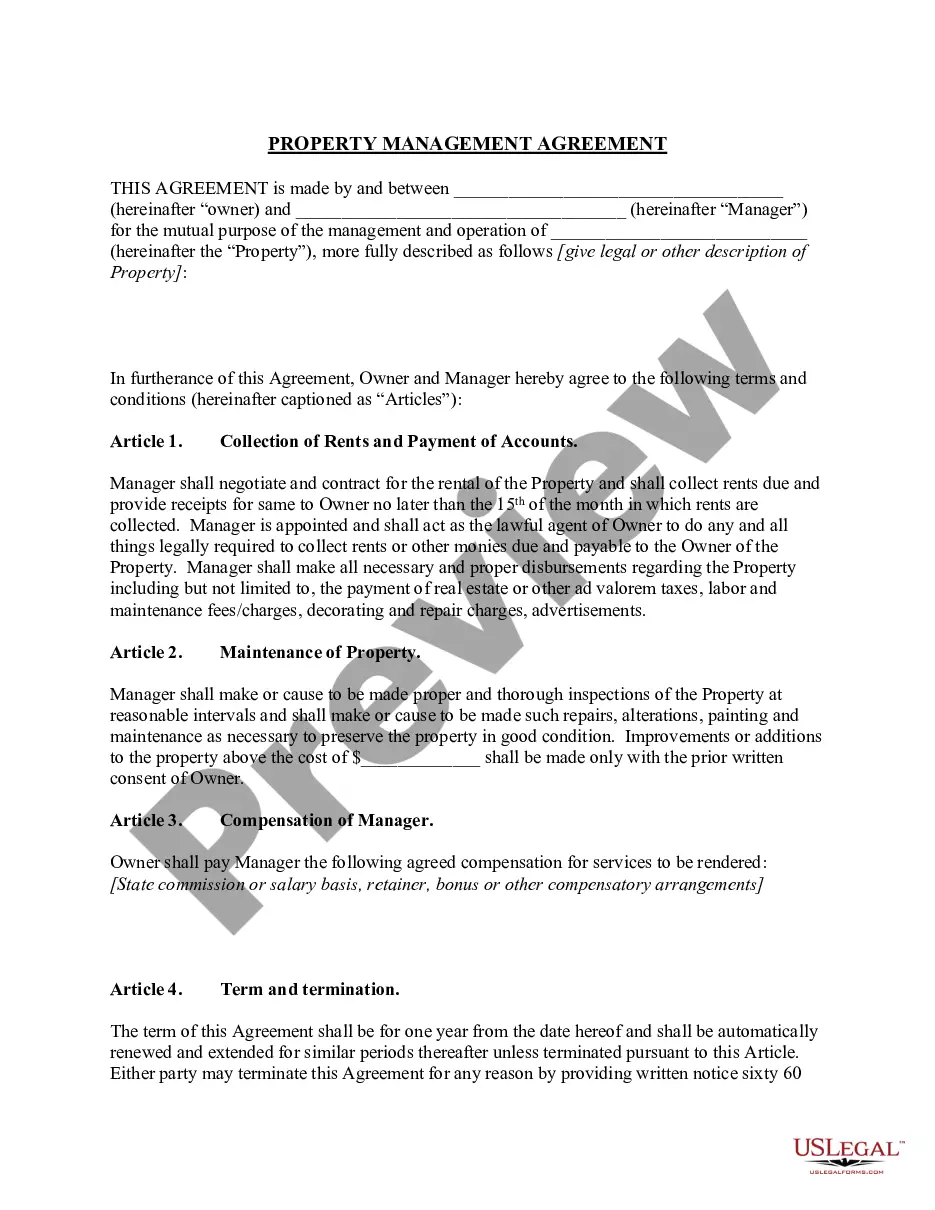

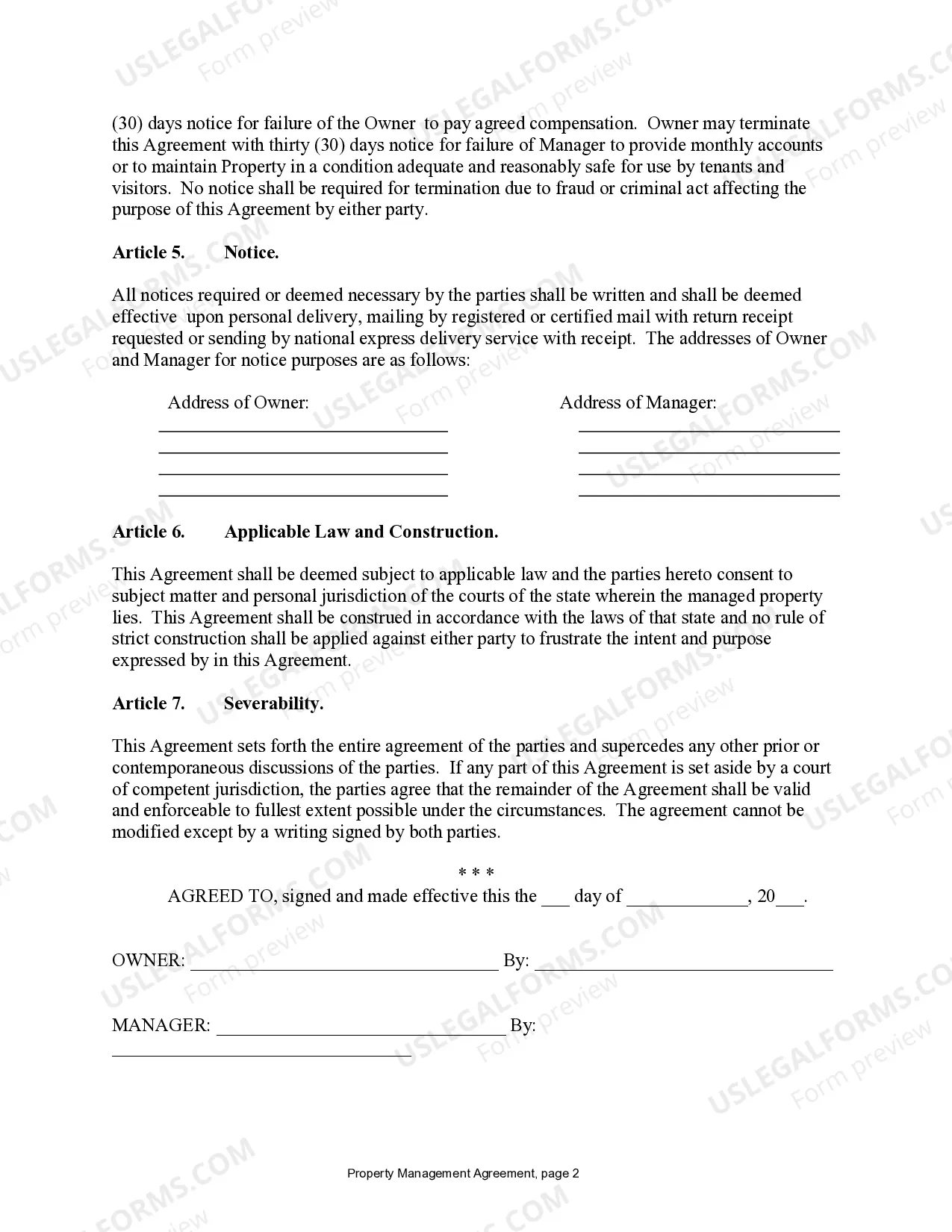

This Property Manager Agreement is an employment contract. A Property Manager Agreement is a contract containing terms and conditions of employment of property manager by owner of rental property. This form is compliant with state statutory law.

Property Management With No Credit Check

Description

How to fill out Property Management With No Credit Check?

When you need to finalize Property Management With No Credit Check that aligns with your local state's rules, there can be various options to choose from.

There's no need to scrutinize every form to verify it fulfills all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any subject.

Using the Preview mode and reviewing the form description if available. Locate another template via the Search bar in the header if necessary. Click Buy Now when you discover the appropriate Property Management With No Credit Check. Choose the most suitable subscription plan, Log In to your account, or create a new one. Make a payment for a subscription (PayPal and card options are available). Download the template in your preferred format (PDF or DOCX). Print the document or fill it out electronically using an online editor. Acquiring professionally crafted formal documents becomes effortless with US Legal Forms. Additionally, Premium users can also benefit from the robust integrated solutions for online PDF editing and signing. Experience it today!

- US Legal Forms is the most extensive online repository with a collection of over 85,000 ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's rules.

- Therefore, when downloading Property Management With No Credit Check from our platform, you can be confident that you possess a legitimate and current document.

- Acquiring the necessary template from our system is exceptionally straightforward.

- If you already have an account, simply Log In to the system, confirm your subscription is active, and save the selected file.

- In the future, you can visit the My documents tab in your profile and retain access to the Property Management With No Credit Check at any time.

- If this is your first encounter with our website, please follow the below instructions.

- Browse the suggested page and verify it for compliance with your needs.

Form popularity

FAQ

To split rent evenly among three people, first determine the total rent amount and divide it by three. Each person’s share can then be calculated to ensure fairness and transparency. If your landlord requires payment in one transaction, consider using property management with no credit check services that may assist with collective rental agreements. This strategy can simplify the payment process while accommodating all parties involved.

If you are struggling to meet the three times the rent requirement, consider exploring property management with no credit check options. These services may offer flexible leasing terms that allow you to qualify based on your income and rental history rather than your credit score. You can also look into co-signers or roommates to help share the financial burden. This approach creates more opportunities for secure housing while bypassing traditional credit requirements.

When managing properties with no credit check, it is crucial to understand that there is no universal minimum credit score that landlords should accept. It often depends on various factors like rental history, income stability, and job security. Many landlords find it beneficial to evaluate a tenant's overall financial responsibility rather than focusing solely on a credit score. Utilizing property management with no credit check can also help landlords consider alternative indicators of reliability.

The lowest credit score a landlord will accept can vary significantly, but many will consider scores starting at 500. Some landlords utilize property management with no credit check practices to ensure fair handling of applicants with lower scores. Being honest about your financial situation can lead to understanding and potential solutions. Always communicate openly with your landlord about your qualifications.

A 570 credit score is considered poor, which may limit your options in securing financing or rental agreements. However, with property management with no credit check services, you may find landlords ready to overlook this score. It's beneficial to improve your score through timely payments and managed debt. Doing so can open more doors for rental opportunities in the future.

Generally, the minimum credit score to rent a property is around 580, though it often depends on the individual landlord's policies. Some landlords might conduct property management with no credit check, allowing individuals with lower scores a chance to secure a rental. When applying, remember to highlight your rental history and income. This demonstrates reliability and can help offset credit concerns.

Most landlords prefer a credit score of at least 620. However, many recognize that life circumstances can affect this number and may offer flexibility. In the world of property management with no credit check, landlords can still provide fair opportunities to potential tenants, helping them find suitable housing despite a lower score. Always check with your prospective landlord for their specific criteria.

The minimum credit score to buy a house typically starts around 620 for conventional loans. However, various lenders may offer options with lower scores, especially with programs designed for property management with no credit check. Understanding your financial situation is crucial before pursuing home ownership. You can consider working with a lender who specializes in unique financing solutions.