Mortgage For Contract Employees

Description

How to fill out Georgia Subordination Agreement Of Mortgage?

Regardless of whether you handle documents often or need to file a legal report occasionally, it is essential to have a resource where all examples are pertinent and current.

One thing you must do with a Mortgage For Contract Workers is to ensure that it is the latest edition, as it determines whether it can be submitted.

If you wish to streamline your quest for the most recent document samples, seek them on US Legal Forms.

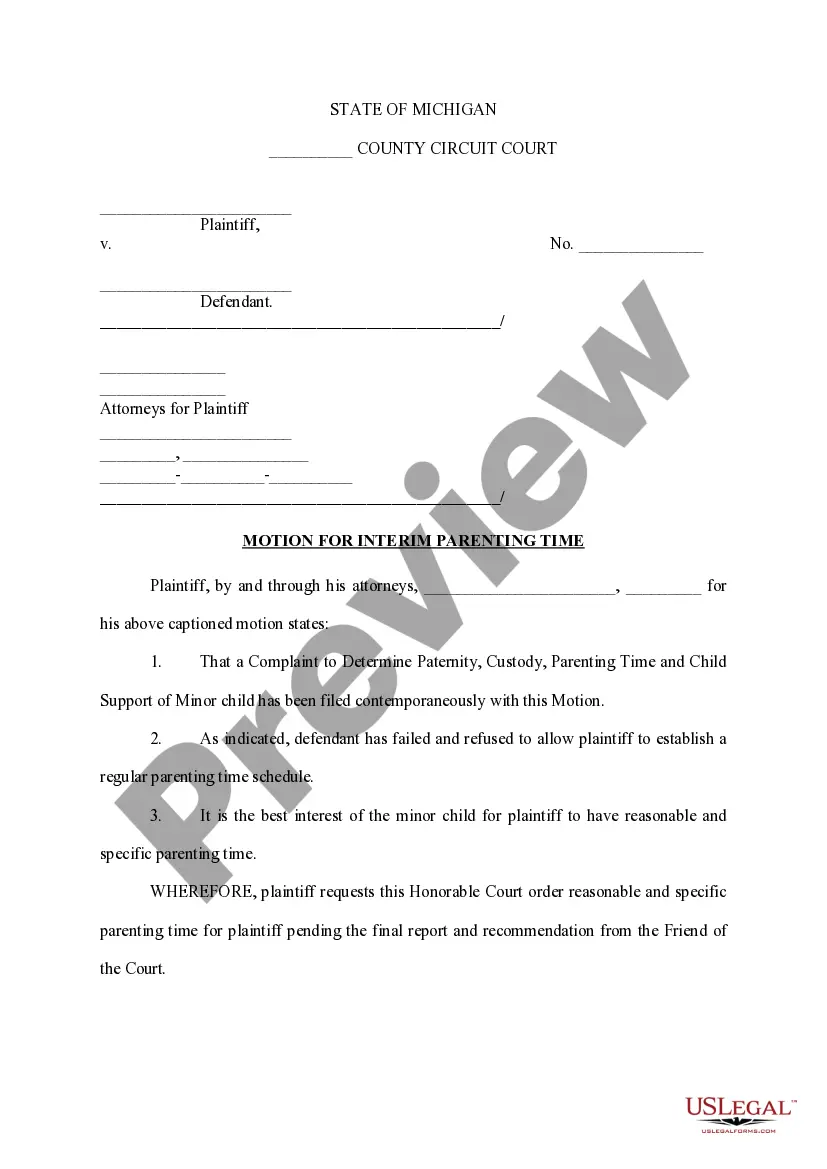

To acquire a form without an account, follow these instructions: Use the search option to locate the form you desire. Examine the Mortgage For Contract Workers preview and outline to confirm it is precisely what you need. After verifying the form, simply click Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Provide your credit card details or PayPal account to complete the transaction. Select the file format for download and confirm it. Eliminate the confusion associated with legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a directory of legal documents that includes nearly any sample you may need.

- Look for the templates you need, assess their relevance immediately, and discover more about their application.

- With US Legal Forms, you can access over 85,000 document templates across various fields.

- Find the Mortgage For Contract Workers samples in just a few clicks and save them at any time to your account.

- A US Legal Forms account will enable you to access all the samples you need with ease and minimal effort.

- Just click Log In in the site header and navigate to the My documents section where all your required documents will be available. You won’t have to spend time searching for the right template or verifying its authenticity.

Form popularity

FAQ

Yes, you can get a mortgage if you're self-employed. In general, you'll need to prove two years of income history from your self-employment with tax returns.

Yes, self-employed workers have more paperwork involved in the mortgage application procedure. But that doesn't mean you won't get approved for the mortgage you need. Your income may also be a little lower, but lenders look at your net income (income after expenses) to determine whether you are eligible for a mortgage.

Her experience is that you can get approved if you can show at least two years of consistent tax returns and your last two months of income are consistent with the returns. According to Caprio, freelancers shouldn't have problems getting approved for a mortgage as long as their income has been fairly consistent for

Lenders much prefer applicants who have worked at one salaried job for at least two years, even if your annual income is just as high. It's frustrating trying to get a home loan as a contractor, but lenders have to make sure that you'll be able to pay them back.

If you have a with W2 and you also make 1099 income, then you can combine the two to qualify for your mortgage. FHA lenders will ask for you to completely document all of it to qualify.