Mortgage Contract In Law

Description

How to fill out Georgia Subordination Agreement Of Mortgage?

There's no longer a need to waste time searching for legal documents to meet your local state obligations.

US Legal Forms has gathered all of them in one place and made their accessibility smoother.

Our site provides over 85k templates for any business and personal legal matters organized by state and application area.

Use the search field above to look for another template if the previous one didn't meet your needs. Click Buy Now beside the template title once you identify the right one. Choose the most appropriate pricing plan and create an account or Log In. Make a payment for your subscription using a card or PayPal to continue. Select the file format for your Mortgage Contract In Law and download it to your device. You can either print your form to fill it out manually or upload the sample if you'd rather use an online editor. Completing official documents in line with federal and state rules is fast and straightforward with our platform. Try US Legal Forms now to maintain your documentation in order!

- All forms are expertly drafted and verified for accuracy, so you can feel assured in obtaining a current Mortgage Contract In Law.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents whenever necessary by navigating to the My documents section in your profile.

- If you're encountering our service for the first time, the process will require a few more steps to finalize.

- Here's how new users can find the Mortgage Contract In Law within our collection.

- Carefully read the page content to confirm it includes the sample you need.

- To do this, utilize the form description and preview options when available.

Form popularity

FAQ

The time it takes to obtain a mortgage contract in law can vary based on several factors. Typically, it can take anywhere from a few weeks to several months, depending on the lender's process and your financial situation. Factors such as credit history and necessary documentation can affect the timeline. Utilizing platforms like US Legal Forms can streamline the preparation of necessary documents and help expedite the process.

Yes, a mortgage is a legal contract in law that creates a security interest in real property. This contract holds both the borrower and lender accountable to the agreed-upon terms. It is enforceable in court, providing protection for both parties if disputes arise. Understanding the legal implications can clarify your responsibilities under this contract.

In the sale of a home, the mortgage contract in law is usually prepared by real estate attorneys or title companies. These professionals ensure that all legal requirements are met and that the terms are clearly stated. This preparation helps protect the interests of both the buyer and the seller during the transaction. Having experienced professionals involved can simplify the process significantly.

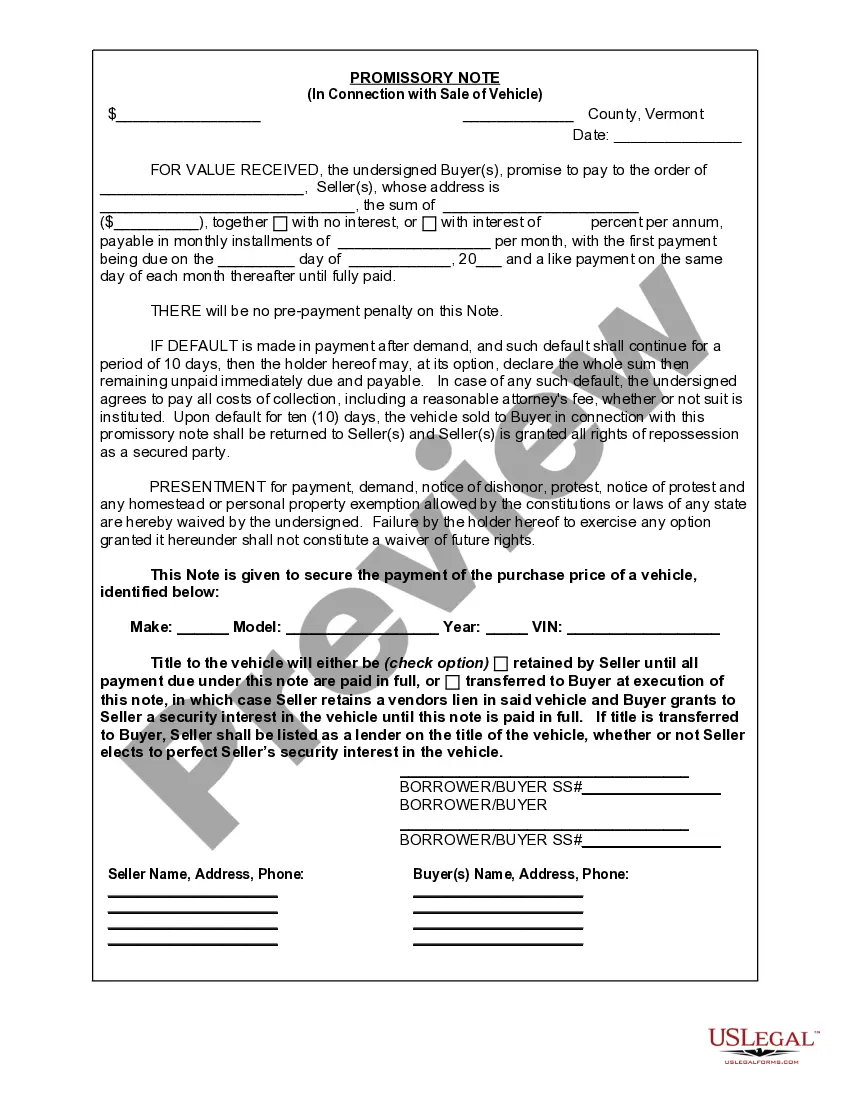

A mortgage contract in law may have limited enforceability without a promissory note. The promissory note serves as evidence of the debt and outlines the repayment terms. If a note is missing, it may complicate legal actions related to the mortgage, so it is essential to ensure both documents are in place.

Yes, you can write your own mortgage agreement. However, it is crucial to comply with state laws and regulations governing mortgage contracts in law. Writing your own agreement allows for customization, but consulting with a legal expert can help you avoid common pitfalls and ensure the document meets legal standards.

The mortgage contract in law that indicates a borrower's obligation is the mortgage deed. Once you sign this document, it legally binds you to the terms of your mortgage. It is important to fully understand your responsibilities outlined within this contract to avoid any future complications.

Yes, you can sue your mortgage company for breach of contract if they fail to uphold their part of the agreement outlined in the mortgage contract. Examples of breaches may include improper handling of payments or failure to provide required notices. However, it's advisable to consult a legal expert to evaluate your case and navigate the complexities involved.

You can back out of a mortgage contract, but the process may vary depending on the circumstances. Generally, if you decide before closing, you might be able to cancel without significant consequences. However, once the closing occurs, backing out can lead to financial losses or legal actions. It's essential to understand your rights under the mortgage contract in law.