This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed to Secure Debt with Power of Sale, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. GA-8206

Secured Debt Examples

Description

How to fill out Georgia Deed To Secure Debt With Power Of Sale?

Working with legal papers and procedures might be a time-consuming addition to your day. Secured Debt Examples and forms like it usually need you to search for them and navigate the way to complete them correctly. Therefore, whether you are taking care of economic, legal, or personal matters, having a thorough and convenient web library of forms at your fingertips will significantly help.

US Legal Forms is the best web platform of legal templates, boasting more than 85,000 state-specific forms and a variety of tools that will help you complete your papers easily. Explore the library of pertinent documents accessible to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered by any time for downloading. Shield your document management operations by using a high quality service that lets you put together any form within a few minutes without having extra or hidden cost. Simply log in in your profile, locate Secured Debt Examples and download it right away in the My Forms tab. You may also gain access to formerly saved forms.

Is it your first time using US Legal Forms? Sign up and set up up your account in a few minutes and you’ll have access to the form library and Secured Debt Examples. Then, follow the steps listed below to complete your form:

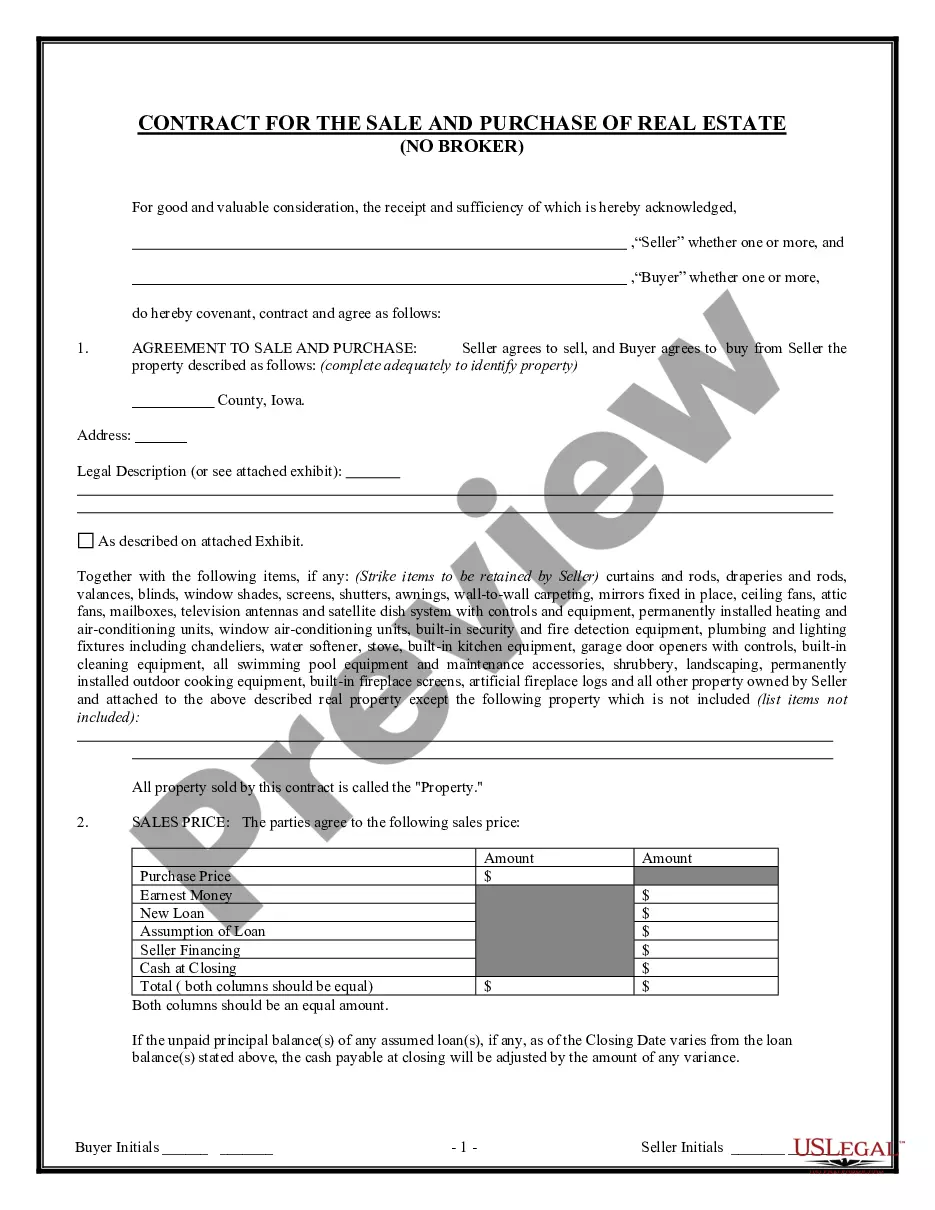

- Make sure you have found the proper form using the Review option and reading the form description.

- Select Buy Now as soon as all set, and choose the monthly subscription plan that fits your needs.

- Choose Download then complete, sign, and print the form.

US Legal Forms has 25 years of experience assisting consumers control their legal papers. Get the form you require right now and improve any process without having to break a sweat.

Form popularity

FAQ

Key Takeaways. Secured debt is debt that is backed by collateral to reduce the risk associated with lending. In the event a borrower defaults on their loan repayment, a bank can seize the collateral, sell it, and use the proceeds to pay back the debt.

A common example of a secured line of credit is a home mortgage or a car loan. When any loan is secured, the lender has established a lien against an asset that belongs to the borrower. With mortgages and car loans, the house or car can be seized and liquidated by the lender in the event of default.

Secured Debt Ratio means the quotient (expressed as a percentage) of (a) all Secured Debt divided by (b) Total Asset Value.

Examples of secured debt include homes loans and car loans. The loan is secured by the car or home, which means that the person you owe the debt to can repossess the car or foreclose on the home if you fail to pay the debt.

Examples of secured debt include mortgages, auto loans and secured credit cards. Unsecured debt doesn't require collateral. But missed unsecured debt payments or defaults can still have consequences. Examples of unsecured debt include student loans, personal loans and traditional credit cards.