This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed to Secure Debt with Power of Sale, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. GA-8206

Secure Debt Application With Collection Agency

Description

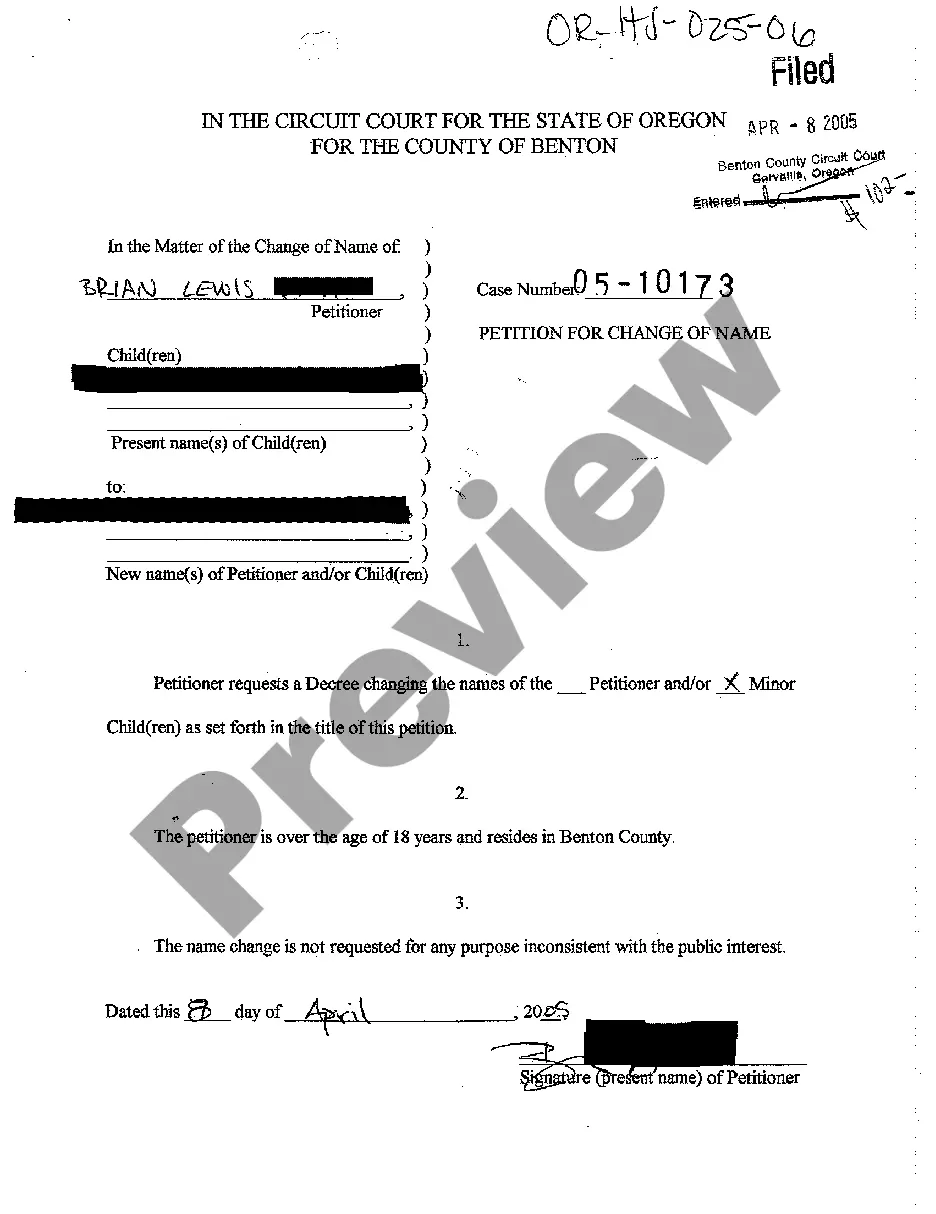

How to fill out Georgia Deed To Secure Debt With Power Of Sale?

- Log in to your US Legal Forms account if you're a returning user. Confirm your subscription is active; if it's not, renew it promptly.

- Examine the available templates in Preview mode. Make sure the selected form meets your requirements and complies with local jurisdiction norms.

- If you don't find the appropriate form, utilize the Search tool to find a more suitable template.

- Once you identify the right document, click the Buy Now button and choose a subscription plan that fits your needs. Note that you must register to gain access to the extensive library.

- Complete the payment process by entering your credit card details or using PayPal for your subscription.

- Finally, download the completed form to your device. You can always access this document under 'My Forms' in your profile for future reference.

By using US Legal Forms, you gain access to an extensive collection of over 85,000 legal documents, ensuring you can find exactly what you need. This service not only provides a diverse array of forms but also connects you with legal experts for any assistance required.

Streamline your legal document needs with US Legal Forms. Start your journey today and ensure your debt application is handled accurately and efficiently!

Form popularity

FAQ

To request debt validation, send a formal letter to the collection agency asking them to provide proof of the debt. Include your account details and a clear statement of your request. The agency is required to respond within 30 days, providing you with documentation supporting their claim. Utilizing a secure debt application with a collection agency can guide you through the validation process, ensuring you protect your rights effectively.

The 777 rule refers to a guideline that suggests debt collectors should cease their efforts after seven years. This duration is based on the time frame for credit reporting and how long negative marks can affect your credit report. Understanding this rule can be beneficial when dealing with debt collectors. To protect your rights, consider a secure debt application with a collection agency, which can help you navigate these situations.

Debts typically become uncollectible after a certain period, which varies by state. In most cases, this period lasts between three to six years. After this time, creditors may no longer pursue legal action to recover the debt. However, securing a debt application with a collection agency can provide insight into your options and help you manage outstanding debts effectively.

The best sample for a debt validation letter includes the date, your contact information, and a clear request for validation of the debt. It should state the debt amount and ask for comprehensive documentation to support the claim. You can use resources like USLegalForms to find templates that help you more effectively secure a debt application with a collection agency, ensuring all necessary information is captured.

You can ask a collection agency to validate the debt by formally requesting documentation of the amount owed. Use clear language in your communication, asserting your rights to verification. As part of this process, it's wise to mention your intention to secure a debt application with a collection agency, indicating you want transparency regarding the debt before proceeding.

When writing a debt validation letter to a collection agency, begin with a professional greeting and specify the debt in question. Include your contact information and request that they provide sufficient evidence of the debt’s validity. Remember to state that you wish to secure a debt application with the collection agency, ensuring they understand the importance of your request for accurate documentation.

To write a letter of debt validation, start by clearly stating your request for validation of the debt. Include your personal information, such as your name and address, along with the account details related to the debt. It’s also helpful to mention that you are looking to secure a debt application with a collection agency, emphasizing your right to verify the legitimacy of the debt before making any payments.

When dealing with a collection agency, it is crucial to protect your personal information. Avoid sharing sensitive details, such as your Social Security number, bank account information, or personal assets. Additionally, do not agree to payment plans without fully understanding your rights. A secure debt application with a collection agency should come with a clear understanding of what information to safeguard.

Debt collectors must adhere to strict rules that protect consumers. They are forbidden from using threats, contacting you at inconvenient times, or sharing your debt details without permission. They cannot harass you or mislead you about what they can do. Understanding these restrictions can guide you in choosing a secure debt application with a collection agency, ensuring your rights are upheld.

The best approach is to initiate negotiations by offering a lower amount than what you owe. Be clear about your financial limitations, and propose a secure debt application with a collection agency to streamline the process. Getting everything in writing is crucial; this ensures both parties are aware of the agreement. Take your time to review the terms before finalizing any settlement.