Georgia Property Inheritance Laws

Description

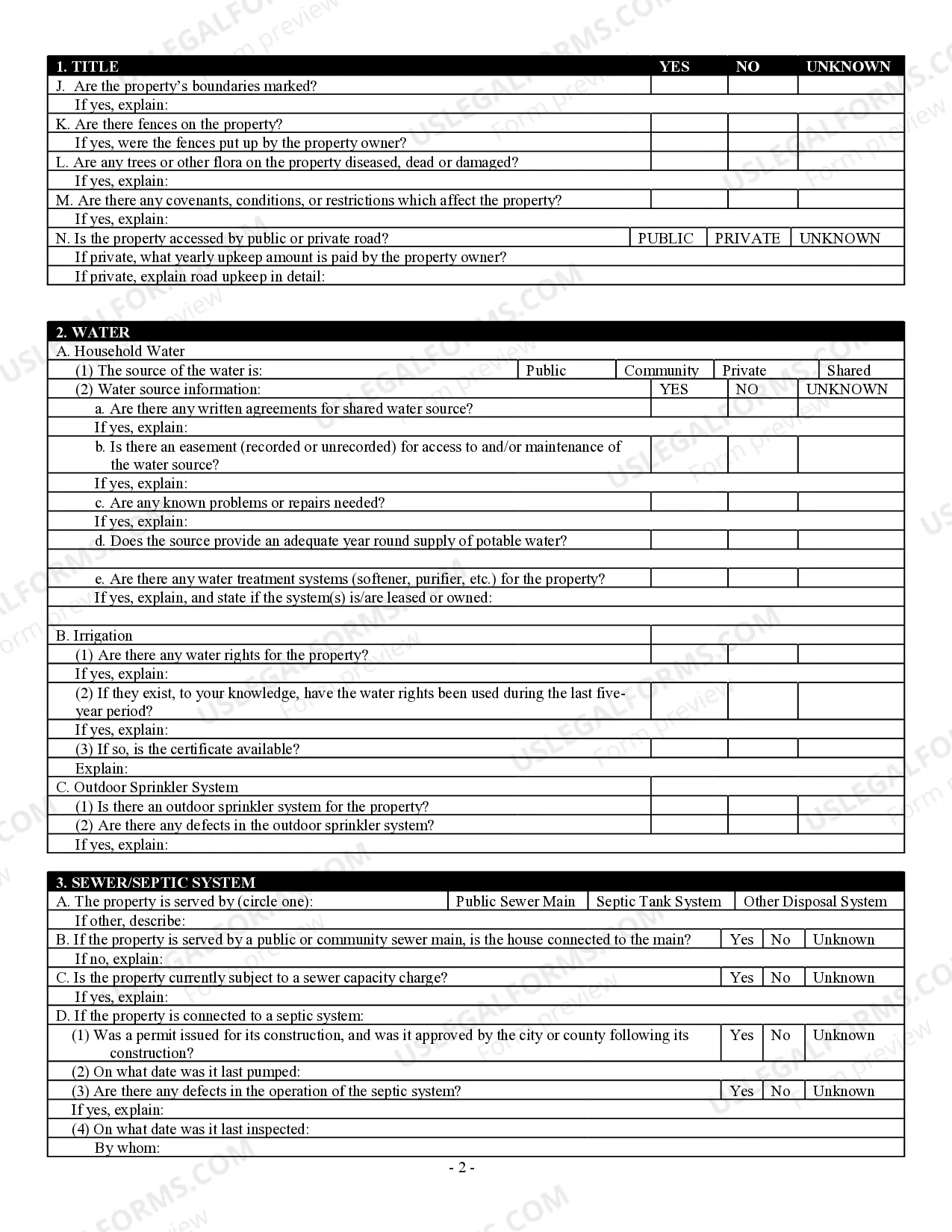

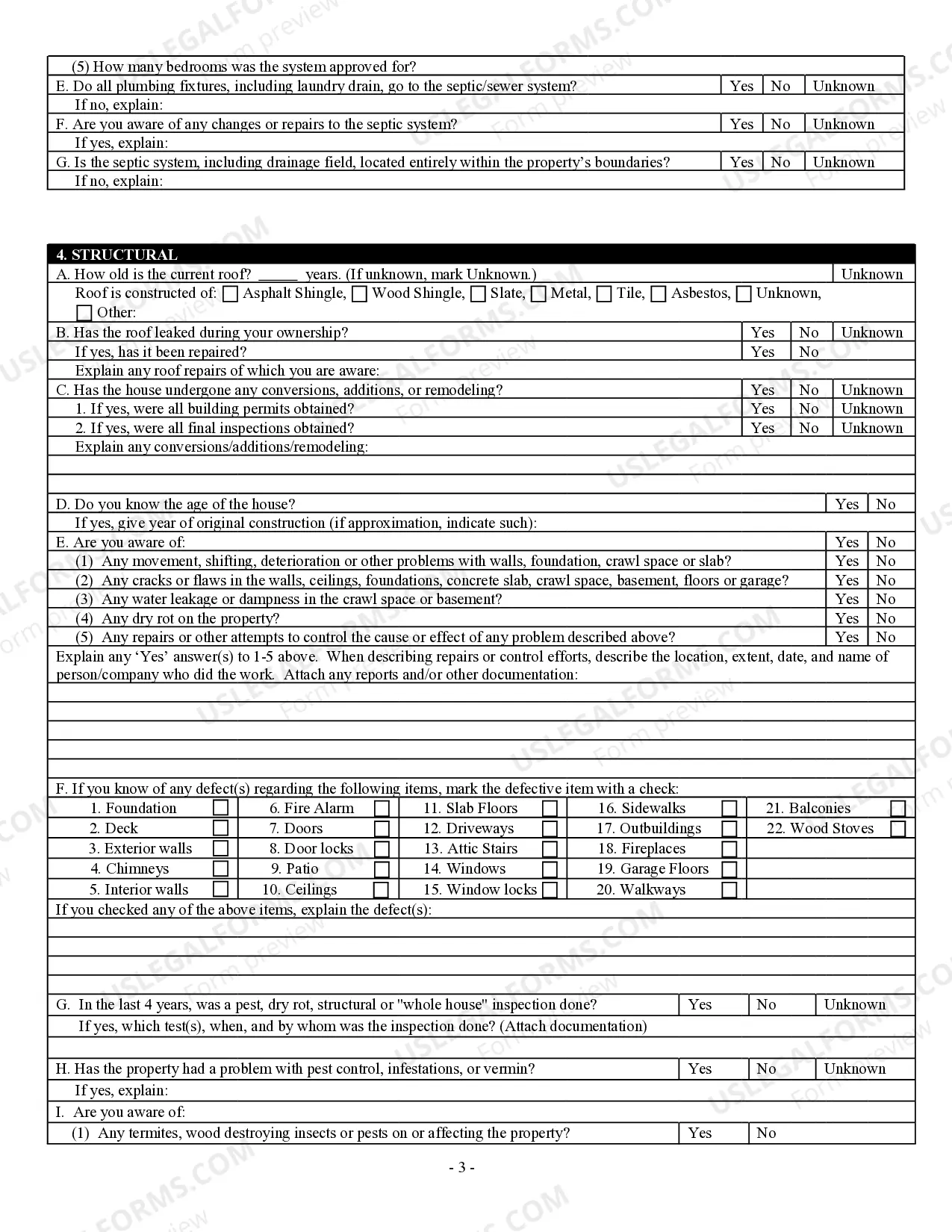

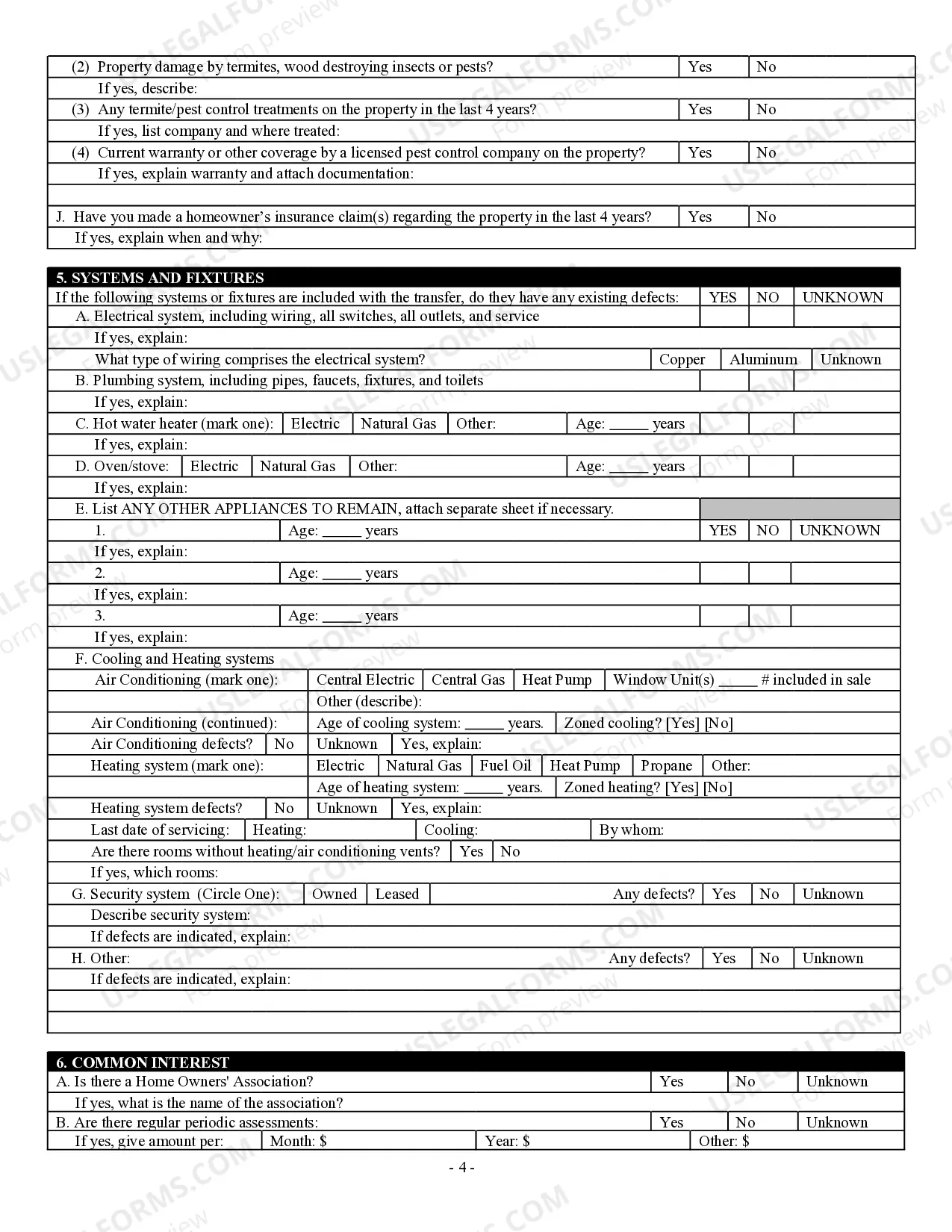

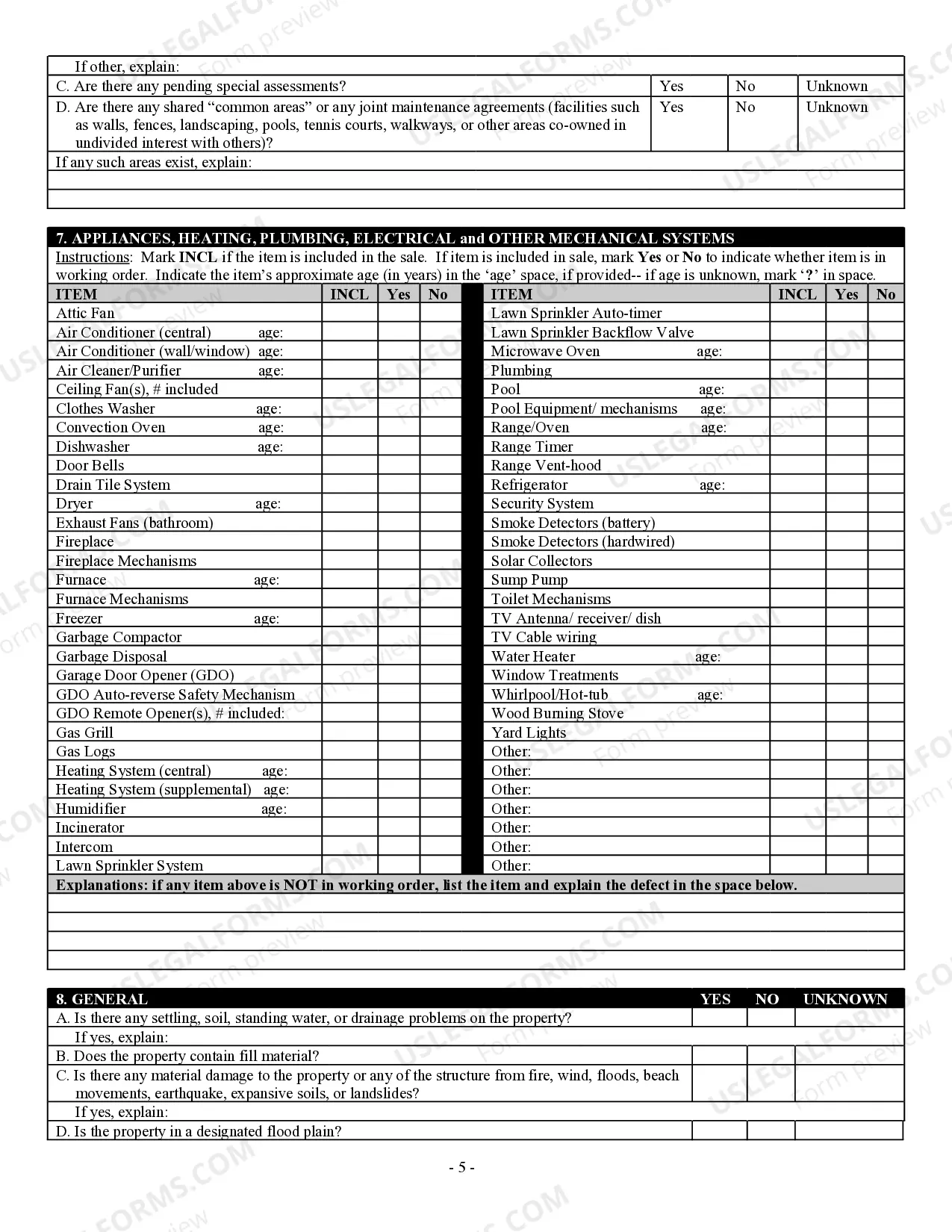

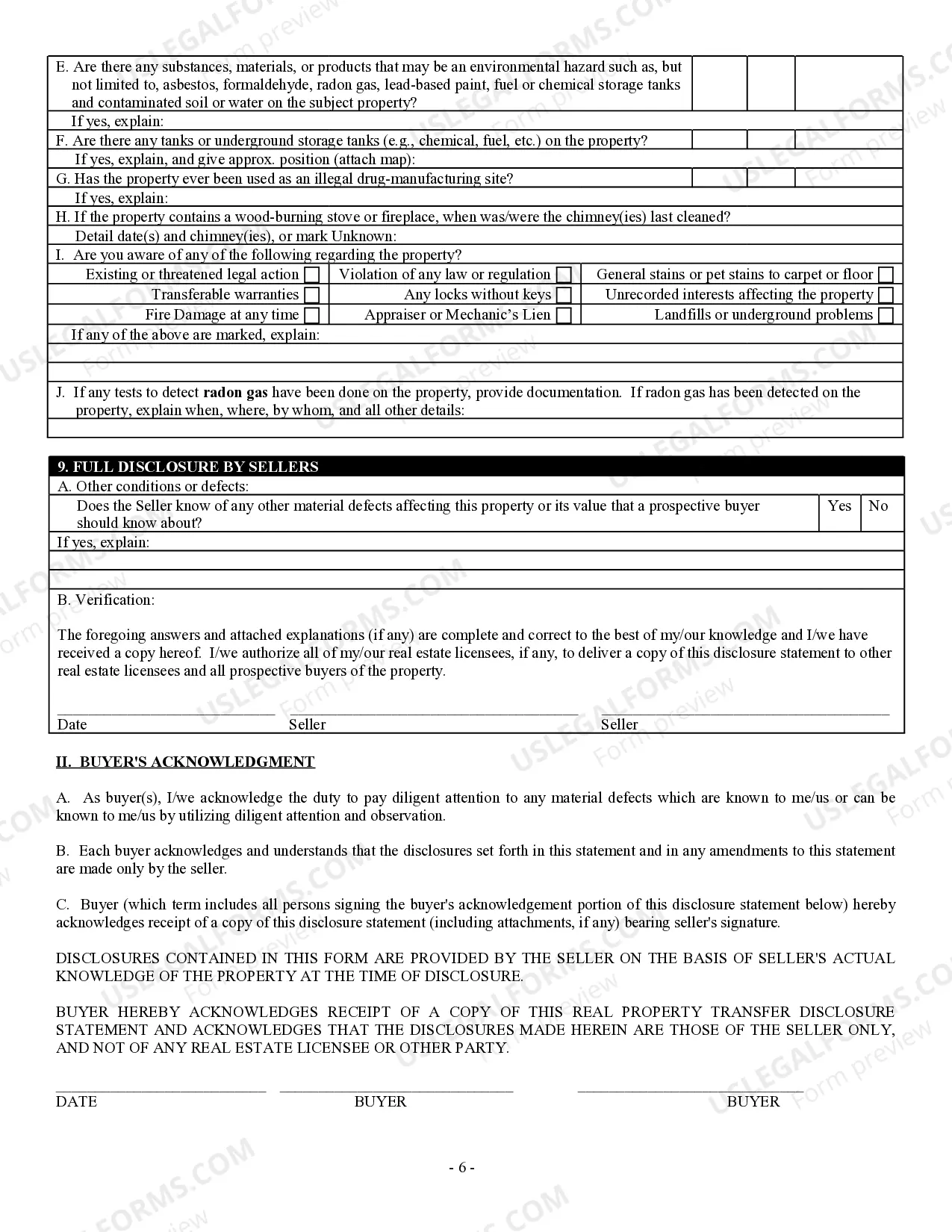

How to fill out Georgia Residential Real Estate Sales Disclosure Statement?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may demand extensive research and considerable financial investment.

If you’re seeking a more straightforward and economical method of drafting Georgia Property Inheritance Laws or any other documentation without unnecessary hurdles, US Legal Forms is always accessible.

Our digital repository of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal affairs.

However, before diving into downloading Georgia Property Inheritance Laws, consider these suggestions: Review the document preview and descriptions to confirm that you’re on the correct document. Ensure the form you select meets the standards of your state and county. Choose the most appropriate subscription plan to obtain the Georgia Property Inheritance Laws. Download the document, then complete, certify, and print it. US Legal Forms enjoys an impeccable reputation and over 25 years of experience. Join us today and make document preparation easy and efficient!

- With just a few clicks, you can swiftly reach state- and county-specific forms meticulously prepared for you by our legal experts.

- Utilize our website whenever you require a dependable and trustworthy service through which you can quickly find and retrieve the Georgia Property Inheritance Laws.

- If you’re already familiar with our site and have created an account, simply Log In to your account, find the form, and download it or re-download it anytime in the My documents section.

- Don’t have an account? No problem. It requires minimal time to register and explore the library.

Form popularity

FAQ

A Maine LLC Operating Agreement is a written contract between the LLC Members (LLC owners). This legal document includes detailed information about LLC ownership structure, who owns the company and how the LLC is managed.

There is a $175 one-time state filing fee to form a Maine LLC. There are also ongoing fees (like a $85 Annual Report fee), which we discuss below.

How much is a Maine Business License? Maine doesn't have a general business license at the state level, so there are no fees there. However, your business may need a state-level occupational license or municipal-level license or permit to operate.

Yes. Unlike most states?in which an operating agreement is encouraged but not required?Maine's statutes clearly state that ?a limited liability company agreement must be entered into or otherwise existing? before an LLC can be formed. (A ?company agreement? is the same thing as an operating agreement.)

If you want to do business under a different business name in Maine, you'll need to file for a DBA, or 'Doing business as. ' Find out more about how to get a DBA, how it affects your business, taxes and more.

Your Maine LLC forms are all available for free on the secretary of state's website. Choose a Name for Your LLC in Maine. ... Choose a Maine Registered Agent. ... File Your Certificate of Formation. ... Create an Operating Agreement. ... Request a Federal EIN. ... File Maine LLC Annual Reports.

LLC managing members are required to file an operating agreement with the Secretary of State after successfully filing for formation. The form is used to standardize the management structure, operating procedures, policies, and any other provision established by the ownership.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...